What Is Conflux? The CFX Token Promises Massive Returns!

In this article, we will discussing about the Conflux Network project. We will also look into the CFX token to determine its potential.

Despite the rapid growth of cryptocurrencies globally, Asia and Africa remain the continents struggling with the mass adoption of cryptocurrencies. For example, in Nigeria- Africa’s economic hub, trading cryptocurrencies are banned. Commercial banks, FinTechs, and financial institutions in the country cannot offer citizens crypto or related services. Alternatively, citizens cannot trade these assets, and if they are found guilty, they could go to prison for breaking the law. Unfortunately, a similar law is now operational in Asia’s economic hub, China. This law also forbids financial institutions from offering crypto services to citizens and residents of the nation. Fortunately for China, and unlike Nigeria, DeFi outfits like Conflux Network are moving their blockchain space forward.

What Is Conflux Network?

Based in Asia, Conflux is a Defi ecosystem that promotes cross-border and multi-chain collaboration in the continent and beyond. Launched in 2018 by the Conflux foundation, it is a permissionless Layer 1 public blockchain connecting decentralized economies across protocols. The blockchain network is currently transforming the global reaction of the world to a sustainable and borderless economy.

It is also known as a protocol for a new wave of DApps, finance, and Web 3.0. Based in China, the network currently prides itself as the only state-endorsed public blockchain in the country. Therefore, it provides a home for blockchain projects in the Asian nation and expands its crypto ecosystem. It is also a fast, secure, scalable, and interoperable network known for its low fee charges. The native and governance token of the network is CFX, which also functions as a utility token.

How Does Conflux Network Work?

It utilizes a hybrid model incorporating both PoW (Tree-Graph) and PoS consensus mechanisms to secure the network. The Tree-Graph possesses immense ability to process transactions in parallel, utilizing a Directed Acyclic Graph (DAG) structure. Its incorporation with a PoS consensus increases Conflux’s security and maintains top-notch decentralization and efficiency. Another advantage of this fusion is eliminating “51% attacks” while providing finality to transactions. The state-of-the-art public blockchain also utilizes Turing-complete smart contracts to limit human intervention in its network. To balance scalability and low transaction fees, Conflux relies on ShutteFlow. ShuttleFlow is a cross-chain asset protocol that allows Conflux to communicate with data and assets from other Blockchains. It is pivotal to Conflux’s operation and is an important piece of the protocol’s functionality.

Why Is Conflux Network Unique?

Apart from solving scalability issues for DApp developers, Conflux’s unique technical infrastructure provides users with a breathtaking experience. The protocol’s attempts to solve most mainstream issues facing blockchain users and developers make it unique and desirable. One of such problems is Defi Compartmentalization. The rapid expansion of the young DeFi space has seen it move in a different direction across multiple blockchains. Unfortunately, this results in investors paying multiple fees for asset conversion across these chains. However, Conflux allows these users experience multi-chain interoperability by providing them with Shuttleflow.

Shuttleflow currently helps users convert digital assets across multiple chains for cheap rates. Another problem Conflux solves for DApp developers is compliance. The lack of complaint technologies and tools for blockchain developers is a huge determent to the growth of the crypto ecosystem. However, developers receive support for building compliant DeFi technologies with the Conflux suite of tools. Lastly, Conflux help to solve the lack of liquidity caused by compartmentalization via its multi-chain approach. This solution fosters the linking up of traders and markets in new and exciting ways.

Why Should I Use Conflux Network?

For users and developers, Conflux provides them with varieties of solutions tailored to their individual needs. According to its founders, the blockchain attempts to solve Ethereum’s trilemma—security, scalability, and decentralization. Apart from being a regulatory compliant, public, and permissionless blockchain in China, it is growing beyond Asia. Listed below are a few of the advantages the network posses over others;

Scalability

Conflux’s attempt at solving scalability remains one of the most exciting features of the multipurpose chain. Users and developers enjoy unmatched scalability on the interoperable network. The uniqueness of this scalability is that it achieves it without sacrificing decentralization. The network’s 6000 Transaction Per Second (TPS) is one of the highest in the crypto ecosystem. When compared, it is faster than that of popular networks like Ethereum and Bitcoin.

Accessibility

Conflux is a very open and accessible network to all users. The network provides a suite of advanced tools to streamline DApp development for developers. These tools aid them in building a variant range of products, from financial applications to digital assets.

Cheap

Another advantage of Conflux is that it is very cheap to operate for all users. This is possible due to its high scalability. DApp developers can build on the network at low costs, alternatively allowing users to pay low for their services. This benefit has also been vital to the network attracting many developers to its platform.

Rewards

Conflux’s staking contract feature also provides users with opportunities to earn passive rewards. To earn these rewards, users will stake their tokens and lock them into the smart contract for a specified time. Traditionally, users prefer to stake their coin rather than trade it due to the low risk attached. Fortunately, developers on the protocol also can offer their DApp users staking, and they can also earn rewards.

What Is The CFX Token?

CFX is the life wire of the Conflux chain and remains one of its most important elements. Primarily, it functions as a utility and governance token. To gain voting rights to the Conflux community governance, token holders will need to stake the token. By staking it, users also earn passive rewards in it. Community governance covers submitting proposals to alter or add features to the network. These proposals range from fee structure changes to overhaul of technical alterations. Other token holders will also participate in the voting process to ensure it is free and fair.

Like other chains, the more CFX they hold, their vote holds more weight. Another use of the token is for developers to use it to create bonded storage for their DApps. To achieve this, they will lock into a smart contract and alternatively earn interest on them. A portion of the interest earned via this staking is paid out to miners for securing the network. The token is available for purchase in many crypto exchanges, including WazirX, Gate.io, Kucoin, and Binance.

How To Buy CFX Token

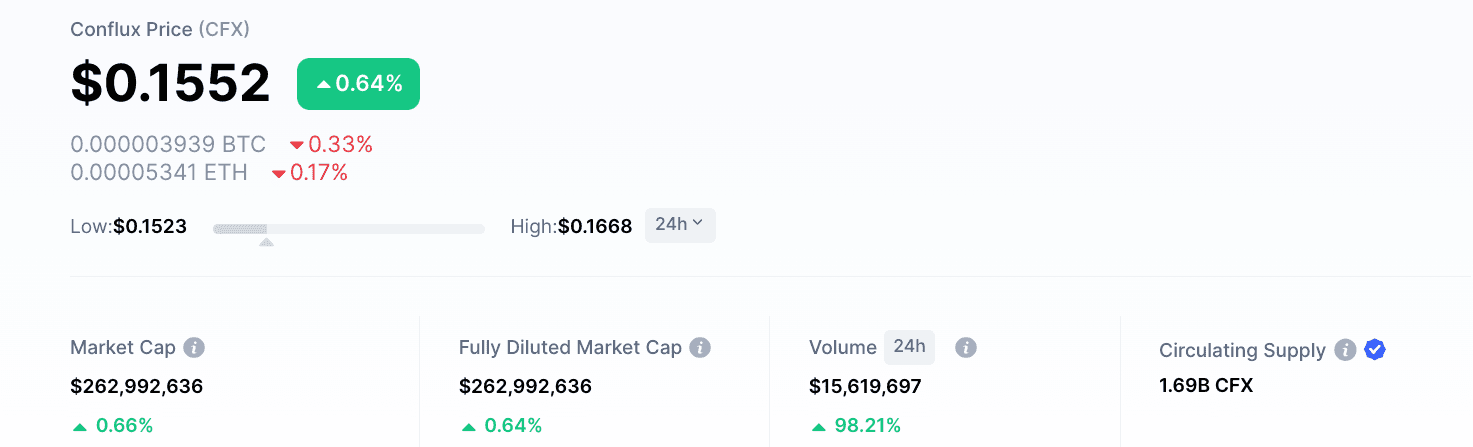

According to CoinMarketCap, CFX has a circulating supply of 1,692,756,586 coins, and a maximum supply of 5,000,000,000 coins. The token is available for sale and trading pairs on many exchanges, including Binance. Unfortunately, Binance currently prohibits U.S. residents from purchasing CFX on its exchange. Binance. Fortunately, residents from Australia, Canada, Singapore, the U.K., etc., can buy it from the leading exchange platform. Follow the four simple steps below to buy CFX on Binance;

Step 1 – Sign Up/Log In

As a user, you will need to log in or sign up on Binance. Using your email address or phone number, you can do that on the Binance App or Website. The Binance app is available for download on Android and iOs stores, compatible with the respective devices. The signing-up process is usually seamless and complete after supplying a few KYC details. To complete it, you will need to verify the information you have provided. However, existing users will only need to log in to their accounts.

Step 2 – Deposit Funds

After logging in, it is important to fund your Binance account. This will enable you to complete the purchase of CFX smoothly. Funding your account is stress-free and could be done via a bank transfer, a debit, or credit card. Binance also allows users to fund their accounts via peer-to-peer trading in some jurisdictions. Alternatively, users can also take advantage of the numerous third-party payment options available on Binance.

Step 3 – Purchase CFX Token

You will now use the funded account to purchase either BTC, BUSD, or USDT on Binance. The most preferred option is to purchase USDT due to token CFX. After that, you will search for CFX and complete your purchase by pairing CFX/BTC, CFX/BUSD, or CFX/USDT. The purchase of the new tokens will automatically reflect in your account.

What Does The Future Hold For Conflux And CFX?

The status quo of CFX in the Conflux ecosystem does not look to change now and, in the future, should become stronger. Conflux’s offerings of various services, most of which are vital to crypto users, will further increase its attractiveness and value. Another factor that may contribute heavily to its future growth is the support from the Chinese government. That growth will see Conflux Network and CFX excel outside China and Asia. The protocol will be pivotal as a gateway for other blockchain development teams to thrive in China and beyond. According to Crypto Analysts, if they follow through with their roadmap, user interest in the project to rise further as expansion looms.

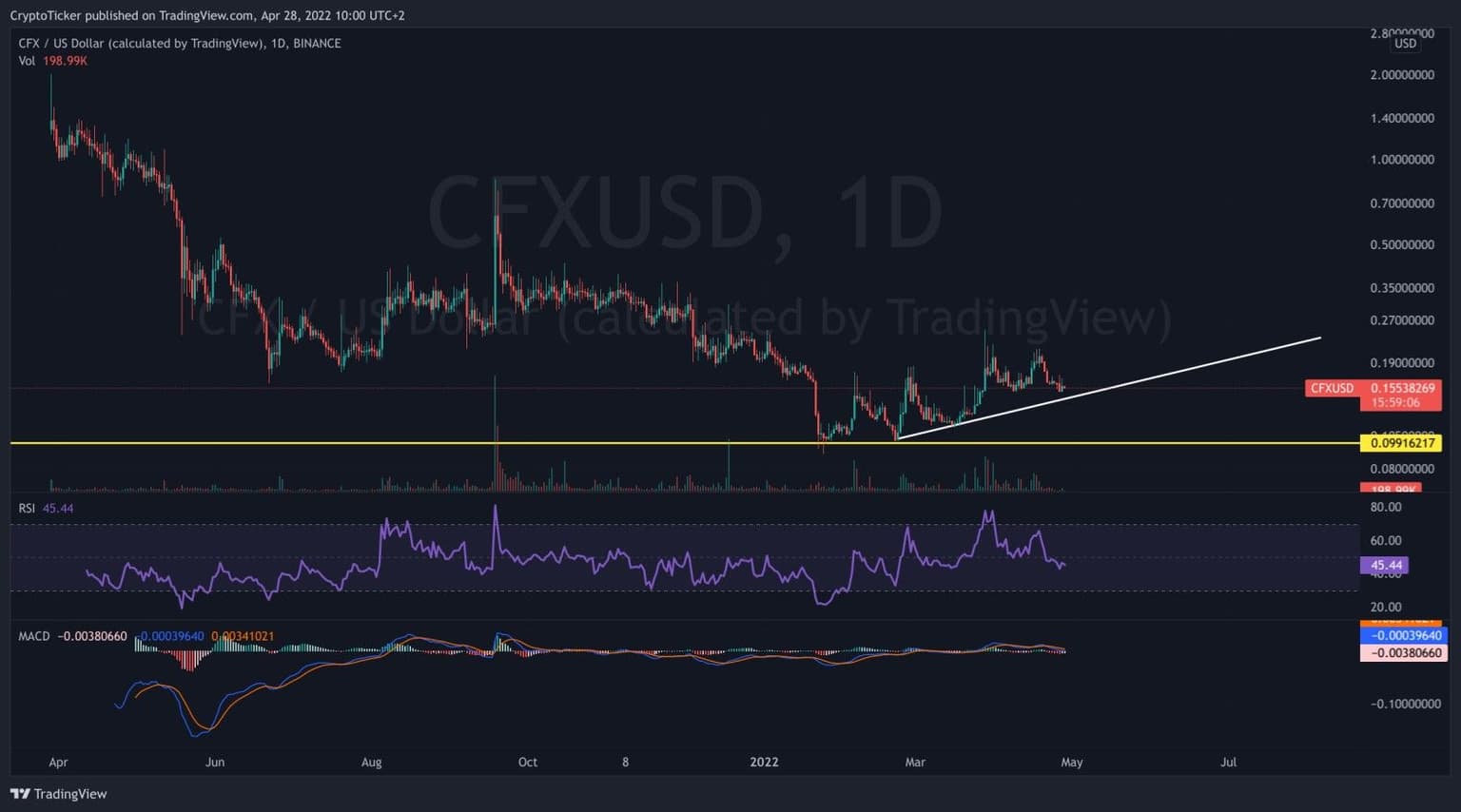

CFX Price Prediction

According to CoinMarketCap, the token’s recent dominance ranks it among the best 200 tokens in the crypto market. Its average 24hour trading volume is up to about $16.5 million amidst a market cap of $273.1 million. Its current price of $0.161 is 90% off its ATH price of $1.7 it traded a year ago. Despite a fluctuating performance this week, the token’s gain of 25% this month is quite remarkable. This is why crypto analysts have divided opinions about the future of the token.

DigitaCoin thinks the token will end the year at $0.22, predicting a bullish run for the asset. Their predictions for the assets in 2023, 2024, and 2025 do not see it going beyond $0.35. The Crypto analysts are uncertain whether CFX will reach $1 in 2030. Alternatively, GovCapital is optimistic about the future of CFX, predicting the token to end in 2022 at $0.22. Should this happen, investors’ year-to-date (YTD) ROI will slightly tilt above 100%.

Like DigitalCoin, GovCapital predicts that CFX may not cross the $1 mark by 2030. Unfortunately, WalletInvestor is pessimistic about the future of the token, as they predict a bearish run. The Crypto analysts see CFX falling by 90% this year. According to WalletInvestor, CFX is not ready to take the market by storm, as they warn investors about its future. However, while predictions can be great, crypto-assets remain volatile, and anything can happen in the future. The advice to investors is to commit funds they can lose to crypto assets.

Conclusion

Licensed in China, Conflux is a permissionless Layer 1 public blockchain connecting decentralized economies across protocols. To achieve consensus, it utilizes a hybrid model incorporating both PoW (Tree-Graph) and the PoS consensus mechanism. CFX is the native and governance token of the network and equally functions as its life. Despite a volatile month for the token, its average performance remains decent. Many analysts believe that Conflex as an organization will propel the Blockchain space in China into a new realm. However, crypto analysts remain divided over the future of CFX, largely due to its instability.