The Crypto Market is Crashing yet again because THIS Speech

Why are cryptos crashing? Let's discuss in detail what Powell said and what impact this speech will have on the crypto market.

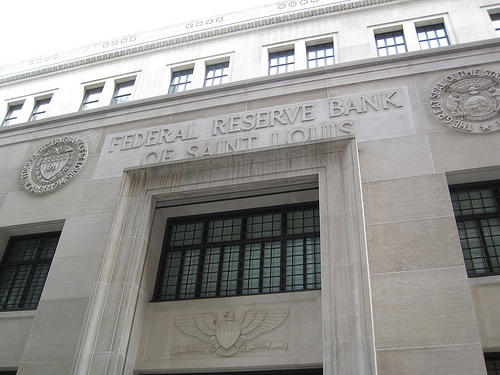

Jerome Powell, head of the US central bank FED (Federal Reserve) let the markets crash with his speech yesterday. Why are cryptos crashing? Let’s discuss in detail what Powell said and what impact this speech will have on the crypto market.

Anti-Inflation Measures

The central banker’s speech had been awaited by the markets for some time. After Wall Street and the crypto markets rose sharply in the past few weeks, a relaxed central bank policy was expected for the continuation of the rally. After Powell announced the largest rate hike in US history a few months ago, markets initially tumbled before recovering slightly recently.

The reason for the strong rate hikes by the central bank is to combat persistently high inflation. In the USA, this had recently cooled off somewhat, which is why no aggressive central bank policy was expected. Especially against the background of an imminent recession in the USA.

Why are Cryptos Crashing: Content of the Speech

While Wall Street and the crypto markets awaited a speech that would help ease the situation, Powell announced that he would continue to fight inflation by all means. Powell explained that fighting inflation would take time and prepared investors for a slowing economy. After Powell announced the fight against inflation in his speech to the target, investors now suspect an interest rate increase of 0.75 percent. This would mean that interest rates in the US would rise to 3.25 percent.

Experts are of the opinion that the interest rate could even be over four percent at the end of the year. The highest value in years.

Effects on the capital market

The unexpectedly drastic speech by the head of the FED now confirmed the fears of some investors that the FED would subordinate the labor market, economic output and the stock market to fighting inflation. The Dow then fell by 1000 points.

Since the cryptocurrency market is being more and more correlated with capital markets, we saw a significant drop in its market cap in the past 24 hours by an average of more than 6% to date. Bitcoin reached yet again its critical 20K price, with expectations to break it lower.

Higher interest rates mean less capital in the market. Higher interest rates and less capital make assets like stocks and cryptocurrencies less attractive, while bonds become more popular with investors. Above all, risky investments such as (unprofitable) tech stocks or cryptocurrencies then become unattractive. The risk-return ratio is getting smaller. In addition, the opportunity costs increase due to the increasing attractiveness of interest-driven securities.

High interest rates are also a problem for the underlying companies. Due to high interest rates, many companies can no longer take out loans, which has a negative impact on innovative strength and growth.

End of the Crypto rally?

After the Powell speech and the underlying market crash, the rally of the past few weeks appears to have been a bear market rally. Investors must now prepare that the capital gains of the past few weeks could soon wipe out if we reach new lows.

In the long term, however, the future is not so black. The US labor market is stable, there is even a shortage of workers. Should this change, the FED would presumably ease central bank policy. The situation is similar if the economy is shrinking too much. Powell is currently having to react harshly in order to use the stable times to turn around interest rates in order to fight inflation.

Rudy Fares

Equity Trader, Financial Consultant, Musician and Blockchain Aficionado. I spend my time doing Technical and Fundamental Analyses for Stocks, Currencies, Commodities and Cryptocurrencies.

Regular updates on Web3, NFTs, Bitcoin & Price forecasts.

Stay up to date with CryptoTicker.