LINK Price Analysis: Can Chainlink Price Reach $100 End-of-Year?

At the time of writing, the LINK/USD is sitting at $13.55 (+1.32%). Now, the question is: Can Chainlink Price reach $100 end-of-year? Let’s take a look at it in more detail. The Chainlink price is performing exceptionally well over the past few […]

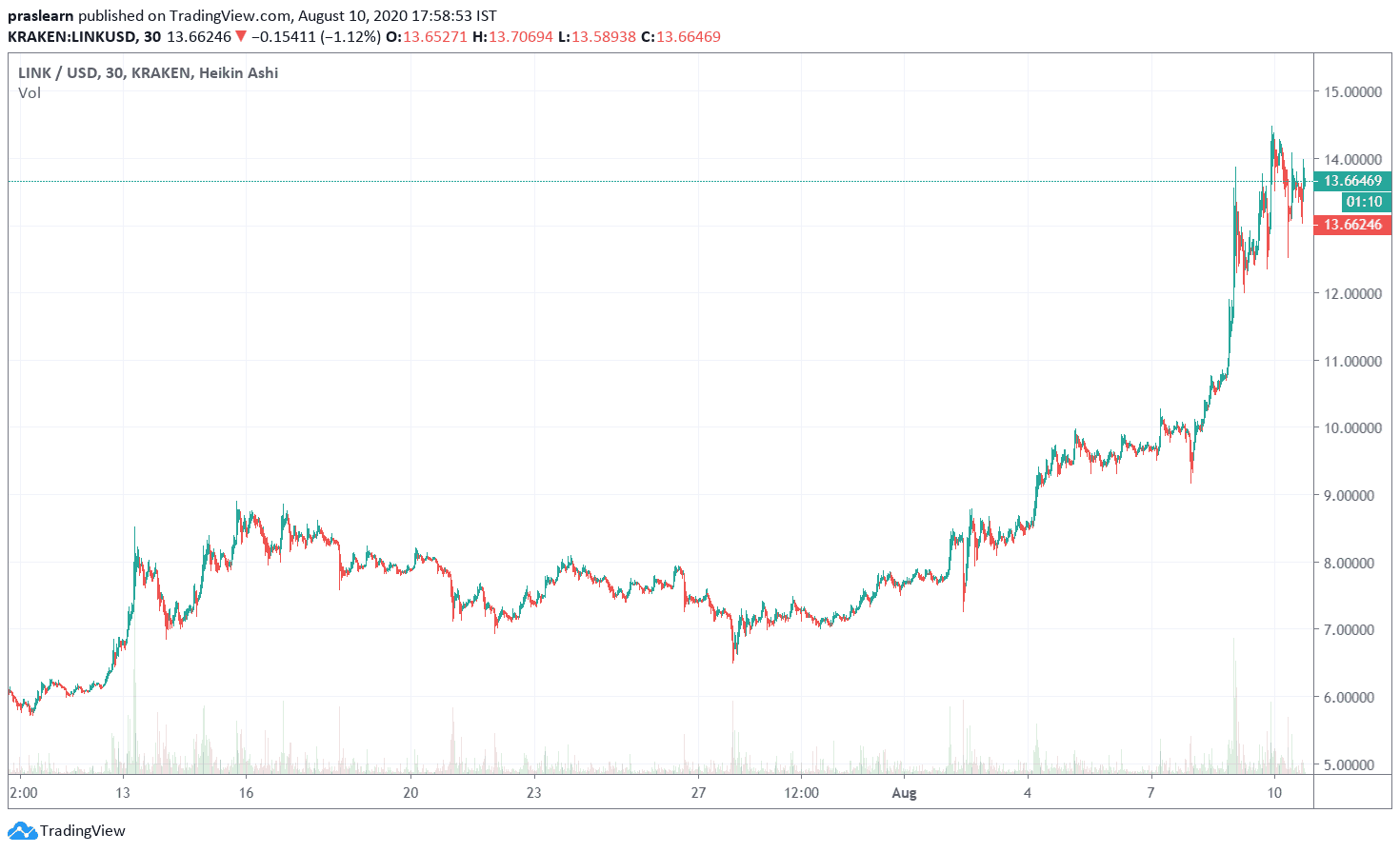

At the time of writing, the LINK/USD is sitting at $13.55 (+1.32%). Now, the question is: Can Chainlink Price reach $100 end-of-year? Let’s take a look at it in more detail.

The Chainlink price is performing exceptionally well over the past few days. The entire cryptocurrency market is in the green zone. At the time of writing, the Chainlink price is sitting at $13.55 (+1.32%). In our previous LINK price analysis, we had mentioned that the volatility of the cryptocurrency market seems to have declined and the signal line hanging above the price bars showed the upward trending price of the LINK.

LINK Price Analysis: Chainlink Price and Bulls are Really Strong

The Chainlink price Sharpe ratio calculated over the past 30 days of daily returns is almost 7.67. The Sharpe Ratio or Sharpe indicator is usually applied to calculate the performance of an investment by adapting for its risk. The greater the ratio, the higher the investment return related to the significance of risk assumed, and therefore, the more solid the investment. The ratio can be utilized to estimate a particular coin or an entire portfolio.

Now, as mentioned earlier, the current LINK price is $13.55, an all-time high. LINK bulls are remarkably strong right now driving Chainlink to new highs almost every week. The monthly chart is heavily in favor of the bulls which are facing very limited resistance to the upside. The daily 26-EMA has been serving as support for months now and may not encounter any influential selling pressure unless they miss the support level. The key metrics are as follows:

Price $13.58

24hr Change +1.59%

24hr Vol $971,834,524

Liquid Marketcap $13,528,794,852

Liquid Supply 1,000,000,000

Max Supply 1,000,000,000

LINK Price Analysis: Can Chainlink Price Reach $100 End-of-Year?

The trading volume of ChainLink has been climbing significantly in the past three months from an average of $80 million in January 2020 to highs of $1.3 billion now. When it comes to market dominance, LINK has one of the most parabolic charts.

The market cap dominance is now almost 1.30% and when it comes to longer timeframes, ChainLink price levels major coins like Bitcoin and even Ethereum. The weekly chart is fiercely bullish with a strong uptrend and surprisingly weak resistance to the upside. Bulls also succeeded to build a few support levels on the way up which should support LINK price in case of a pullback. Now, the trading volume has grown in the past 3 months.

The LINK/USD price is up by more than 450% since the past year and the RSI is overextended but it may not be an influential factor in the next few months as much of the recent increase in the market could be attributed to FOMO.

Conclusion

Now, it will be too early to predict anything about the LINK price. The $100 mark could be too high. But the cryptocurrency world is full of surprises. Right now, LINK/USD is showing excellent growth. All the parameters are in the green zone. It will be interesting to see how LINK/USD behaves in the next 45 days.

Momentarily, if you divide the current market cap of Chainlink by Bitcoin’s current supply by normalizing supply and backing out price considering market cap remains the same (price if BTC-normalized supply) then the LINK/USD price is huge. Now, the LINK/USD break-even multiple, the multiple by which the current price will have to rise in order to reach $100 is almost 7.9 and this could be too much but as mentioned earlier, the cryptocurrency world is full of surprises and anything can happen here. We wish you happy trading!