When the word “cryptocurrency” is mentioned, most people immediately think of Bitcoin. The first and still the largest cryptocurrency by market cap is “Bitcoin”. It is usually considered a reference price in the industry, also in comparison to indices such as the S&P500, the DAX, or other values. Even apart from Bitcoin, there are cryptocurrencies that drive the industry forward with new ideas, technologies, and solution approaches – and often outperform Bitcoin. How to choose the best Cryptocurrency for you before 2023? Let’s find out in this Altcoin Investing Guide.

Altcoins: A mix of Innovation, Memes and Scams

So-called “altcoins” are all cryptocurrencies that are not Bitcoin. In addition to Ethereum, other major currencies and projects such as XRP, Cardano or MATIC are also considered Altcoins.

During the boom of the last few years, new Altcoins shot up every day. In addition to meme coins like Dodge or Shiba Inu, it was only a matter of time before the first fraudsters mingled alongside Altcoins. In the recent past, failed projects such as Terra or Anubisdao have become examples of crypto fraud. But in addition to memecoins, fraud and failed projects, there are often altcoins that can play a major role in shaping the future of the internet. Innovative ideas and coin start-ups mix with creative DeFi models or metaverse productions. But how do I find the profitable projects that deserve a future from the constantly growing range?

Altcoins Investing: 5 Steps to Choose an Altcoin

The Team

The first step in screening altcoins should always be the team. The individual team members and executives should be scrutinized very closely.

- Has the team already gained experience with other crypto projects?

- How is the project managed (goal achievement, communication, website, etc.)?

- How is the project financed or financially positioned?

The Goal

One of the most important investment aspects is the goal of the project. So it is important to understand what problem the project wants to solve and how this should be done. It is important to determine whether the problem is an actual one or a created one.

- What problem does the project aim to solve?

- Is there a market for the solution?

- Is the problem real or homemade?

- Are there use cases for the product?

The Technology

The technology on which the project is based or which it intends to provide is the next step. It is important to understand which goal the project is pursuing and on which technology this is to be based.

- Which blockchain is used?

- Have there already been similar projects?

- …why would they possibly fail?

- Are there competitors in the market?

- How innovative is the technology?

Marketing Plan

The marketing of the project should also be closely monitored. So it is usually dubious to announce blatant advertising measures or to publish unrealistic expansion plans.

- What is the team’s marketing strategy?

- Are the set goals achieved?

- How is the project expanding?

The Token

Furthermore, it is essential to understand the token. Basic technical details are crucial in order to understand the token. This part is comparable to approaches of stock analysis.

- What is the market capitalization?

- What is the maximum circulation amount?

- Is the token deflationary or inflationary?

- What shares do the stakeholders hold?

Where to Buy Altcoins?

Altcoins can be bought on more than 50 exchanges. However, it is important to choose solid exchanges. The latest FTX crash showed how important is it to choose the right broker. Centralized exchanges are still the gateway from legacy finance into blockchain tech. We at CryptoTicker recommend the following trusted exchanges:

Conclusion

Finally, it is important to consider the potential risks and drawbacks of an altcoin. Like any investment, there is no guarantee of success, and it is important to carefully weigh the potential risks and rewards before committing to an altcoin. It is a good idea to research the altcoin’s potential competition, as well as any regulatory or legal challenges it may face.

Altcoin investing requires a thorough understanding of the altcoin market and the factors that can impact an altcoin’s success. By researching the market cap, technology, team, community, and potential risks of an altcoin, investors can make informed decisions and potentially identify altcoins with the greatest potential for success.

Offer from CryptoTicker

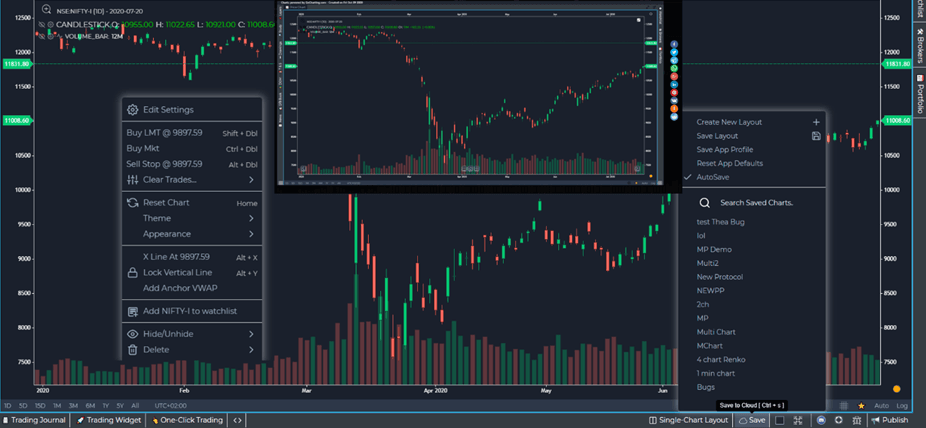

Are you looking for a chart analysis tool that doesn’t distract you with community messages and other noise? Check out GoCharting ! This is an easy to use online charting tool that requires no downloads or prior knowledge.

Click here to get a 10% discount on your first payment (monthly or yearly)