Why are Whales Accumulating Bitcoin After the Crypto Crash?

The crypto market witnessed volatility as some players, often referred to as "whales," seem to be accumulating Bitcoin post crypto crash.

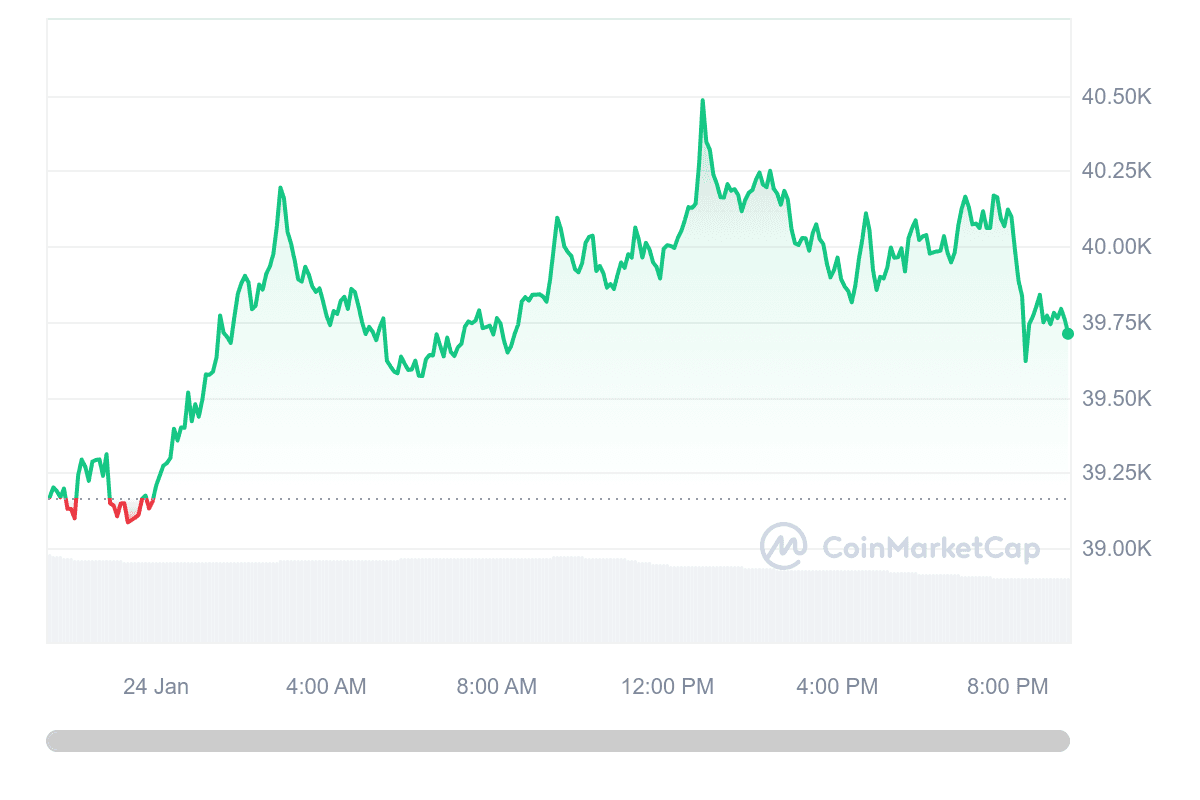

The crypto market is witnessing intriguing moves as some notable players, often referred to as “whales,” seem to be accumulating Bitcoin during a period of price decline. An analysis of BTC prices on Bitfinex compared to other exchanges reveals a $200 premium, suggesting potential whale purchases. This phenomenon raises questions about the motivations behind these moves and their implications for the broader market.

Since January 16th, BTC prices on Bitfinex have consistently shown a $200 premium compared to other exchanges, notably Coinbase. Bitfinex, affiliated with Tether and catering to crypto whales, has experienced a surge in trading volumes over the weekend, indicating possible whale activity. In contrast, Coinbase, with a larger retail user base, witnessed a decline in weekend trading volumes.

Signals of Whale Accumulation post Crypto Crash

The observed premium on Bitfinex and the uptick in weekend trading volumes suggest a potential resurgence in whale accumulation. Similar signals were noted in 2023 before a year-end mini-bull run. During that period, BTC deposits on exchanges declined, signaling reduced selling pressure. The recent dynamics on Bitfinex, coupled with prices falling below $40,000, hint at a renewed phase of whale accumulation.

Trend Reversal and Market Dynamics

Recent market movements indicate a potential trend reversal. Despite expectations of a return to $40,000, some analysts predicted a floor at $38,000. The resistance to significant declines below this level may be attributed to whales intervening to prevent further price erosion. Additionally, an emerging correlation between the Hang Seng index and Bitcoin prices suggests intertwined dynamics, with recent movements in the Hong Kong stock exchange impacting Bitcoin’s trajectory.

Will the Market Recover after the Crypto Crash?

While these observations do not conclusively signal a trend change, they suggest a possible end to the recent downtrend. If the whales’ actions align with market sentiments, Bitcoin’s price may stabilize around $38,000 in the coming days, presenting potential opportunities for market participants.