BREAKING – Are investors selling Bitcoins in December 2020?

After an extended consolidation around the USD 19,000 price range, Bitcoin price dipped way below that price and reached USD 17,600. After the events of the big fall of cryptocurrencies around the same time 3 years ago, traders and investors became wary of that time of the year and became uncircumspect in their trading stance.

After an extended consolidation around the USD 19,000 price range, Bitcoin price dipped way below that price and reached USD 17,600. After the events of the big fall of cryptocurrencies around the same time 3 years ago, traders and investors became wary of that time of the year and became uncircumspect in their trading stance. This year is no different, and the recent 9% drop in the price along with other technical indicators created a panic across all cryptocurrencies. Are investors selling Bitcoin again this December 2020?

Bitcoin Price Prediction – Technicals showing weary Price-Actions

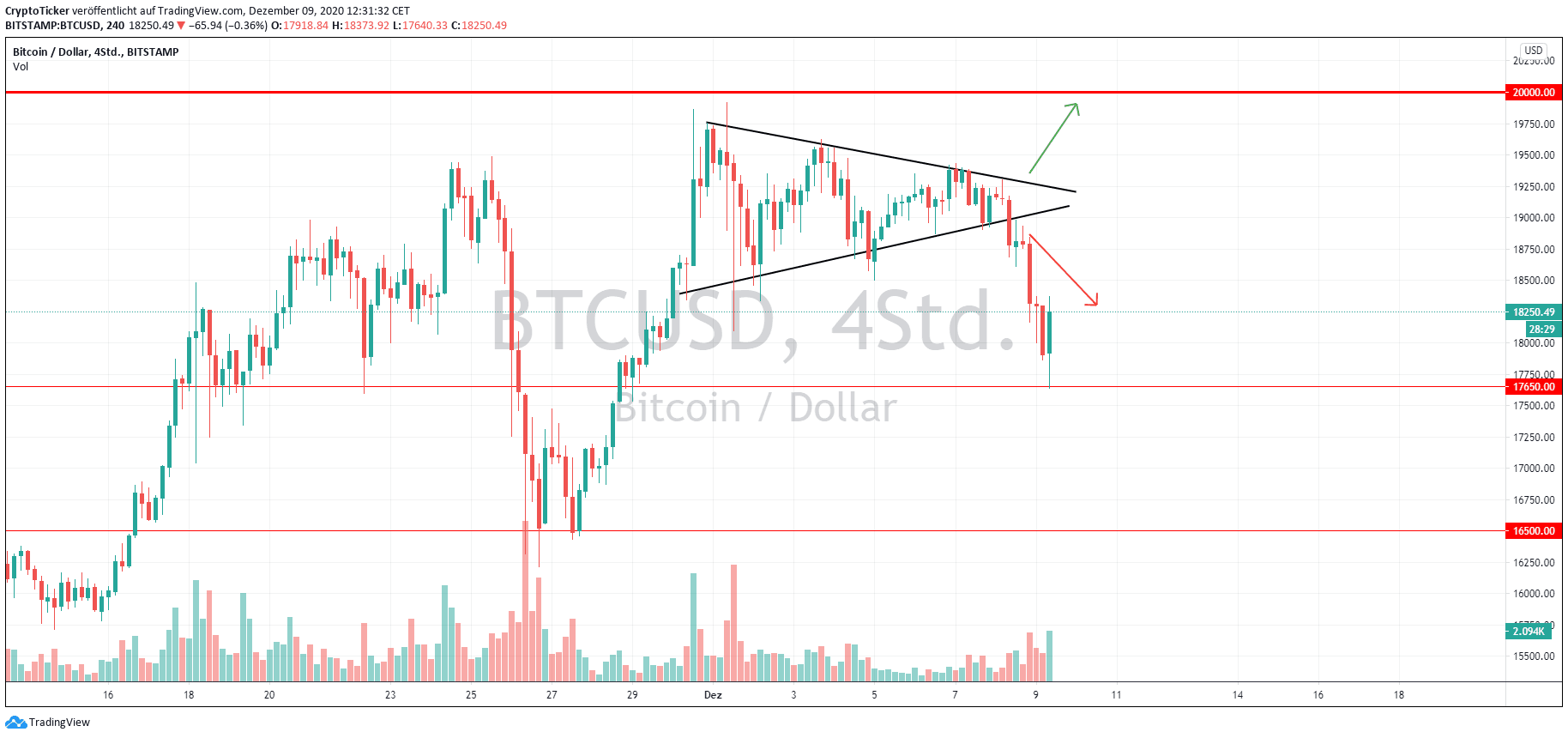

In our last article, we spoke about a triangle formation happening in the price-action of Bitcoin prices, with two potential scenarios:

Interestingly, the second scenario took place, and prices broke the lower triangle line, only to reach the support area of USD 17,650 for a brief moment, and corrected back above the USD 18,000 psychological price.

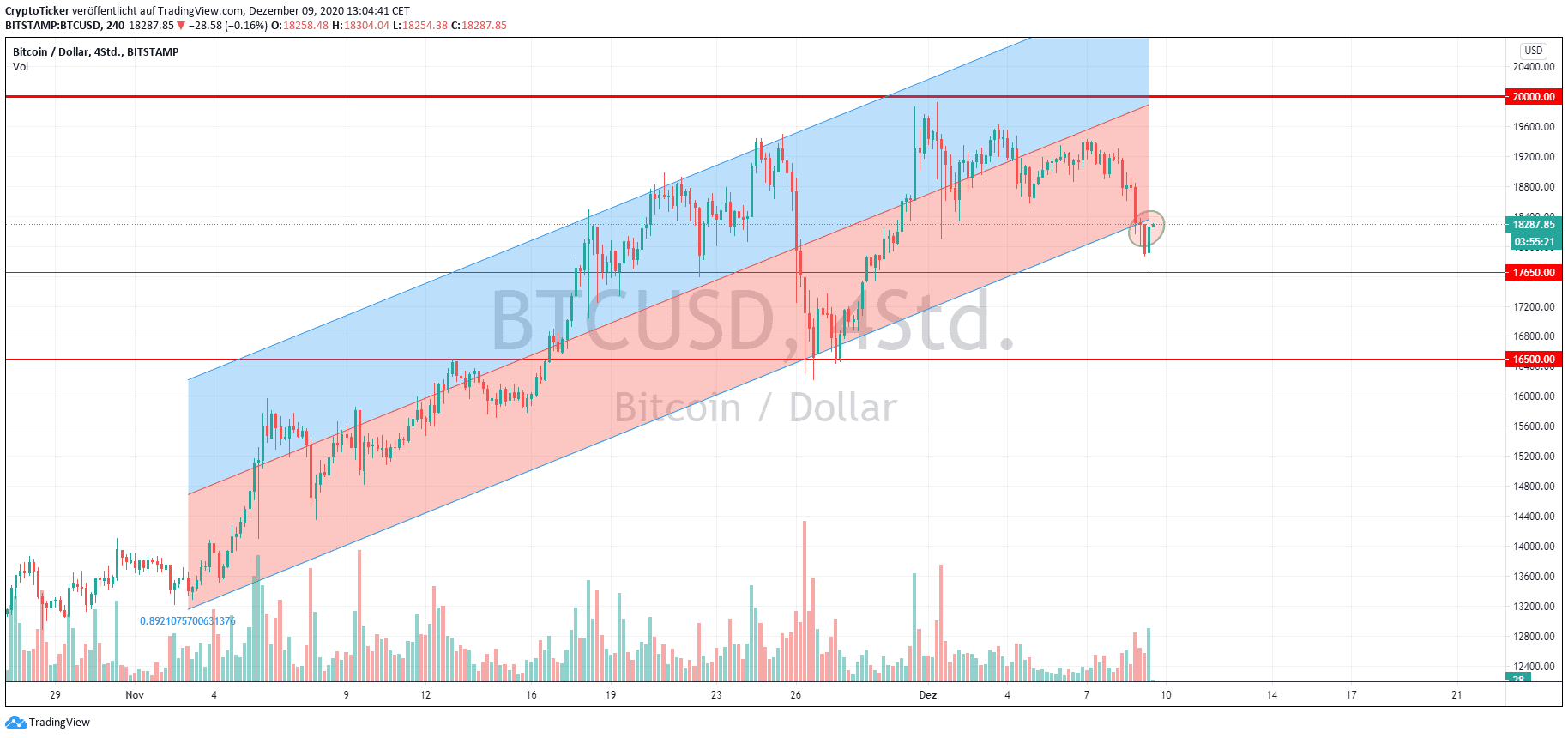

When did this second scenario take place? Well, you guessed it…Midnight on the 9th, when volatility increases most, a topic highly brought up in our articles. Although the general trend for Bitcoin prices is up, the current price just broke the lower uptrend channel (Fig.2). This might be a fakeout where the price will go back inside the channel, but in all cases, here are the new important levels to watch for:

- USD 17,650

- USD 16,500

Is the current price dip due to Profit-Taking?

An interesting tweet discussed a fact which justifies the current dip of Bitcoin prices, and attributed it to profit-taking from “old Hodlers”, meaning Bitcoin owners who bought at very low prices are selling to cash out.

Back in Dec 2017, a similar price dip happened, followed by another in Jan 2018, and people attributed those past events to people cashing out for the holidays, then followed by the Chinese New Year.

But unlike in 2017, people are waiting for dips to buy back and stock up on cryptocurrencies, especially big financial institutions and investors. That’s why the coming price-action will heavily affect the coming Bitcoin prices.

The whole cryptocurrency market overview

In the past 7 days, the whole cryptocurrency market is seen down. This is normal as most cryptocurrencies have been consolidating at their peaks, and here comes the current dip:

1- Bitcoin (BTC) : – 4.37 %

2- Ether (ETH) : – 6.06 %

3- Ripple (XRP) : – 11.35 %

4- Tether (USDT) : 0 %

5- Litecoin (LTC) : – 13.70 % (surpassing Bitcoin Cash and ChainLink)

6- Bitcoin Cash (BCH) : – 9.48 % (surpassing ChainLink)

7- Chainlink (LINK) : – 10.40 %

8- Cardano (ADA) : – 10.01 %

9- Polkadot (DOT) : – 7.31 %

10- Binance Coin (BNB) : – 8.40%

Stay Ahead, Stay Updated

Rudy Fares

Follow CryptoTicker on Twitter and Telegram for daily crypto news and price analyses!