Bitcoin Price enters Consolidation – Should Buyers get ready?

The Bitcoin rollercoaster strikes yet again. After the recent price decrease back to the USD 17,600 level, Bitcoin prices managed to recover and enter the uncharted territory of USD 19,000. This price-linger around all-time highs shows big strength and confidence in Bitcoin prices, with hopes of breaking the USD 20,000 mark back in sight. Should people expect a breakout or a fakeout?

The Bitcoin rollercoaster strikes yet again. After the recent price decrease back to the USD 17,600 level, Bitcoin prices managed to recover and enter the uncharted territory of USD 19,000. This price-linger around all-time highs shows big strength and confidence in Bitcoin prices, with hopes of breaking the USD 20,000 mark back in sight. Should people expect a breakout or a fakeout?

Bitcoin escaped the downtrend – back to the original uptrend

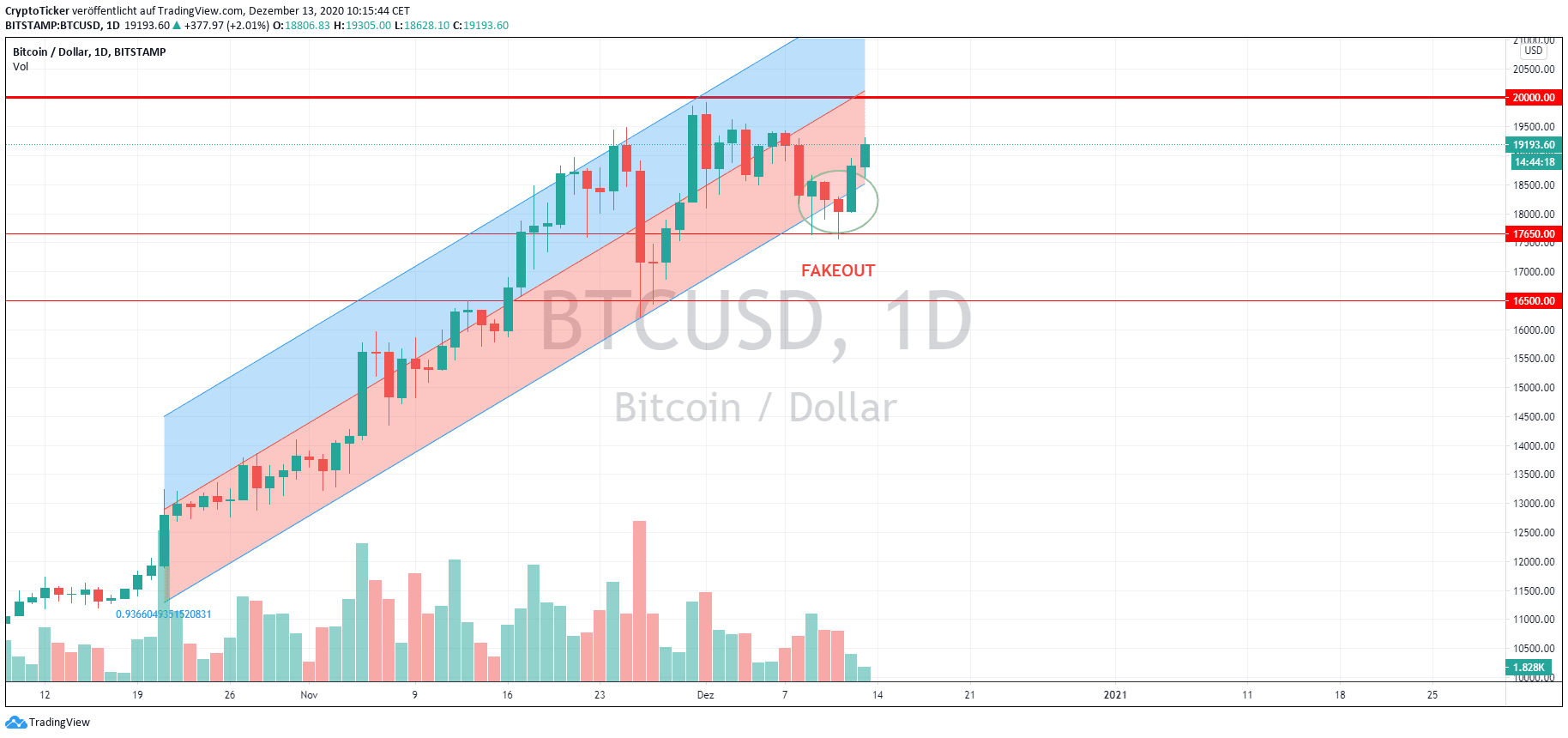

In a previous article, we discussed how Bitcoin prices broke the lower uptrend channel line, in anticipation of an end to the current uptrend. We also showed a potential recovery green line, which represented a recovery in prices back to the USD 19,000 area.

Well today, Bitcoin did just that, turning the breakout into a mere fakeout. Prices went back into the original uptrend channel (fig.1), on the road to hit USD 20,000.

What’s needed to reach the 20k target?

Some people would think that in order to reach the USD 20,000 target, a major breakthrough should take place, like major news advancements, or announcements, or even another 2017-like hype.

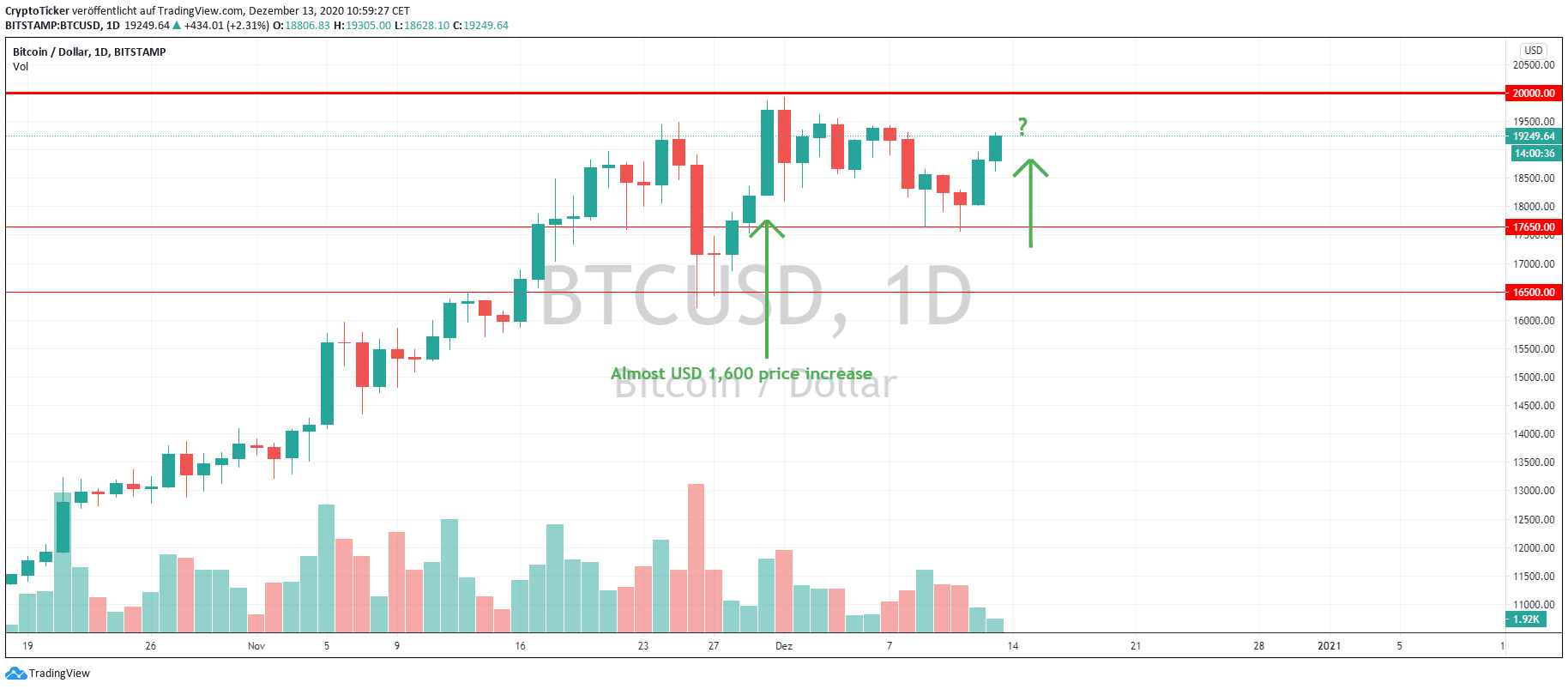

In fact, we just need another “30th of November” volatility day or even half of that! In figure 2, we can clearly see an increase in the price of Bitcoin in 1 day only by USD 1,600. Currently, we just need half that price increase to reach USD 20,000 as the current price of Bitcoin at the time of writing is USD 19,250.

Cryptocurrency Market Overview

In the last 24 hours, the whole cryptocurrency market showed a price recovery. This could be a natural phenomenon since Bitcoin, which still has a whopping 63.5% market dominance, recovered in prices, and is nearing its all-time high price of 20k:

1- Bitcoin (BTC) : + 5.30 %

2- Ether (ETH) : + 4.99 %

3- Ripple (XRP) : – 1.82 %

4- Tether (USDT) : 0 %

5- Litecoin (LTC): + 7.38 % (surpassing Bitcoin Cash)

6- Bitcoin Cash (BCH) : + 3.77 %

7- Chainlink (LINK) : + 3.88 %

8- Cardano (ADA) : + 5.61 %

9- Polkadot (DOT) : + 3.68 %

10- Binance Coin (BNB): + 3.81 %

Stay Ahead, Stay Updated

Rudy Fares

Follow CryptoTicker on Twitter and Telegram for daily crypto news and price analyses!