While Bitcoin, Ethereum, and many other altcoins take the spotlight of cryptocurrencies, Stablecoins are also worthy assets. Stablecoins are assets whose value pegs to another entity devoid of volatility and very stable. Today, the crypto market possesses more than 30 such assets. Today, one of such highly-rated stablecoin is the DAI token. However, it is important to digress a bit into what stablecoins entail to understand DAI.

What Are Stablecoins?

Stablecoins are assets that equip holders with the benefits of cryptocurrencies while limiting their exposure to their risks. They can do this because they are backed by a reserve currency or an alternate asset. Stablecoins also provide an alternative to issues like high volatility associated with typical cryptocurrencies. Their benefits include speedy settlement, instant transfers globally, and low transaction fees like cryptocurrencies. Today’s types of stablecoins are fiat-collateralized, crypto-collateralized, and algorithmic-collateralized. While fiat-collateralized stablecoins are backed by physical currencies like USD, crypto-collateralized are backed by cryptocurrencies.

However, algorithmic-collateralized stablecoins do not necessarily have a backing, and their values are maintained via an algorithm. Examples of stablecoins in the crypto market today include Tether (USDT), Binance USD (BUSD), USD Coin (USDC), DAI, etc. Fortunately, one benefit of holding stablecoins is that their value is stable and seldom subject to price volatility. Unfortunately, this is why these assets are not the best for investors looking to earn huge returns.

What Is DAI?

Launched in 2017, DAI is an algorithmic stablecoin whose price synchronizes with the value of the U.S. dollar. It is an ERC-20-compatible token and stablecoin managed by the Maker Protocol and its decentralized governance community- MakerDAO. While its price maintains equality with the USD, it’s collateralized by multiple cryptocurrencies. Maker Protocol manages the stablecoins price, issuance, and development. As a stablecoin, it helps in reducing volatility while enabling DeFi features such as lending, borrowing, or trading. While Maker Protocol help produces new DAI tokens, MarkerDAO regulates its value.

To generate new Dai tokens, users must deposit crypto-assets into Maker Vaults on the Maker Protocol. Users can access these Vaults via Oasis Borrow or other interfaces built by the community. On Oasis Borrow, users can lock in collateral such as ETH, WBTC, COMP, etc. Alternatively, there are options of borrowing assets with collaterals in DAI. Users can borrow within the collateral ratio, ranging from 101% to 175%, depending on other risk factors. Using fiat money like USD, investors can purchase DAI on many crypto exchanges and DEXs, including Binance, Coinbase, Kraken, and ByBit.

Who is Behind The DAI Project?

Maker Protocol and MakerDAO are the platforms behind the DAI stablecoin, maintaining its issuance and development. Rune Christensen created the MakerDAO in 2015 and subsequently launched the Maker Protocol in 2017. Today, both platforms remain the underlying architecture running the stablecoin. Maker Protocol is the platform that allows users globally to produce DAI stablecoins using multiple cryptocurrencies as collateral. The platform enables users to use cryptocurrencies like ETH, BAT, USDC, wBTC, and COMP as collateral. Many collateralizable cryptocurrencies ensure DAI’s volatility remains low and price stability high. The platform promises to improve on its collateral options via voting by its community in the future.

What is The MakerDAO?

MakerDAO is a decentralized autonomous organization running via smart contracts, executed on the Ethereum blockchain. MakerDAO’s management and governance are solely in the hands of token (MKR) holders, who can also vote on new proposals. Their authority also exerts beyond the DAO and into Maker Protocol and DAI. Alternatively, MKR holders also influence the DAO by setting the DAI Savings Rate (DSR) and acting as guarantors. This means that, should DAI ever crash, they will lose their investments and assets.

Benefits Of Using DAI

DAI is one of the most integrated digital assets in the blockchain ecosystem, and holders can use it in many DApps, blockchain-based games, etc. One significant advantage of owning the token is that it exposes holders to a crypto asset with low price volatility. However, listed below are the exciting features of the DAI token;

Highly Rewarding

DAI is a token that avails its holders of multiple opportunities to earn. Through the DAI Savings Rate (DSR), holders can stake tokens in a lockup period whilst earning passive rewards. The platform also presents investors opportunities to earn via its community-owned MakerDAO. DAI holders can deposit tokens into MakerDAO’s smart contract and earn rewards. After staking funds, the smart contract programming automatically adds interest to the depositors’ accounts. Lastly, with no minimum deposit conditions, investors are also eligible to withdraw earnings anytime.

Decentralized

DAI runs on a transparent and permissionless system that ensures users have unrestricted access to their wealth. This is why its holders enjoy the benefits of open access to their assets. It is made possible because DAI is not managed by a private owner but via a software protocol (DAO). This is why, unlike fiat currencies, there are no credit checks, approvals, or third-party interference.

Fast And Cheap

Unlike traditional wire transfers, completion time and costs can be very expensive and overbearing. However, with DAI’s cheap transfer fees and fast processing time, cross-border transactions from one user’s wallet complete efficiently. Apart from being cheap and fast, these transactions are transparent and efficient.

Highly Secured

DAI is an Erc-20 token secured by Ethereum’s Ethash algorithm. Its developers utilize routine audits and other security measures to bolster its security. To further improve its security, the MakerDAO developers ensure the complete verification of all smart contracts on its network.

Multiple Uses

DAI provides a stable currency and means of financial inclusion for citizens living in locations with severe economic instability. Since its value is soft-pegged to the USD price, holders can use it to hedge against fiat currency devaluation. However, DAI is also a flexible and highly scalable token, with variant uses on the Ethereum network. Its holders can use it for staking to earn rewards and borrowing it to buy other crypto assets. DAI holders also use it to hold profits from other token sales as a stable investment. At writing, more than 400 applications have integrated Dai, including wallets, DeFi platforms, games, etc.

Limitations Of DAI

Like most stablecoins, Investors looking to earn massive rewards might not find DAI a suitable investment. This is because stablecoins do not present holders with an opportunity for trading gains. While owning them is also less risky compared to cryptocurrencies, stablecoins may lose value if the company goes bankrupt. Unfortunately, its value also depends on investors’ trust in the company holding the collateralized reserve asset. Although under low probability, this trust may change and lead to DAI’s collapse.

How To Buy DAI On Coinbase

It is impossible to mint DAI, unlike Bitcoin, Ethereum, and many other cryptocurrencies. However, new DAI tokens are produced via the use of Maker Protocol. This is why its total supply is limitless, depending on how much collateral is in the vaults. At writing, there are about 6,551,647,664 DAI coins in circulation. DAI is available for purchase on many exchanges and DEXs, including Binance, Coinbase, Kraken, and Uniswap. However, to buy the token on Coinbase, kindly follow the steps below;

Step 1

Signing up on Coinbase is the first for new users. You will have to download the Coinbase app or use the exchange’s website. The app is available on both android and iOS stores for compatible devices. This process is usually seamless and complete after supplying a few KYC details. You will also need to verify the information you provided. It is worth noting that only verified accounts will have access to the Coinbase trading platform. However, existing users will only need to log in to their accounts.

Step 2

After creating an account or logging in, you will need to add a payment method to your Coinbase account. This will enable the purchase of DAI to be very seamless. Funding is straightforward, and with either a bank transfer or any compatible debit/credit card, your account now has funds.

Step 3

After funding, you can then purchase your DAI tokens. Click on trade, select DAI from the search bar items, and enter the amount you want to buy. You will then review and confirm the amount and make payments for it.

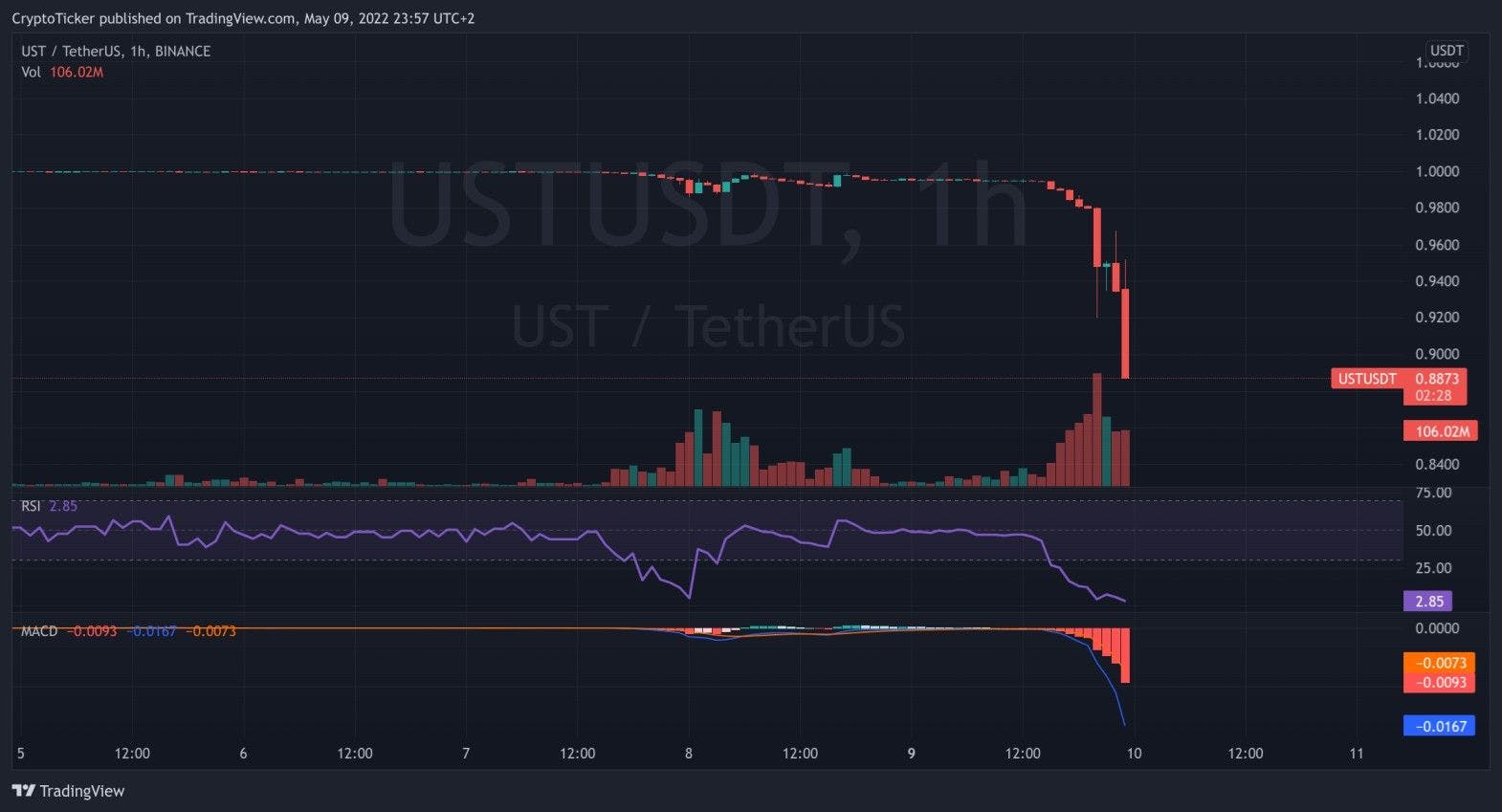

What is Happening To Stablecoins?

Earlier this month, the collapse of the general crypto market saw stablecoins like UST, USDC and DAI falling in value. This was unusual and strange, as stablecoins remain the safe and strait-laced cousins of cryptocurrencies. This turmoil saw major stablecoins like UST and USDC fall below $1, while market capitalizations also fell. Crypto analysts continue to ascertain the situation, looking for loopholes and why stablecoins moved in such directions. Some analysts mentioned issues related to permissible reserves and regulations around stablecoins.

While for some, they think investors might be increasing their risk-consciousness toward the low-risk assets. Fortunately, that shortfall period is over, as almost all stablecoins are back to the status quo. Unfortunately, that market shift began a new wave of uncertainty about the future of asset-backed cryptocurrencies. It also created doubts about their futures. However, only time will tell whether stablecoins will maintain their new positions.

Conclusion

Stablecoins are assets that equip holders with the benefits of cryptocurrencies while limiting their exposure to their risks. Launched in 2017, DAI is an algorithmic stablecoin whose price relies on the value of the USD. It is an Ethereum-compatible stablecoin managed by the Maker Protocol and its decentralized governance community- MakerDAO. An advantage of owning the token is that it exposes holders to a crypto asset with low price volatility. However, bar the unfortunate incident that happened to stablecoins earlier this month, they are back to stability.