Stone Ridge Asset Management Invests $115M In Bitcoin!

In another corporate Bitcoin investment, Stone Ridge asset management group announced on Oct 13 that they have invested $115M in Bitcoin, acquiring around ~10,000 BTCs. This is another entry, in a list of recent spree of corporate Bitcoin investments for […]

In another corporate Bitcoin investment, Stone Ridge asset management group announced on Oct 13 that they have invested $115M in Bitcoin, acquiring around ~10,000 BTCs. This is another entry, in a list of recent spree of corporate Bitcoin investments for the treasuries. They are being managed by the Stone Ridge’s subsidiary New York Digital Investment Group (NYDIG).

New York Digital Investment Group (NYDIG) offers execution and custody services, meaning that it has the infrastructure to purchase and hold cryptocurrencies, on behalf of it’s clients. The best part is that the group has the relevant licenses and complies with relevant regulations.

Why Are Companies Buying Bitcoins?

The primary motivation of companies buying BTCs seems to be the current global financial turmoil and insufficient if not potentially harmful taken by the federal government, to remedy the situation – namely the endless currency printing. The Feds have gone on a printing offensive, raising fears of severely devaluing the currency.

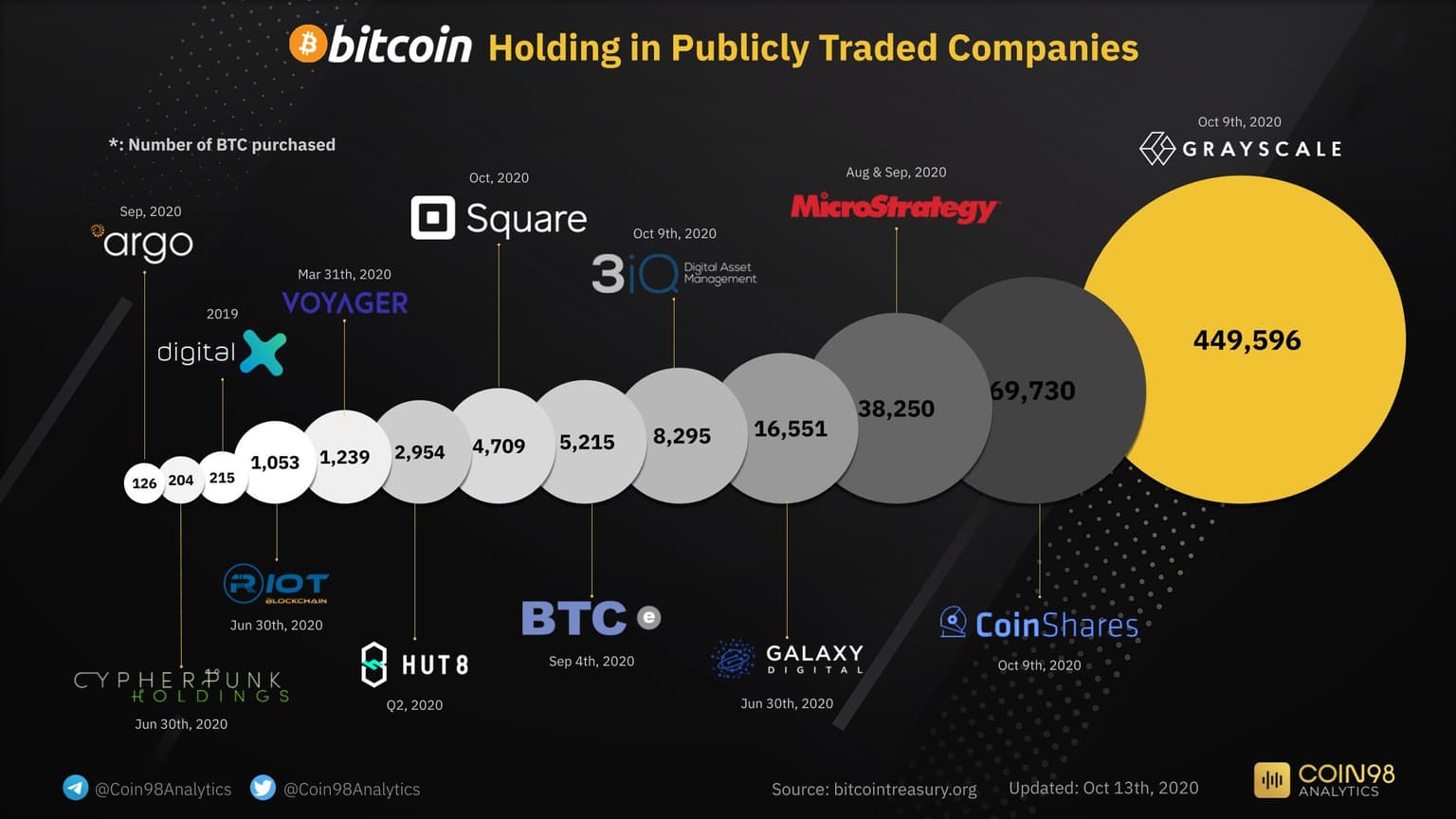

Unsurprisingly, Grayscale is still number one with holdings of over 449k+ Bitcoins, CoinShares is second with approx 69k+ Bitcoins and Microstrategy has landed the third spot with 38k+ Bitcoins. The other significant holders are Galaxy Digital with 16k+ Bitcoins and 3iQ digital asset management with 8.2k+ Bitcoins.

However, Bitcoin has shown a strong correlation to the traditional financial markets and more data is needed to back up the commonly held narrative of Store of Value (SoV). But, Bitcoin is up significantly YTD compared to other financial products and benchmarks, though other major cryptocurrencies (Ethereum, Chainlink etc.) have outperformed BTC.

Govts Are Warming Up-to Cryptocurrencies

If the recent statements and actions are any indication, the governments are themselves warming up to the idea of blockchain technology and cryptocurrencies. Recently on Jul 22, the Office of the Comptroller of the Currency (OCC) – an independent bureau of US Department of Treasury of United States of America gave a nod for national banks and federal savings associations to start providing cryptocurrency management and custody services to the public.