The rapid growth of the Defi space, especially in the last 24months, has continued to be met with various challenges, as crypto analysts believe that there is a lot of work to be done. The general belief is that the Blockchain project developers still have a long way to go, as these issues appear to be more technical than adoption- which has continued to be on the rise. The reason behind most of these issues is not far-fetched from the fact that Defi transactions are still typically slow and very expensive for the average user. However, with the rapid rise of many Decentralized Exchanges (DEXs), it seems that the solution to the problems facing the Defi space is already in sight. In this article, we will be discussing Raydium DEX.

What are Decentralized Exchanges (DEXs)?

Decentralized exchanges, also referred to as DEXs, are peer-to-peer marketplaces that allow crypto traders to transact with each other without boundaries. Like almost every idea behind the Blockchain, DEXs are decentralized and foster financial transactions that aren’t conducted by banks, intermediaries, or any third-party affiliation. One of the basic differences between Central Exchanges and DEXs is that, while central exchanges allow users to exchange between cryptocurrencies and fiat money, DEXs only allow trade between two cryptocurrency tokens.

Another important difference to note between these two important Blockchain service providers is that, while CEXs transactions records are stored in their internal database, DEXs transaction records are visible and recorded on the Blockchain. Examples of DEXs include Swapzone, PancakeSwap, dYdX, and Raydium, and the Ethereum Blockchain hosts a majority of them. Like central exchanges, the growth of DEXs has been astronomical in the last year, as the Defi tools have continued to prove their importance to the growing Cryptocurrency space.

What Is Raydium DEX?

Raydium is the first decentralized Automated Market Maker (AMM) built on the Solana Blockchain for its Serum DEX. The AMM platform allows users to trade, swap, and provide liquidity to earn rewards on their digital assets. The protocol utilizes Serum for its swap system and also for greater liquidity. Like every protocol built on Solana, Raydium leverages the Blockchain’s speed and its affordability. For the uninitiated, an Automated Market Maker (AMM) is a DEX or Protocol used in the digital market to dictate the selling and buying price of assets.

The native utility token of Raydium is RAY, and it was launched on February 21, 2021. The overall circulation of the RAY token is estimated to be capped at 555 million, with the project developers allocated 20%. Unfortunately, the developers can not sell their allocated tokens, as it is expected to be locked for a minimum of three years. At the time of writing, RAY tokens currently trade slightly below $10, and only about 33% of the maximum amount of tokens in circulation can be mined.

How Does It Work?

It is worthy to note that, like many native tokens, RAY allows its holders to participate and vote on new proposals in the system. The power of each holder is a determinant of the number of tokens in their possession. The token also guarantees its holder a whopping 0.03% of trading fees generated via staking. Due to the AMM mechanism, it was built with, Raydium has two basic properties. The first property provides users with access to Serum’s order book. The second property is that its algorithm relies solely on the Constant Function Automated Market Maker (CFAMM). The CFAMM algorithm uses a mathematical function that ensures that regardless of trade made, reserve asset remains constant. The Serum order book being used by Raydium is an on-chain protocol whose incorporation with Raydium is mutually beneficial to users of both protocols who can access either of the two liquidity pools.

Features Of Raydium DEX

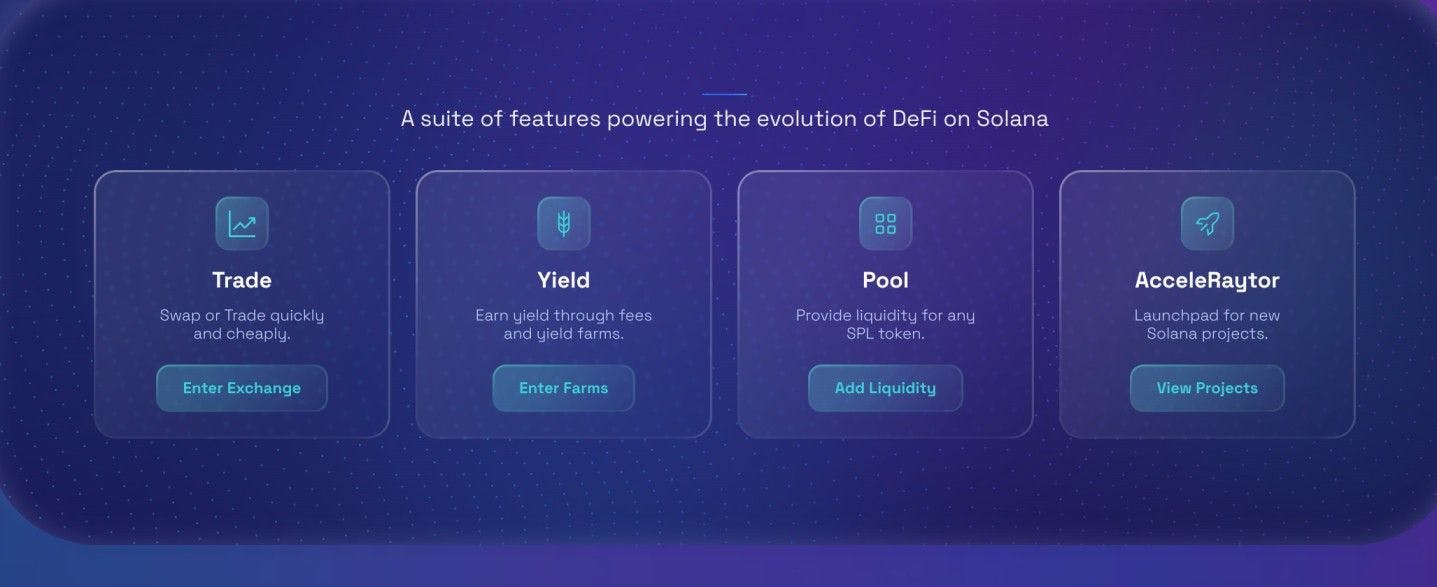

Crypto Swap

One of the reasons Blockchain developers use AMM is largely due to its capabilities of assets exchange without borders. Fortunately, this is one of the features of Raydium that makes it an important protocol in the Solana Blockchain. The Swap feature of Raydium allows users to exchange two tokens by trading the one they have for the one they want. The process is as swift and as easy as ABC.

Interaction With Serum

Raydium equips users with exclusive access to the liquidity pool of the Serum space. It perfectly executes its AMM protocol with Serum’s order book.

Fast and Cheap

Raydium is one of the few projects on the Solana Blockchain that has been able to integrate the speed of the network to its system and incorporate the low gas features of the Blockchain. Transaction speed on Raydium is very fast, while it also boasts of lower gas fees compared to Ethereum-based Defi projects.

Yield Farming On Raydium

For the uninitiated, Yield Farming are DeFi based programs that allow crypto users to invest, stake, or lock up their tokens and earn rewards. Sometimes, investors can also lend out their assets to earn this reward. Fortunately, Raydium liquidity providers are not excluded, as they are rewarded with a little percentage of the transaction fees generated in the DEX.

To ensure fairness, Raydium has also issued a token that allocates the correct amount of reward to users based on ownership of a stake in the project. The Raydium developers have also ensured that holders who hold on to their native tokens are not excluded from this reward, as they also earn RAY tokens for basically owning the token.

Users who want to bring liquidity into Raydium are expected to possess a functioning Solana wallet with the right amount of USDT. After that, they will be required to connect it to Raydium and start farming. Every time a user swaps between a pool, a fee of 0.25% is taken on the trade. 0.22% of the trade is the portion that goes back to the LP pool as rewards, and about 0.03% of it goes to RAY staking. It is worthy to note that tokens deposited for farming can be withdrawn at any time, as there are not limited to any form of restriction.

Conclusion

The Raydium DEX is built on Solana, and since its architecture is tied to both Solana and Serum, it can interact with other Decentralized Applications (DApps) on the Blockchain. It is also worthy to note that Project Raydiate is a viable reward program of the Blockchain. Project Raydiate is a program that allows Raydium users to earn rewards via participation in social media surveys and challenges to increase the project’s adoption. However, most of these rewards are exclusive to RAYgional Ambassadors. RAYgional Ambassadors are exclusive social media group members of the Raydium community who get rewarded monthly for their promotional activities tailored towards the project’s growth.