Voyager Crypto files for Bankruptcy – Those Crypto Companies are NEXT?

What happened to Voyager crypto? Which other crypto companies are risky? In this article, we take a look at what happened to Voyager Digital.

As the crypto market sinks, many crypto companies take a heavy hit from the falling crypto prices. The biggest issue that they mostly face is a significant decrease in their cash flow, making them unable to pay their fixed expenses. A snowball effect occurs rendering those companies broke, and in turn, filing for bankruptcy. Voyager crypto lately filed for bankruptcy in the midst of the crypto crash. This isn’t the first company to do so, as 3 Arrows and Celsius already are knee-deep in their chapter 11 bankruptcy. What happened to Voyager crypto and which other crypto companies are risky?

What is Voyager Crypto?

Voyager crypto is a mobile app on both Android and iOS. It allows users to buy, sell, and stake more than 100 cryptos. The company has its own token called the Voyager Token (VGX), allowing its holders to maximize their earnings with no lockups. The project started back in 2018 and was incorporated in the United States.

Voyager Crypto files for Bankruptcy – What Happened?

The Fall of 3 Arrows Capital

After the fall of 3 Arrows, many other crypto companies got affected. 3 Arrows Capital was a cryptocurrency hedge fund based in Singapore. It started back in 2012 during the very early rise of the crypto market. The company had significant exposure to different kinds of cryptos and was very risky. However, due to the previous bull runs, the company took previous price actions to project their “worst-case scenario”. Surprisingly, the latest crypto crash was among the heaviest, affecting the cash flow of the company.

As 3 Arrows Capital filed for bankruptcy, it missed its payments on its loans. When you miss paying other companies, those other companies also get hit. One of those companies happens to be Voyager Digital, which missed payments that total around $650 million.

Voyager tried to withstand the 3AC hit

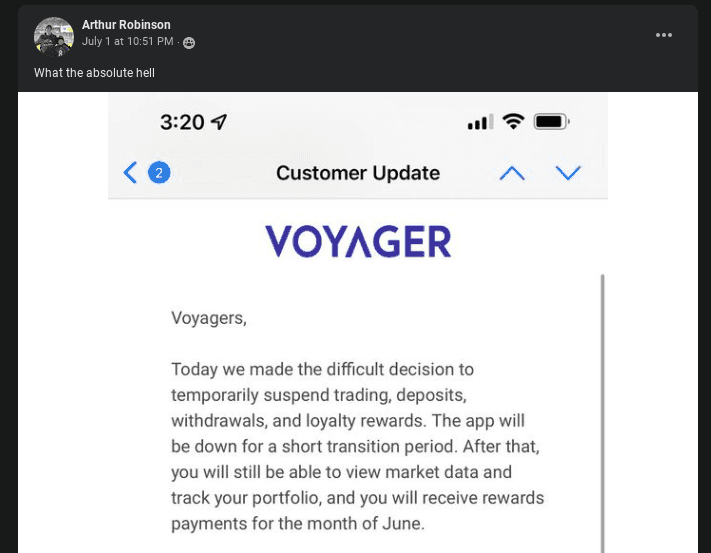

In turn, Voyager’s cash flow got affected. Voyager first sent an email to all its investors, saying that they had to halt all trading activities, withdrawals, and deposits. All the Voyager debit cards stopped working, in addition to their loyalty rewards. The company did not disclose at first what was going to happen, as they said that they were in heavy discussions on how to “fix things”, leaving investors hanging.

An update to customers: https://t.co/myyrQ6gZi7

Users received newsletters regarding the suspension decision, and as you might have guessed, were not too happy about it.

Voyager Files for Bankruptcy

3 days after that incident, Voyager announced that they filed for chapter 11 bankruptcy. To soften the blow, the company used the term “Protection to Implement Restructuring to maximize value for all stakeholders”. All users of the platform can only access the apps in “view mode” only. They can see their portfolios and the latest crypto prices. Other than that, they can only wait until the lawsuit against 3AC finishes, then for the liquidation of the company to happen. After that, they can only hope to receive some form of compensation depending on their balance on the platform.

Voyagers, today we began a voluntary financial restructuring process to protect assets on the platform, maximize value for all stakeholders, especially customers, and emerge as a stronger company. Voyager will continue operating throughout.https://t.co/TxlO4eua8E

Which Crypto Companies are RISKY?

Following this event, the crypto community started to throw names of well-known crypto exchanges that might also follow the path of Voyager. Here’s a list of all those companies.

- KuCoin: A lot of users are already circulating news that KuCoin is insolvent, and are spreading news in the crypto community. However, KuCoin issued a public notice about how confident they are in withstanding the situation and how well-capitalized they are.

- Vauld: Vauld is another crypto exchange that halted its trading operations, withdrawals, and deposits. The very first scenario of Voyager is happening to this company. There are talks that Nexo is looking to acquire Vauld during their crisis.

- Coinbase: Another news surfaced in the crypto community about Coinbase selling its users’ private information to the FBI and to ICE. While this is not news about insolvency, it made investors wonder whether the company was in need of additional cash inflows to sustain its activities. Also, Coinbase recently fired more than 1,100 of its staff while its stock tumbled by more than 70%.

Is it RISKY when Crypto Companies suspend Withdrawal?

It is not uncommon for crypto companies to halt trading activities and withdrawals on their platform. This usually happens when the crypto market is highly volatile, whether movements were up or even down. Downward trends create high selling pressure and affect crypto companies that are highly leveraged. Just as for the average trader, using high leverage will definitely take a heavy toll on your bottom line.

Binance is one of the leading crypto exchange currently. They too halted trading operations and withdrawals in certain markets as the crypto market turned volatile. However, this happens for short hours only, and the trading activity continues soon afterward.

Maybe it’s time to Consider using Hardware Wallets?

The safest method to preserve your cryptos would be hands down owning a private hardware wallet. Not only will you have complete ownership over your cryptos, but you’ll be able to hedge all risks that are associated with centralized or decentralized exchanges, such as bankruptcy, hackings, phishing, and keeping your info private.

You might want to consider owning a Trezor or Ledger wallet!