Ethereum Price Forecast 2020: Are Ethereum Coins worth it?

Ethereum is still, after Bitcoin, the undisputed number 2 of all cryptocurrencies. With an Ethereum price per coin of USD 136, Ethereum currently has a market capitalization of USD 14.8 billion. Ethereum price forecast – Ethereum has two major problems During […]

Ethereum is still, after Bitcoin, the undisputed number 2 of all cryptocurrencies. With an Ethereum price per coin of USD 136, Ethereum currently has a market capitalization of USD 14.8 billion.

Ethereum price forecast – Ethereum has two major problems

During the ICO run around the years 2017-2018 (we observed almost 2000 ICOs with a volume of over USD 15 billion), investors had to buy millions of ethers to participate in the ICOs. These ethers were often trapped for a period of time and were out of the market. As a result, the Ethereum price had two drivers behind it, high demand and a tight supply. That was the only way back then that the Ethereum price could rise above the $ 1400 mark.

Now, the tides have turned. There are hardly any ICOs left and more and more ethers that were once involved are being sold on the market. The shortage of supplies is history.

Demand is also not that high anymore. Although there are new applications (e.g. DeFI) that require and take ether to a small extent, the volume is in the struggling range compared to the ICO times. The current development around ETH 2.0 is still subject to some uncertainty. And nothing scares investors like insecurity. So it is time for real progress to be made on this front to nurture the Ethereum price.

> Now let’s take a look at the charts to assess the possible development. <<

The Ethereum Price- the starting point looks bleak

Ethereum Price

ETH vs. USD weekly chart – Coinbase

First, look at the starting position in the log chart. A downward trend can be seen in its third wave downwards. There should be a chance for ETH to reverse the trend after the low at USD 80. But there are glaring warning signs.

Let us consider wave B at point E. The price drop during this wave was 90% at the peak. This is far more than a “normal” corrective movement, it is more like a slow surrender.

However, the subsequent recovery from point C to point D is much more important. Even if this peak recovery had been over 300%, we have to look at the relation to the previous sale. And this is exactly the problem. The recovery was extremely weak in relation. The exchange rate rose very precisely to USD 366. This is exactly where the 38er Fibonacci retracement of the last sale runs. The price failed because of the first major resistance and also strengthened the resistance zone between USD 351 and USD 420. From a technical point of view, after such a weak long reaction, after such a strong sell-off, it can be expected that the price will continue to fall.

The Ethereum Price in a downward trend – how far can it go?

Ethereum Price

Even if the movement to point E does not have to be a straight line, you can expect the current trend to continue. From a technical point of view, this means that the Ethereum price for 2020 at a low of USD 44 before a recovery is possible again from here.

To start the price target of USD 44, ETH must break through the important support at around USD 80. This may take a few months, but it should be irrelevant for an annual forecast.

Let’s summarize – what can we expect from the Ethereum price in 2020?

The Ethereum rate is still in a downward trend. This trend is likely to continue in 2020. Therefore, you can expect prices to continue falling in the coming year

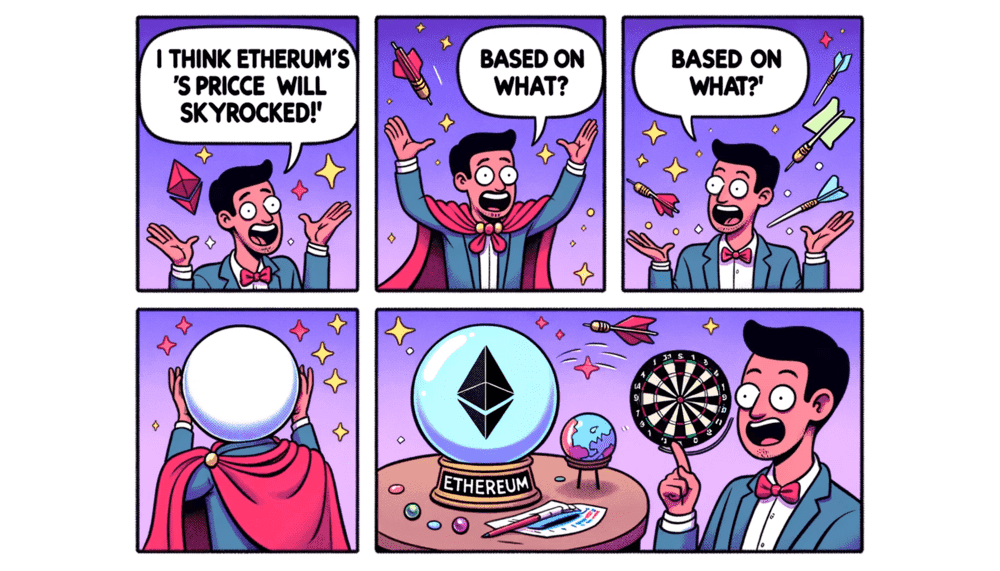

Despite all the care we take in our forecast, the situation can, of course, develop very differently. The further an analysis goes into the future, the less precise it becomes. It is and remains a question of probabilities. Nevertheless, we think it is important that we clearly explain our schedule to you and clearly state our goals. This article was originally written in German by Max Renzing.