Bitcoin Outperforms Nasdaq as Wall Street Grapples with 2026 Tech Slump

Bitcoin hits $96,500, decoupling from a sliding Nasdaq as institutional rotation and regulatory clarity drive a new "Digital Gold" rally in early 2026.

The financial landscape on January 15, 2026, is witnessing a historic decoupling. While the tech-heavy Nasdaq and S&P 500 face significant headwinds from geopolitical tensions and new domestic interest rate caps, the cryptocurrency market is surging. Bitcoin is currently leading the charge, trading near $96,500 and proving its resilience as a non-correlated "Digital Gold".

Nasdaq in the Red: The 2026 Tech Slump

Wall Street's tech sector is under heavy fire. Major indices like the Nasdaq Composite have slid by 1.0% to roughly 23,471, weighed down by fresh restrictions on software exports and a broader "risk-off" sentiment. Banking stocks, including Wells Fargo and Bank of America, have also dropped sharply following proposed caps on credit card interest rates.

This equity volatility has triggered what many analysts are calling a "Great Rotation." Capital is moving out of stagnant tech stocks and into liquid, high-growth digital assets. For real-time updates on this shift, keep an eye on our crypto news section.

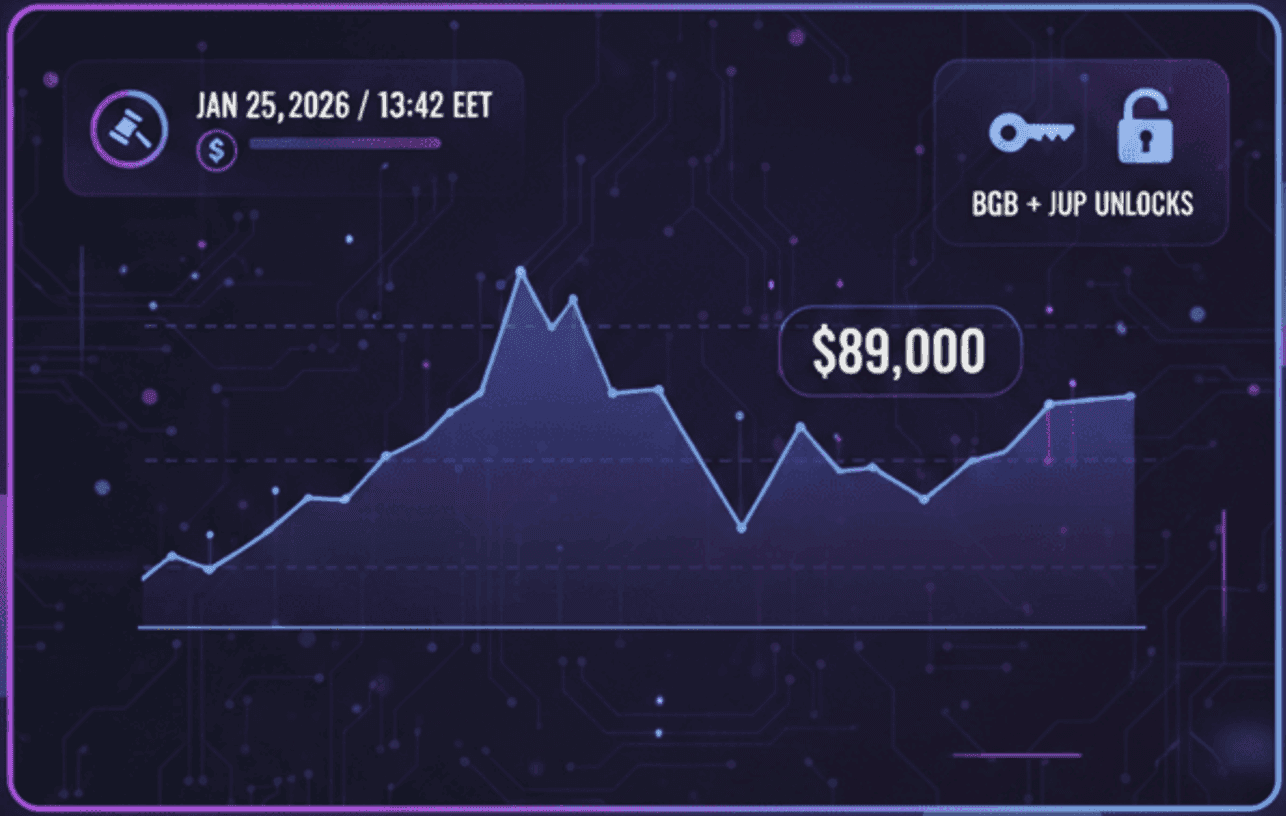

Bitcoin Technical Analysis: Breaking the $96,000 Barrier

Bitcoin's price action is currently showing extreme strength compared to traditional markets. After a period of consolidation, BTC-USD has reclaimed the $96,000 level, marking a significant psychological victory for bulls.

BTC/USD 1D - TradingView

Key Insights from the Technical Chart:

- Support & Resistance: The $90,000-$92,000 zone has flipped from resistance into a rock-solid support floor. Immediate resistance now sits at $98,000, with the 50-week Moving Average at $101,000 acting as the "ultimate gateway" to a new all-time high.

- Bullish Divergence: The 4-hour chart displays a hidden bullish divergence—where the Relative Strength Index (RSI) makes lower lows while price makes higher lows—a classic signal for trend continuation.

- Institutional Inflows: Positive net inflows into spot ETFs, specifically the BlackRock iShares Bitcoin Trust (IBIT) and Fidelity's FBTC, are providing the necessary liquidity to sustain this decouple from the Nasdaq.

Why 2026 is Different: Regulation and Treasuries

The primary catalyst for this outperformance is the progress of the Digital Asset Market Clarity Act (CLARITY) in the U.S. Senate. Unlike the volatility of previous years, the 2026 rally is underpinned by Digital Asset Treasury (DAT) companies—over 170 publicly traded firms now hold Bitcoin on their balance sheets, viewing it as a core reserve asset.

While Bitcoin thrives, Ethereum and other altcoins are seeing a more selective recovery. ETH-USD is stabilizing near $3,300, but lacks the same aggressive momentum seen in BTC. Investors looking to diversify during this period should consult our exchange comparison to ensure they are using platforms with the highest liquidity.

Bitcoin Price Prediction: The Road to $100k

As we move deeper into Q1 2026, the gap between crypto and stocks remains a critical signal for the broader macro outlook. If Bitcoin can secure a weekly close above $99,250, the path to $110,000 and beyond becomes clear.