Ethereum Leads Market Crash – Price Drops Below 2017 Equivalent

Ethereum, the second largest cryptocurrency by market cap, dropped by over 20% to hit a low of $258 - its price is now lower than its valuation last year.

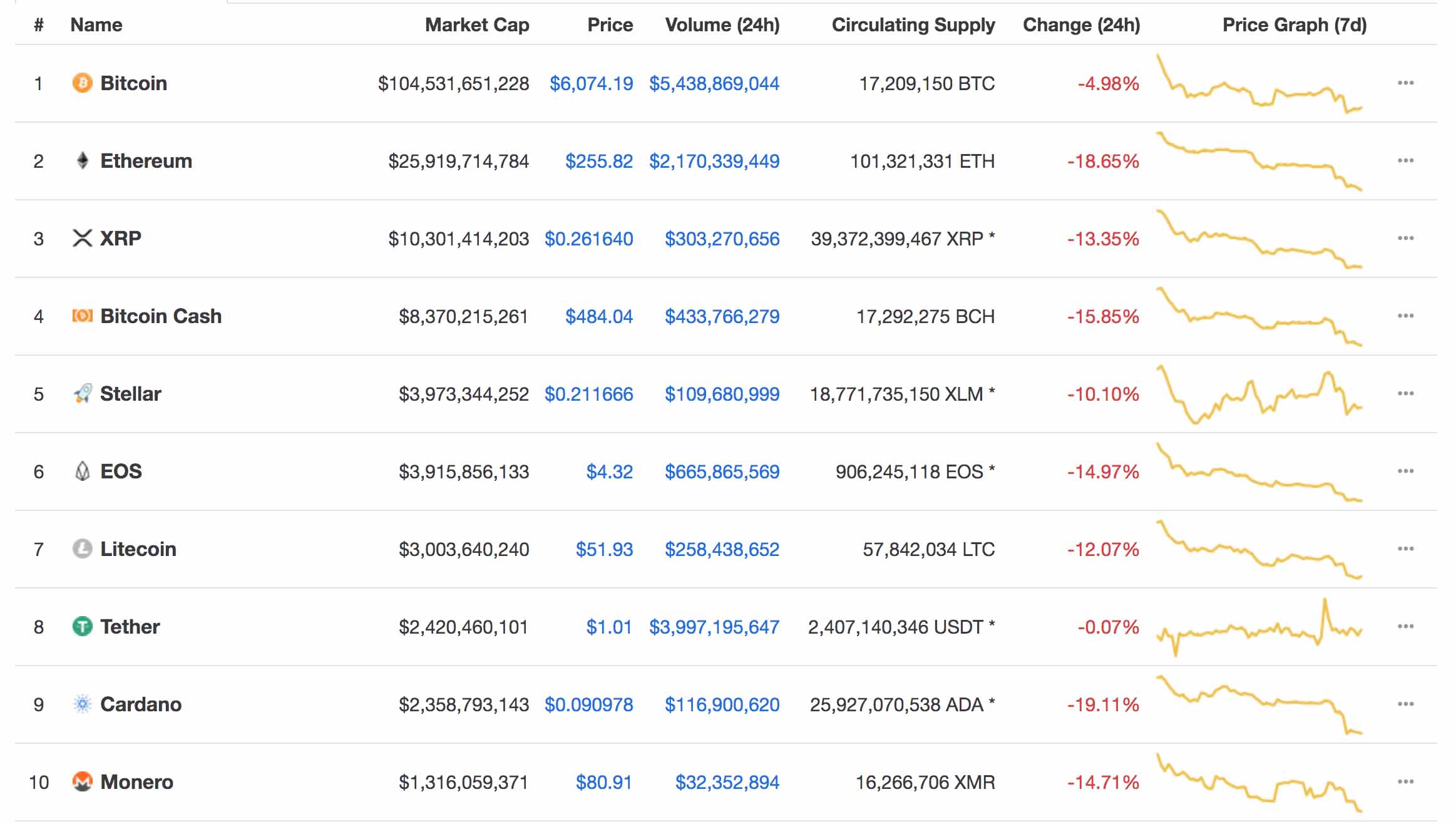

The cryptocurrency market bloodbath in 2018 doesn’t seem to be slowing down. After losing over one-fifth of its market capitalization last week, the crypto market took another nosedive, with Ethereum in the lead, this time dropping past the $200 billion mark. In less than 24 hours, the total market cap of all cryptocurrencies shed nearly $30 billion – or over 13% of its value, resulting in a sea of red in the streets of CryptoVille.

Ethereum, the second largest cryptocurrency by market cap, was the first to go down. Just when its price started showing signs of stabilizing yesterday, it started plunging this morning – going from $328 to $258 – a 21.3% fall. This drastic decline also means that Ethereum’s price is now lower than its valuation last year – which was nearly $300, as shown in the graph below.

This is the first time that the price of one Ether has decreased over the last 12 months. In the last 7 days only, Ethereum’s market cap went from $41 billion to $25 billion – nearly a 40% decrease.

Altcoins Follow Ethereum

Since the Ethereum platform is the birthplace to various altcoins like EOS, Augur, and Binance Coin, its demise inadvertently led to the downfall of various other tokens as well. The top 10 cryptocurrencies by market cap – spare Tether and Bitcoin – all suffered double-digit losses, with Cardano taking the brunt of the impact, losing nearly 20% of its valuation in the last 24 hours.

As various altcoins stumble, Bitcoin’s dominance in the cryptocurrency market approached a 2018-high – at the time of writing, the valuation of Bitcoin alone is worth 54.5% of the entire cryptocurrency market. During last week’s crash, Bitcoin, the pioneer cryptocurrency that is also the biggest cryptocurrency by market cap, was one of the first coins to go down. Having just broken the $8,000 barrier in late-July, Bitcoin failed to sustain its upward momentum and began its descent on August 1 – dropping by almost $1,500 to hit a low of $6,242. At the time of writing, Bitcoin’s price is stabilizing at $6,055, not a very huge difference compared to its price last week.

It is believed that the recent crypto market crash was instigated by the U.S. Securities and Exchange Commission (SEC)’s decision to delay their verdict on the approval of a Bitcoin-backed exchange-traded fund (ETF). This proposal was put forth by VanEck, a New York-based investment firm, who is partnering with Solid X, a financial service company. Earlier this year, the two companies attempted to launch an ETF that is backed by Bitcoins as opposed to futures

However, Ethereum’s recent crash is much more complicated than that.

Reasons Behind Ethereum’s Demise

Ever since its inception in late-2013 by Vitalik Buterin, Ethereum has always been regarded as a visionary, improved version of Bitcoin, as it gave developers the opportunity to build decentralized applications – or dApps for short – on its platform. However, there are several constraints to that.

To various Bitcoin supporters, Ethereum fails to provide true decentralization. In an email to TechCrunch, a Bitcoin bull expressed his reasoning behind his preference of Bitcoin over Ethereum.

“People are also beginning to understand the unique value of an immutable, decentralized ledger, and recognize that Ethereum is not that.”

The proliferation of cases of scam and fraud in the ICO community is also another reason behind Ethereum’s demise. Various Ethereum-based projects that raised billions of dollars often don’t have a working product to back its claims. Moreover, dApps like CryptoKitties are starting to lose their hype, thanks to the rise of Bitcoin’s Lightning Network, which allows for the addition of nodes and apps — also known as LApps. These LApps essentially function in the same way as dApps, just that they are built on the Bitcoin ledger.

Furthermore, the volatility of Ethereum’s price has always been its Achilles heel. The unstable price of Ether not only undermines its ability to perform as a currency, it also brings in the wrong group of people who invest in Ethereum or its projects simply because of the notion of “getting rich” and not because they believe in the project itself, per se.

Amidst all the chaos in today’s crypto market, we can only be certain about one thing – that past performance does not guarantee future returns. Therefore, the only logical move in today’s bear market would be to never invest more than you can afford to lose.

Follow us on Twitter, Facebook, Steemit, and join our Telegram channel for the latest blockchain and cryptocurrency news.