Why Do Crypto Crash? Here Are Some Important Reasons

In this article, we will be assessing the crypto market to determine some of the reasons why the crypto market crashes.

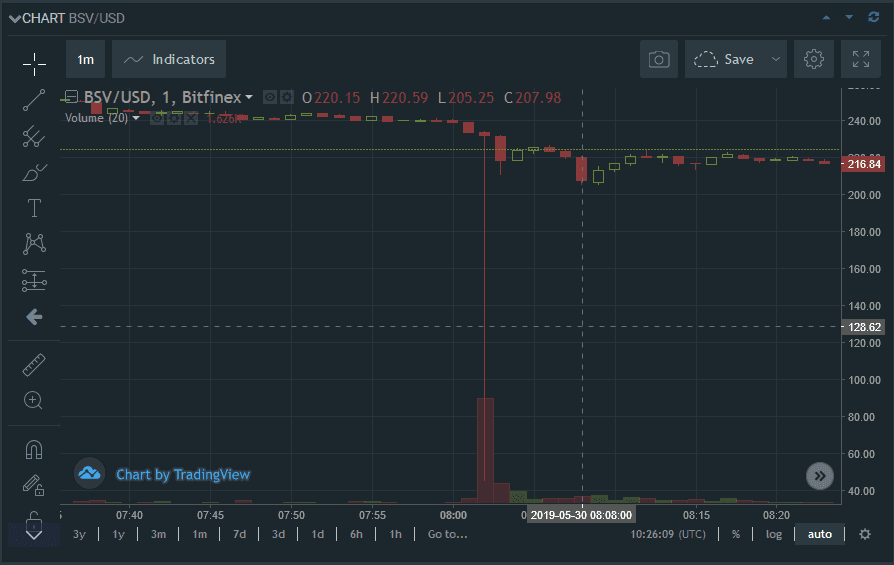

Cryptocurrencies are not strange to uncertainties, as price volatility remains a curse and a blessing to the thriving space. Digital asset prices continue to remain unstable for a period as fluctuations hit them hard. This uncertainty is also why the adoption of cryptocurrencies in financially sensitive regions remains slow. Investors within this region are more economically prudent and prefer to invest in traditional assets like stocks. Fortunately, in some cases, investors who purchase cryptocurrencies cheaply can still sell them at a profit when crashes occur. Unfortunately, most investors are on the losing side when these crises arise. However, crypto analysts continue to assess the market to ascertain what affects cryptocurrency prices. Factors like regulations, price volatility, negative media, and selling pressure remains huge determinant in market prices. However, with the crypto market falling last week, it is critical to examine why this happened.

A Look At The Crypto Market Today

As the bearish run continues, Bitcoin, Ethereum, and many leading assets have been down in the last week. This crash has also led to the loss of more than $800 billion in market capitalization. Initially, investors were not panicking, as optimism was high amidst a market correction. However, today, crypto investors are in dismay, as analysts predict that a crash might be imminent.

Surprisingly, the volatile nature of digital assets is why predictions concerning its future can’t be mere speculations. Hence, it is why, no matter what analyst predicts, their future might take a different turn. Bitcoin has lost more than 30% in value this week and is trading below $30k. This is the first time the leading asset has been trading below that price in 12months. Bitcoin is not alone, as many other assets’ value continues to fall beyond redemption. Unfortunately, the last few days summarize that the crypto market is bleeding.

Altcoins Are Not Spared

The hit in the market is not only to Bitcoin, as major altcoins suffered dips too. Terra’s LUNA price fall is the most shocking, as it lost more than 99% of its value in three days. Another shocking asset underperforming is USDT, trading for less than a dollar for the first time in ages. The digital asset has lost 0.65% in price value this week. Ether’s price has also fallen, with the leading altcoin losing about 35% value and now below $2K this week.

The week is also bad for altcoins like BNB, DOT, SOL, ADA, XRP, and DOGE, as they fell massively in price value. SOL’s fall by 52%, XRP by 42%, and DOT by 50% mean the altcoin market is bleeding. However, with ADA losing 46%, AVAX by 55%, and BNB losing by 35%, it caps off a terrible period for altcoins. Meme coins also witnessed a dip in prices as Dogecoin is also down by 43%. However, only a miracle might save this ailing market, as crypto analysts are pessimistic. Unfortunately, there is uproar on social media, too, as investors continue to dump their assets.

Why Is The Crypto Market Crashing?

Crypto analysts in large numbers believe the war in Ukraine could be why the prices of cryptocurrencies are falling. Unfortunately, there are rumors of investors dumping their assets, as they are losing patience with its growth. This phenomenon is prevalent around altcoins, whose growth has remained slow recently. According to fool.com, consumer sentiments towards cryptocurrencies are at an all-time low.

This is evident on popular social media, Twitter, known to be a tool that has fostered the global adoption of cryptocurrencies. A popular survey also shows there is no optimism about its future despite investors committing funds to cryptocurrencies. This is not unusual, as globally-known investors like Warren Buffet once predicted that Bitcoin would crash in the future. Reports concerning North American investors pulling funds off the crypto market at an alarming rate are also not helping. This is also why trading flows of assets tend towards negative recently.

Factors That Influence The Crypto Crash

This week’s devasting trend of cryptocurrencies remains disappointing and devasting, especially to investors. Unfortunately, if it continues, prices will further fall, amidst a collapsing market capitalization from the $1.3 trillion it is today. Fortunately, investors can only hope the trend will discontinue and a market correction looms. However, listed below are factors that could cause a fall in crypto assets value;

Investors are holding too much leverage

Crypto analysts believe more investors today are taking too many high risks in the market. This means that, like traditional markets, investors are using debts to finance future purchases. This will affect the market by influencing miners to hedge against future price drops in their mining coins. Crypto analysts believe these leverages could be responsible for price volatility in the future if not controlled. Another effect of this is that, as prices drop, future holders will start liquidating their positions. This will further instigate price drops, as the crypto market doesn’t have much liquidity.

Cryptocurrency and the stock market in correlation

Before now, the crypto market was an independent space devoid of interference. Unfortunately, that is not the case today, as the recent traditional market adoption now means a correlation exists between them. A fall in stock markets could lead to investors being more cautious with investing in the crypto market. Today, stock prices of large corporations like Netflix continue to fall as unsettlement prevails in Wall Street. This fall’s negative impact is that investors do not want to lose on both ends and remain cautious. This caution will lead to further liquidation and dumping, which will affect the crypto market. Alternatively, technology-related stock prices also affect crypto assets, as they are down at the moment. Furthermore, the impacts of such lowered risks would see the prices of crypto-asset decline.

Security Breaches

The current high rate of security breaches in the crypto market is a cause for alarm for all, including investors. Today, Blockchain networks and protocols expose themselves to too many risks, worrying investors. Investors would be willing to hold on to little assets or sell on time to avert the threat of losses. Since investment activity and sentiments are significant factors that control price in the market, it could be why prices of assets are falling.

Cryptocurrency Regulation

The positive impacts of cryptocurrency regulation can be very beneficial to the market. Alternatively, the negatives of such rules can be daunting to the success of the crypto ecosystem causing a crypto crash. A typical example of a regulation that affected the market was when China banned crypto mining in its terrain. This resulted in miners seeking alternate cheaper options and thus resulting in the overall decline of the network hash rate. Hash rates are several calculations performed per second in a blockchain that allows miners to produce new coins.

When it declines, prices also drop as miners earn in cryptocurrency. Crypto regulation is also responsible for the slow adoption of digital assets in Africa and some parts of Asia. Crypto analysts believe that it will foster its adoption beyond borders if financial regulators understand cryptocurrencies better. There are also calls to financial regulators to implement proper crypto tax guidelines to prevent crypto investors from defaulting. This will also be another source of IGR to the government and may further deepen their interest in cryptocurrencies.

Negative Media

The impact of the media on anything today cannot be underestimated, especially as social media is now a norm globally. Today, social media has power in our society and remains a double-edged sword that can make or mare crypto prices. This is because it is like a glass that reflects cryptocurrencies to investors and enthusiasts at large. Alternatively, the majority of the influencers of the crypto market are also heavily present on social media. For example, Tesla Elon Musk’s tweets about Dogecoin and Bitcoin moving the market. Unfortunately, such an influential tweet could also cause a crypto crash.

This means that social media can control the investor’s moods. Recently, social media apps like Twitter, Facebook, Instagram, and TikTok, have remained pivotal to the crypto market’s growth. Like Musk, Dogecoin price began to surge in July 2020, courtesy of the TikTok trend by Jamezg97. Jamezg97 is a famous crypto enthusiast and investor who uses the platform to discuss cryptocurrencies. However, his trending video, which featured one of the earliest Dogecoin-pumping trends, moved the altcoins price. This created a new wave on the social media platform, improving the value of DOGE in the process.

The Snowball Effect

A snowball effect can be negative or positive, depending on how it pans out. For example, a social situation that angers a group of people can lead to a protest and further confrontation. However, it could also garner more attention to the problem, creating more awareness. In this case, as crypto users continue to discuss cryptocurrencies, it could lead to more adoption of digital assets. Alternatively, that could also mean that they will be luring short-term investors to the space. The impacts of short-term investors, who are quick to trade off assets for early profits, could damage the asset’s price. Selling pressure could also devastate the price of cryptocurrencies, especially if significant investors are dumping them. Typically, cryptocurrencies are very volatile, and low-risk investors would be wary of price decline. However, if selling pressure is high and most investors think the market price will decline, this will collapse any market.

What Next?

Despite a crypto crash, the thoughts of everyone should be toward an uptrend price correction. This trend should see the crypto assets adjust towards regular prices in most cases. Unfortunately, asset prices might derail further from previous prices and may fail to peak. Price correction usually occurs when an asset is at its peak, and analysts expect it to fall by about 10-20% in value. During the correction, the advice to investors is to stick with their plan and should not panic. Decisions are important and should not be swayed by emotions at this stage. This is because corrections are short-lived, and selling amid a correction does not help profits but losses.

Generally, after a crypto crash, cryptocurrencies tend to move back towards an uptrend. This is not for all, but most, as a bull run may occur or not. However, in today’s analysis, crypto analysts predict an uptrend for top cryptocurrencies like Bitcoin and Ethereum. This is because Bitcoin is not alien to crashes, as the digital assets have remained strong to date. Many other altcoins will likely go on a bull run before the end of the year, as crypto market conditions are temporary. Unfortunately, while the metrics and indications do not suggest that today, investors can only continue to hope.