BlackRock Goes All In: From Anti-Crypto to Competing for Bitcoin Supremacy

Once crypto skeptics, BlackRock has pivoted 180 degrees to challenge Strategy Inc. in becoming the world’s largest Bitcoin holder. Here’s how two financial giants are rewriting the rules of crypto adoption.

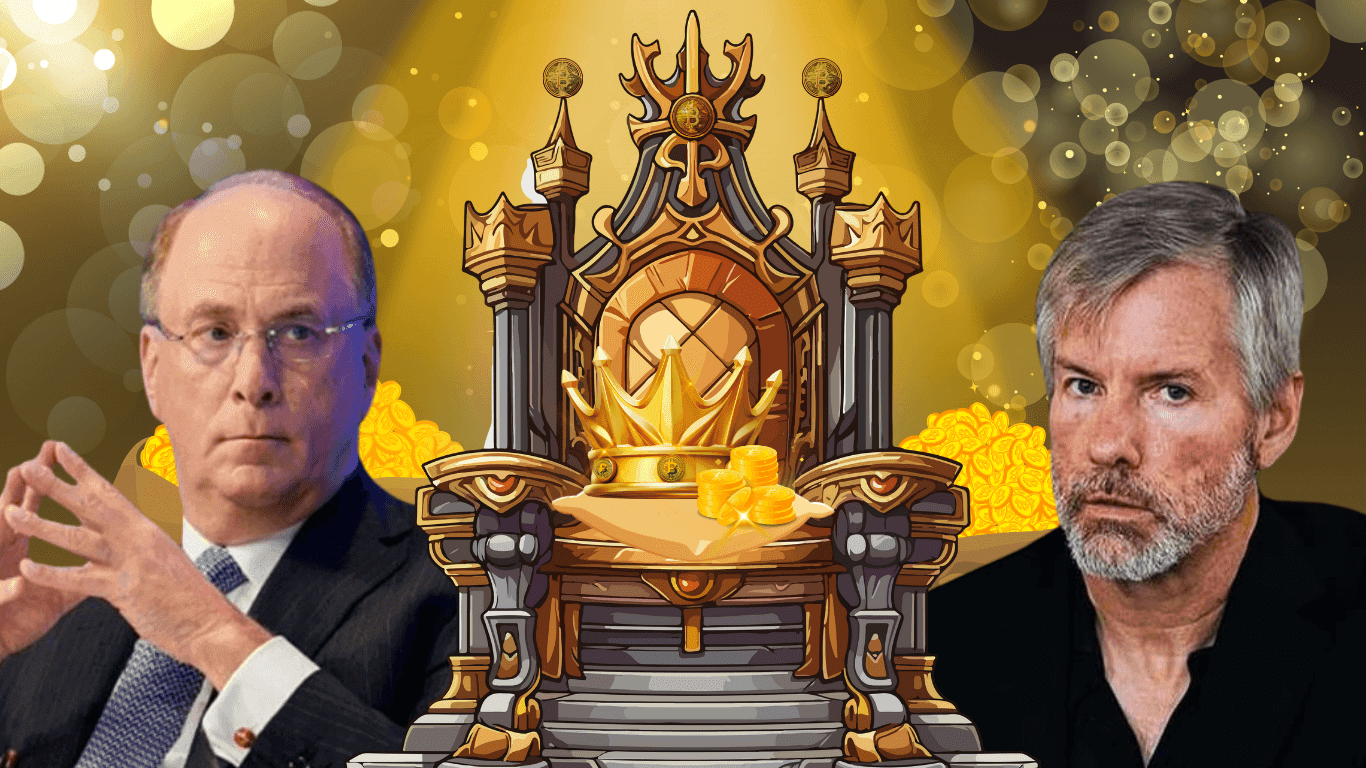

A New Crypto Crown at Stake

The race to become the world’s largest corporate holder of Bitcoin is heating up — and it’s no longer a one-man show. Once a vocal skeptic of digital assets, BlackRock, the world’s largest asset manager, is now in direct competition with Strategy Inc. (formerly MicroStrategy), vying for dominance in the crypto space. With both giants holding over half a million BTC, the question now is: who will claim the crypto crown first?

BlackRock’s Bold Pivot: From Doubt to Domination

Back in 2017–2018, BlackRock CEO Larry Fink dismissed Bitcoin, claiming there was “zero interest” from clients. Fast-forward to 2025, and the firm is managing the iShares Bitcoin Trust (IBIT)—the world’s most successful spot BTC ETF to date.

Key milestones in BlackRock’s crypto turnaround:

- 2023: Filed for a spot Bitcoin ETF

- Jan 2024: iShares Bitcoin Trust (IBIT) approved

- June 2025: IBIT crosses $70 billion in AUM

- June 2025: BTC holdings reach ~667,000 BTC

- Public goal to become the world’s top crypto asset manager by 2030

BlackRock’s U-turn isn’t just strategic — it’s seismic. From lobbying for regulatory clarity to pushing crypto mainstream through ETFs, BlackRock is leading the institutional wave into Bitcoin.

Strategy Inc.: The First Mover Holding Strong

Strategy Inc., under the leadership of Michael Saylor, has long embraced Bitcoin as a strategic reserve. With ~582,000 BTC held directly on its balance sheet, the company remains the largest corporate Bitcoin holder worldwide.

Strategy Inc. milestones:

- First corporate buyer of BTC in 2020

- Converted entire treasury into Bitcoin

- Rebranded from MicroStrategy to Strategy Inc. in 2024

- Views Bitcoin as a hedge against fiat devaluation

- In June 2025, Strategy launched BTC-backed preferred stock offering a 10% yield, aiming to raise nearly $1 billion to buy even more Bitcoin — a clear signal of its long-term conviction.

Side-by-Side: BlackRock vs. Strategy Inc.

| Category | BlackRock (IBIT) | Strategy Inc. |

|---|---|---|

| Bitcoin Holdings | ~667,000 BTC | ~582,000 BTC |

| Strategy | ETFs, institutional asset manager | Direct purchase on balance sheet |

| Market Position | World’s largest asset manager | Largest corporate BTC holder |

| Recent News | IBIT hits $70B AUM, targets top crypto asset manager by 2030 | Issued BTC-backed preferred stock to raise $1B |

| Approach | Regulated, compliant ETFs | Maximalist, leveraged direct buys |

Why This Race Matters for Crypto’s Future

This power struggle isn’t just about who holds the most Bitcoin — it’s a defining moment for crypto’s mainstream legitimacy.

🏛️ BlackRock brings regulatory credibility, Wall Street trust, and deep institutional capital.

🧠 Strategy Inc. brings ideology, conviction, and a bold balance sheet approach.

The outcome may shape how corporations, ETFs, and even nations treat Bitcoin — not as speculation, but as a strategic reserve asset.

Final Thoughts: From Critics to Catalysts

BlackRock’s transformation from crypto critic to market leader proves one thing: Bitcoin has gone institutional. Whether it’s BlackRock leading through ETFs or Strategy doubling down with leveraged buys, this race is reshaping the future of digital finance — and the entire ecosystem stands to benefit.

👉 Ready to join the crypto wave?

Start trading now on Bitget and explore the future of finance.

$BTC, $MSTR, $IBIT