What Is Augur? Is Augur Still Worth Investing In 2022?

In this article, we will be looking into the Augur crypto project to determine if it is still worth and investment in 2022.

The crypto space remains flooded by many cryptocurrencies, providing investors with multiple options of investments and rewards. This is because, Blockchain enterprises continue to spring up, giving users access to different bespoke services. While most of these services are financially related, others focus on solving real-life problems. However, for some projects, they tend to provide services that are non-technical and open to all users. A typical example of such an enterprise is Augur- the prediction market platform.

What Is Augur Crypto?

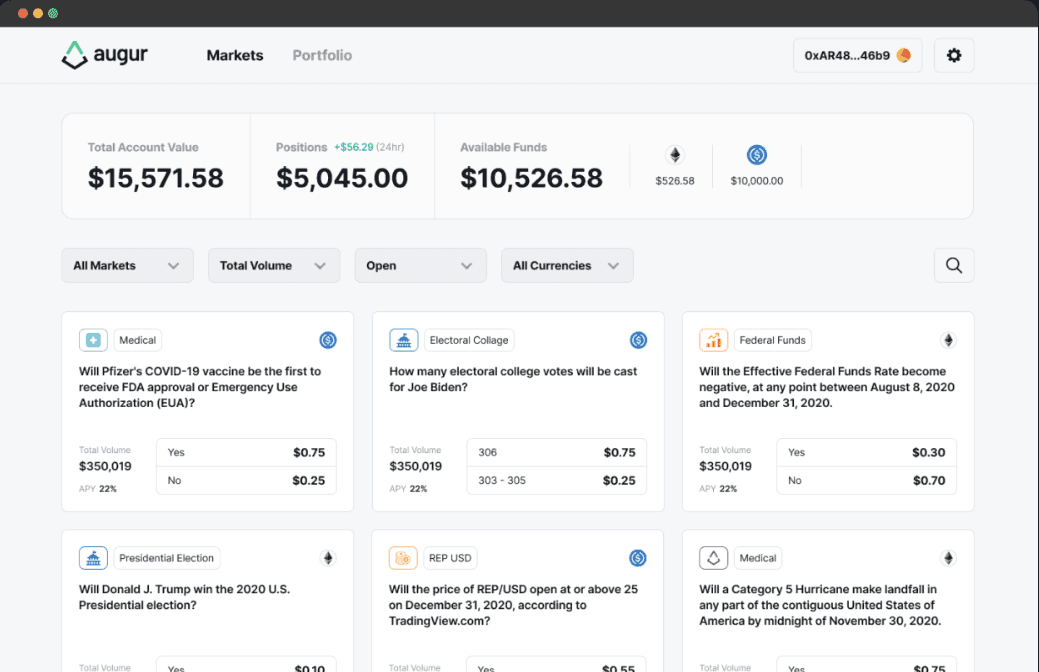

Developed by the Forecast Foundation in 2014, Augur is a trustless, decentralized oracle and prediction market platform. Joey Krug and Jack Peterson, Forecast Foundation founders, are also the brain behind Augur. The platform incentivizes a network of computers to run a predictions market on the Ethereum blockchain. It also allows users to create, observe and trade in any sector in its prediction market. A prediction market works by enabling users to wager on the outcome of events. A prediction market doesn’t work as an exchange, but it is decentralized and allows users to create and exchange shares. These shares are a portion of the value of outcomes that, unlike an exchange, are not controlled by the prediction market.

Augur conserves an order book to record markets created in it. This order book has no limits to trade and allows users predict the outcome of any event predictable. Examples of such events could include weather, sports result outcome, elections, etc. When users predict the outcome of an event successfully, they get rewards. Alternatively, when they fail, they lose their capital. The token that powers the protocol is REP, and users who predict correctly earn their dividends in the token. Before launching, Augur raised $5.5 million in an initial coin offering (ICO) in 2015 by selling 8.8 million REP tokens. Augur’s initial success also saw the project generate $1.5 million in stakes in its first month of launching.

How Does Augur Work?

Augur’s system relies on collective intelligence via market incentives, trade dynamics, and blockchain technology. Augur can generate unique and accurate event forecasts that only exist on the platform. The platform also consists of Ethereum-deployed smart contracts that ensure it remains decentralized. That way, results and outcomes on the platform are void of human or third-party manipulation. Its operational process is in the execution stages to optimize the user experience and ensure fairness on the platform. Listed below are the four steps in which Augur works;

Market Creation

Market creation on Augur is the same as any betting market, and anyone can create one based on real-life events. Augur allows market creators to set outcome parameters and determinants and earn creator fees when the wager settles. The creators’ fee is a portion of the trader’s winning, which is paid to the creator when a trader wins.

Market Trading

Market trading involves users buying stakes in the outcome of an event. These stakes, usually called shares, have unstable prices dependent on multiple factors.

Reporting

Reporting involves Augur’s Oracle determining the event’s outcome based on the data obtained from the real world. Those whose predictions conform with the consensus report earn their rewards in this stage. Unfortunately, users who fall out of this category will lose their staked shares. Ultimately, the lost assets are shared with those who reported with the consensus.

Settlement

This is usually the last stage of its operation, as it involves traders terminating their investments and collecting their payouts.

What is REP Token?

REP is a utility token in Augur that powers it and remains pivotal in Augur’s success as a forecasting tool. Fortunately, unlike other protocols, traders on Augur do not need to own REP to bet on the platform. This is because its primary use on the platform is for the event outcome reporting process. Also, since Augur runs on Ethereum, purchasing prediction market shares are available to ETH token holders. Alternatively, if market participants possess Ethereum’s stablecoin- DAI, they can purchase market shares.

Another use case of the token is being a tool for creating prediction markets. The token is also be used in the Augur ecosystem to dispute an outcome of a result or purchase participation tokens. Users can purchase from exchanges or report correctly on a betting outcome to obtain it. It has a circulating supply of 11,000,000 coins and an uncapped maximum supply. The token is available for purchase on many exchanges, including Binance, Kraken, CoinTiger, DigiFinex, and KuCoin.

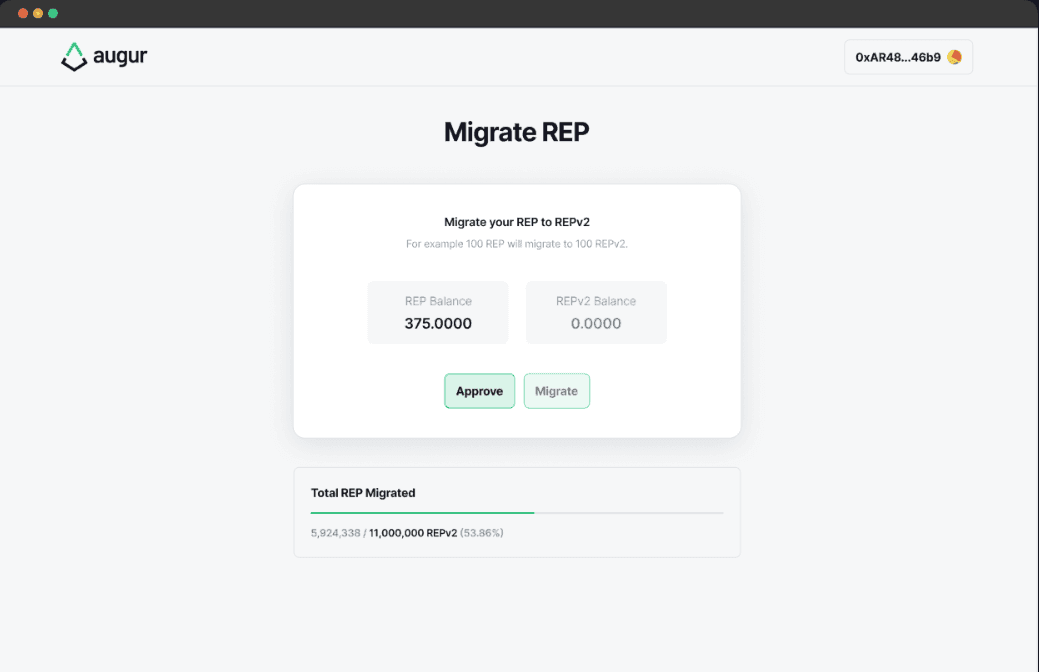

About Augur v2 And REP v2

On July 28th, 2020, Augur launched Augur on the Ethereum mainnet. That upgrade resulted in the introduction of a new token- REPv2. The functions of both Augur and Augur v2 are similar in operation, despite the new token’s introduction. However, for holders of REP to participate in Augur v2, they will need to migrate their token to REPv2 manually. Augur v2 also saw the platform introduce a network-wide market fork- Use It or Lose It. “Use It or Lose It” ensures that holders of both REP and REPv2 participate in any of the forked and future universes of Augur within 60-days. Failure to comply will deny them access to participate in any market fork in the future. To complete the migration process, Augur also equipped exchanges, dApps, DEXs, service providers, and other entities interacting with REP with a complete manual to handle migration.

How To Buy REP Token On Kraken

REP is a cryptocurrency valuable because it the asset tasked to ensure the successful execution of smart contracts on Augur. It is also the only commodity, alongside ETH, used to report event outcomes on the platform. Leading exchange- Kraken offers users an opportunity to buy REP. The platform allows one to buy a minimum of 0.3 REP and up to 1,400 REP or more. Depending on your country and availability, listed below are the steps to buying REP on Kraken;

Step 1 – Sign Up

Signing up on Kraken is the first for new users. Users will have to download the Kraken app on Android or iOs stores or use the exchange’s website. This process is usually seamless and complete after supplying a few KYC details. You will also need to verify the information you provided. It is worth noting that only verified accounts will have access to the Kraken trading platform. However, existing users will only need to log in to their accounts.

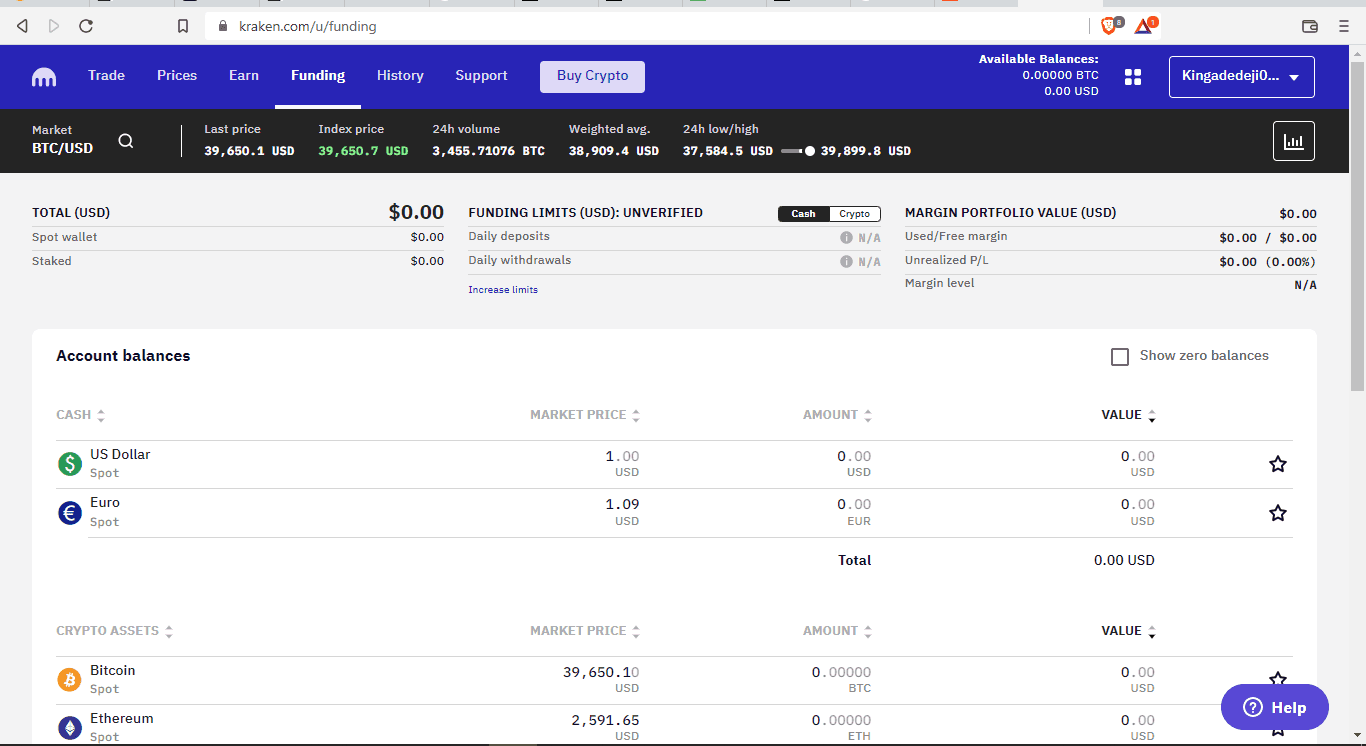

Step 2 – Deposit Funds

After creating your account or logging in, you will need to fund your Kraken account. This will enable the purchase of REP to be very seamless. Funding is straightforward, and with either a bank transfer or any compatible debit/credit card, your account will receive funds. There is an option to purchase REP with these funds directly or with cryptocurrencies like ETC and DASH.

Step 3 – Buy REP Token

After funding, you can then purchase your REP tokens. Click on trade, select REP from the search bar items, and enter the amount you want to buy. You will then review and confirm the amount and make payments for it. The new assets will automatically reflect on your account, and you can decide to either hold, trade or sell them. You will also need to ensure that you have a wallet, enabling you to store it securely. You can also access Kraken‘s advanced charting tools, which give you access to its spot trading on margin.

Augur In The Last Five Years

Since Augur became operational in 2015, it has remained one of the Blockchain’s space top betting markets. However, the market has since become competitive, with a top name like Gnosis making waves. Issues around speed, scalability, and performance marred the platform’s original software launch. However, most of these problems were solved when the platform released its second version (v2) in July 2020. Apart from high scalability and increased performance, its v2 added new crypto bespoke tools suite. This suite includes IPFS, MakerDAO’s Dai, 0x Mesh, and Uniswap’s pricing oracles. Before now, Augur v1 declared specific markets invalid, especially if the outcome of an event cannot be appropriately diagnosed. Unfortunately, this will lead to many markets being negated. However, Augur v2 improved on this logic by allowing betters to wager on an additional option for all markets declared invalid. Therefore, the option of invalid is now available for trading.

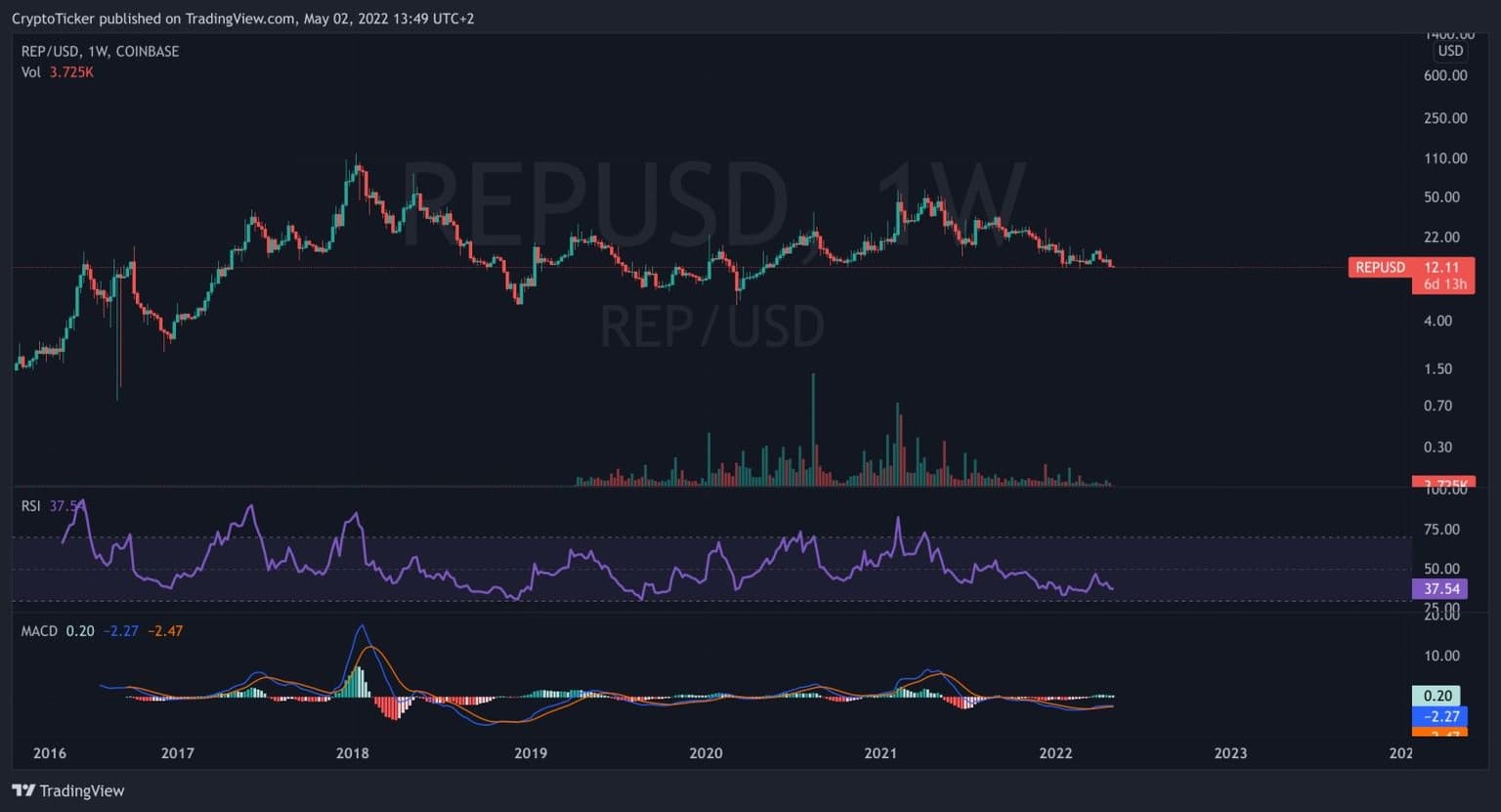

How Did REP Perform In The Last Five Years

For REP, its price value in the last five years has fallen compared to other digital assets. Unfortunately, this collapse has also resulted in the fall of its market cap, as trading volume is also low. The token’s ATH price of $123.24, recorded in January 2018, remains an arduous task. This is because its current price is 90% off the ATH. The token closed 2016 0n $3 to cap off a bad year, where it struggled to perform. However, in 2017, it first showed a glimpse of success, as it closed the year on $78. That performance hit its ATH in January 2018, but the latter part of the year saw another collapse.

Unfortunately, in 2018, it fell to $8.08, almost 90% short of what it traded in December 2017. 2019 was also another year the token struggled as it closed the year on $9.15. Fortunately, in 2020, it looked like it was on its part to growth, as it closed the year on $17.62. This represents a gain of a whopping 100% compared with 2019. Despite its price volatility in 2021, REP closed the year at $17.47, nearly the same as 2020. In summary, for an asset that looks promising and valuable, REP’s performance has been disappointing in the last five years.

Is REP Token Still Worth it In 2022?

Most of the issues around Augur, which have seen the platform underperform, seem to have a resolution. The deployment of Augur v2 in 2020 seems to have solved the majority of these issues. However, its founders need to work more on further upgrades. A typical example is the heavy data reliance of Augur V2 on the Ethereum mainnet. While it is perfect for users, it isn’t great for the current Ethereum main chain seeing historical demand. The platform must also work hard to challenge its competitors, especially those thriving. This will further impact its overall value and influence the future of REP.

The platform’s Total Value Locked (TVL) is a paltry $2,404,033, while its market cap is around $140 million. Its price has fallen from the $17.47 it closed 2021 on but still hovers around $13. WalletInvestor believes in the future of the token and sees it hitting $17.536 this year. They also think it will smash the $30 mark in 2027 to trade for #32.126. PricePrediction is also bullish about REP, as they see it hitting $21 by December 2022. The crypto analysts are optimistic concerning the future of Augur and REP, as they predict the token to hit $67.23 in 2025 and $138.93 in 2027. GovCapital is also confident about the project at Augur and expects it to affect REP positively. They predict the token to hit $32.96 this year and $144.9 by 2017.

Conclusion

Developed by the Forecast Foundation in 2014, Augur is a trustless, decentralized oracle and prediction market platform. The platform incentivizes a network of computers to run a predictions market on the Ethereum blockchain. To operate, users must have Ethereum and its native token- REP. Despite the project dwindling in the last five years, crypto analysts remain optimistic about its future.