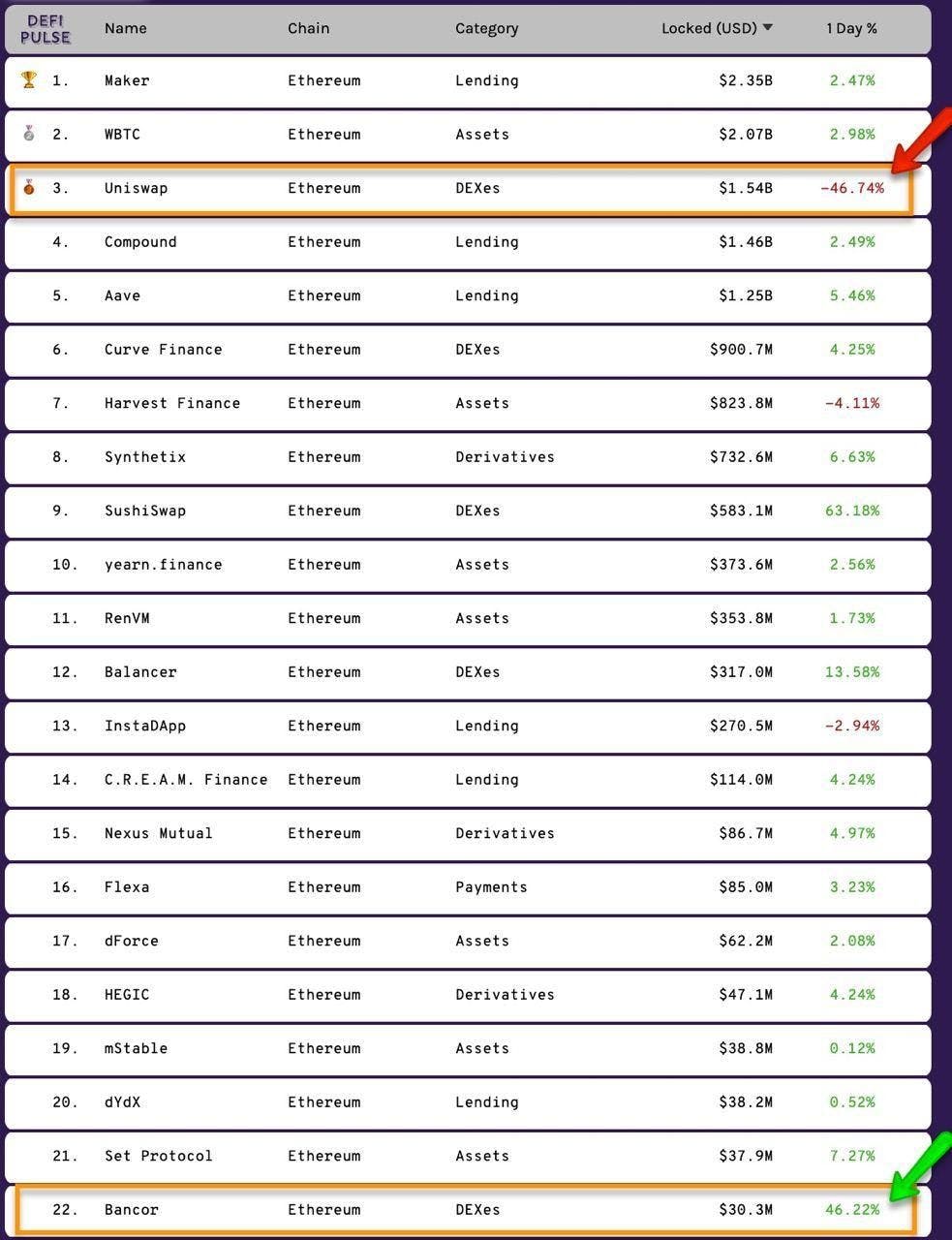

Bancor has amassed a total value locked (TVL) figure of $62.1M since Nov 17, the day it launched a liquidity mining program with extremely high 300% APY in a so called vampire attack as Uniswap UNI liquidity rewards dry. The pioneer automated market maker (AMM) had a total of $24M TVL on the day of program launch, which has since nearly tripled in a short period of time.

It’s liquidity mining program is designed to attract liquidity and keep it within the platform. It is expected to run for 72 weeks. The BNT rewards will start with 6 large cap and 2 mid cap token liquidity pools, distributed each week. Two new tokens can also be added to qualify for incentivized pools, every two weeks. There is a multiplier system, where rewards can stake proportional to the time liquidity is provided. All of this is subject to approval through Bancor governance mechanism.

This comes at a time when Uniswap rewards are drying up and initial UNI-token euphoria seems to be passing. Bancor is banking on the no impermanent loss and single token staking features to retain liquidity, once it’s own rewards eventually end. These features were introduced in Bancor v2.1 and are complemented by optimized bonding curves/Chainlink oracles.

Uniswap offers a long list of tokens and easy integrations, but it’s weak points are high impermanent loss and non-availability of single token staking. That’s where Bancor is planning to chime in. In the last couple of days, data shows that lots of liquidity flowed from Uniswap to Bancor. A trend which is likely to continue in the coming days.

About Bancor

Bancor is a DeFi focused Automated Market Maker (AMM), which allows exchange or trading of tokens without the need of a counter-party or order book based trading mechanism, through liquidity pools for which stakers earn fees from processing token conversions.

The native token is BNT with a total supply of 69.1M. It supports token conversion on both Ethereum and EOS blockchain platforms. The service features easy sign up facility using mobile number, Messenger and Telegram.