Bitcoin clone Bitcoin 2 Surges 5000%

A Bitcoin fork is rising after a huge 5000% wave and following breakdown in a matter of ampere-hours. The fork is named as Bitcoin 2 (BTC2) and originated in the month of February 2018. The cryptocurrency is offering secrecy characteristics […]

A Bitcoin fork is rising after a huge 5000% wave and following breakdown in a matter of ampere-hours.

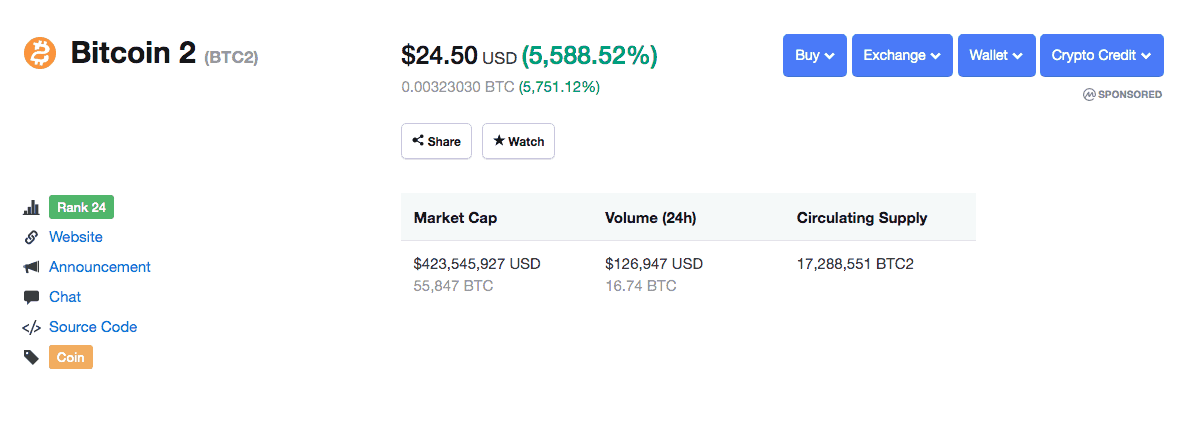

The fork is named as Bitcoin 2 (BTC2) and originated in the month of February 2018. The cryptocurrency is offering secrecy characteristics and fast transactions. In the last 24 hours, the coin evolved out of nowhere, climbing from less than a dollar to a high of $29.27 before dropping to $4.56. Bitcoin 2 (BTC2) entered into the top 25 crypto assets by market cap on June 6, tapping a mountain of $29.27 per coin, according to CoinMarketCap data.

Crypto traders quickly stirred out the insane price movement like a typical pump-and-dump, where whales can purchase and increase the value of a coin with moderate volume in order to create hype and influence others to join in. Once the price increases, the whales trade all their coins to enclose a swift profit.

The asset is only listed on two platform– Crex24 and Escodex. These two exchanges have Bitcoin 2 (BTC2) matched against Bitcoin (BTC). Crex24 seems to have entertained most of the asset’s trading movement during the pump, according to CoinMarketCap figures. BTC2 also displays a relative number of coins to that of BTC in phases of circulating stocks. BTC2 seems to have a circulating supply of 17,288,579, while BTC has 17,744,575 coins in circulation.

How people manipulate the cryptocurrency market?

One of the popular tricks that whales employ to manage the cryptocurrency market is pump and dumps. A whale brings out this trick by steadily acquiring a specific coin, normally over the period of many days, ending in meaningful price gains on trading tables. These price increases will then bring a lot of new money to the coin, otherwise known as FOMO (Fear of missing out).

The entrance of new money drives the price of the coin upwards and when the whale is happy with the advantages that they have produced, they will start to dump. The dumping method will usually transpire in waves. So, the whale will dump, and investors will believe it is just a momentary hole, and ‘buy the bottom’. By the time the whale has stopped trading, they would have gained modestly, whilst investors that FOMO’ed into the coin will face the music. This trick is particularly efficient with low market cap coins because it is simpler for whales to drive the price of these coins due to their shortage of liquidity.

Conclusion

The cryptocurrency market is full of uncertainties, which suggests that there can be a lot of chances to make money. Nevertheless, it also indicates that the market is much more sensitive to direction when connected to more conventional markets.

There are dark pools private exchanges that support whales, such as commercial organizations to exchange anonymously. Dark pool trading movement does not stir the openly traded value of crypto-assets. Thus, whales can store huge volumes of a coin without it being made disclosed to the unrestricted market.