Why are Cryptos UP? Well, it has to do with Grayscale…

Bitcoin price can see a strong increase again after days of consolidation. Many crypto investors were left wondering: why are cryptos up?

Bitcoin price can see a strong increase again after days of consolidation. Many crypto investors were left wondering: why are cryptos up? The reason is the victory of the well-known company Grayscale against the US Securities and Exchange Commission. Grayscale is considered the largest asset custodian for the cryptocurrency. Can the bull run that seems long overdue finally begin?

Why are Crypto UP?

A Washington DC court has ruled in a lawsuit between the US Securities and Exchange Commission and Grayscale. The court found that the SEC had unfairly rejected Grayscale’s Bitcoin ETF application in the past.

#Bitcoin jumps as #Grayscale wins lawsuit against the #SEC

The D.C. court ruled that the SEC improperly rejected the Bitcoin spot ETF. The court ordered the petition for review be granted and the commission's order be vacated. $BTC pic.twitter.com/dyLGKvZmlQ

The authority must repeatedly examine the application to see whether the Grayscale Bitcoin Trust (GBTC) can be converted into an ETF. The SEC rejected the application in October 2021 because the company allegedly did not answer enough questions about how market manipulation could be ruled out.

The Grayscale Trust is the largest fund that manages Bitcoin investments. The company holds extremely large amounts of Bitcoin and is considered one of the most powerful companies in the crypto space.

What is Grayscale Crypto?

Grayscale Investments is a digital currency asset management company founded by Barry Silbert in 2013. By the time of my last update in September 2021, it was one of the largest institutional holders of Bitcoin and other cryptocurrencies. Here are some key aspects of Grayscale:

- Bitcoin Trust (GBTC): This is one of Grayscale’s most well-known products. The Grayscale Bitcoin Trust allows institutional and individual investors to gain exposure to Bitcoin’s price movements without the need to buy, store, or manage the actual cryptocurrency. Instead, they buy shares of the trust, which holds Bitcoin. The trust’s shares trade on public markets, offering a more traditional investment avenue for those interested in Bitcoin.

- Other Cryptocurrency Trusts: While the Bitcoin Trust is its flagship product, Grayscale also offers several other trusts for different cryptocurrencies, like Ethereum (ETHE), Litecoin (LTCN), and more.

- Drop Gold Campaign: Grayscale has been known for its aggressive marketing strategies. One notable campaign was the “Drop Gold” initiative, where they urged investors to drop gold from their portfolios and consider Bitcoin as a superior store of value. The campaign was somewhat controversial and generated significant attention, both positive and negative.

- Premium and Discounts: Shares of Grayscale’s trusts sometimes trade at a premium or discount to the net asset value (NAV) of the underlying cryptocurrency. This can be due to various factors, including demand for the shares, the inability to redeem shares for the actual cryptocurrency, and the unique structure of the investment vehicle.

- Securities and Exchange Commission (SEC): Like all investment firms, Grayscale’s products are subject to regulations. There has been ongoing discussion about the regulatory status of cryptocurrencies and the products that offer exposure to them. As of my last update, Grayscale has expressed interest in converting some of its products, like the Bitcoin Trust, into exchange-traded funds (ETFs), which would be subject to different regulations.

- A Gateway for Institutional Investors: One of the major contributions of Grayscale has been its role in allowing institutional investors to get exposure to cryptocurrencies. Before such trusts were available, many institutions found it challenging to invest in cryptocurrencies due to concerns about security, storage, and regulatory issues.

Why is Bitcoin UP?

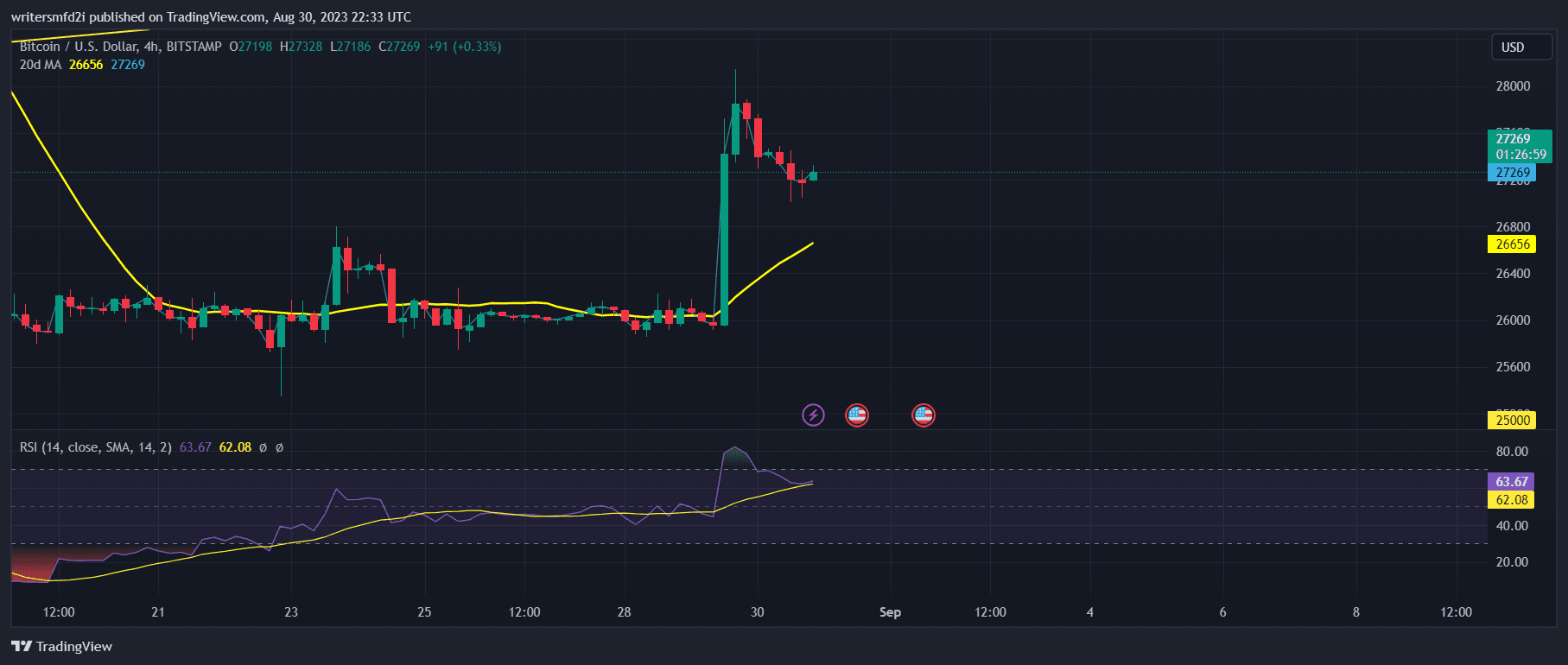

The Bitcoin price saw a massive increase within a few minutes of the Grayscale win. Bitcoin price has risen from $26,000 to $27,550, then adjusted lower towards the current price of $27,270.

In the last few weeks, the Bitcoin price fell from $29,000 to $26,000. This was due to a possible false report that SpaceX had sold $373 million in Bitcoin and the subsequent heavy liquidations of long positions in the futures markets.

Will Bitcoin Price reach $30,000?

Given the ongoing ETF applications from asset managers such as Blackrock and Fidelity, this news could trigger an avalanche that drives the Bitcoin price massively upwards. For weeks we have been of the opinion that the Bitcoin course is extremely undervalued at the moment.

Therefore, the coming days and weeks will be extremely exciting and the Bitcoin price could quickly rise above $30,000. With the halving approaching, a bullish 4Q this year is extremely realistic.