Aave Review 2022 – Is Aave Worthwhile?

This article is all about Aave review 2022 and whether Aave is worthwhile or not. Let’s take a look at it in more detail.

Quick Summary: Aave (previously EthLend) is a DeFi platform that offers cryptocurrency bank accounts as well as cryptocurrency lending. Aave, like the majority of DeFi platforms, is better suited for seasoned crypto investors with a profound comprehension of the investment market. This article is all about Aave review 2022 and whether Aave is worthwhile or not. Let’s take a look at it in more detail.

What is Aave?

According to its website, Aave is a non-custodial liquidity market protocol that enables users to take part as providers or borrowers. Suppliers offer liquidity to the market to generate additional income, whereas borrowers can loan in either an overcollateralized (constant) or undercollateralized (one-block liquidity) style.

Aave has simplified and accelerated the workflow of lending and getting a return on digital assets. Users can apply for a flash loan from its DeFi lending market as well as to lenders. These loans are not securitized and deduct fees; nevertheless, the max number of such loans is usually kept minimal.

Stani Kulechov formed Aave and its original incarnation ETHLend. He was dissatisfied with the lack of lending applications on Ethereum at the time, and his project was created before decentralized finance did exist. Kulechov is a venture capitalist who studied law and started writing the code as a youngster. He was an early supporter of blockchain technology. The CEO stated that he desired to reinvent ETHLend as Aave so that the business could provide more facilities than Ether lending.

Aave pros:

Aave cons:

How does Aave work?

Aave is a platform for lending and borrowing digital assets and cryptocurrencies. The protocol can be utilized to loan or borrow cryptocurrency, which can then be reimbursed with interest. Some tokens have no service charge, however the protocol bills for flash loans.

One of the perks of having such a massive scale of execution and usage is that interest rates for some assets are constant. Aave claims to support more than 15 crypto assets, although not all of them can be utilized as collateral when trying to apply for a crypto loan. Among such assets are (but aren’t restricted to) ETH, ETHlend, and many others. Aave Token is built on the ERC-20 standard and is deflationary by nature. Aave tokens can be purchased on several trading platforms, including Binance.

What are the features of Aave?

How to use Aave?

Easy! Here’s a step-by-step guide to using the Aave platform from beginning to end.

Step 1 – How to Sign up for Aave

Navigate to Aave.com to reach the main landing page. You can see a list of assets here that you can earn or borrow against. You can also view each asset’s market capitalization, price, Annual Percentage Yield (APY), and Annual Percentage Rate (APR) (APR, which is the cost of borrowing). From here, select “Enter App.”

Aave Review 2022: Main Page

Step 2 – What are Aave Market V1 and V2

When you open the Aave app, you are instantly in V2, but you can quickly switch between Aave market V1 and Aave market V2. The switch is situated in the top-right corner of the header. What’s the distinction, you may question? Interesting question.

Aave Review 2022: Aave Main App

Step 3 – How to connect Metamask and Wallet to the Aave platform

Now, go to the top-right header and press the “Connect” button to connect an existing wallet. You will be asked to connect your wallet. You can choose from several external providers, such as Coinbase, or you can link your browser wallet (Metamask, Trustwallet, etc.). A QR code is used to make the connection… Very simple.

Aave Review 2022: Connect-your-wallet

Step 4 – How to use Aave

You are now inside the platform after connecting. You can now see the same Main Page view while connected. Furthermore, because your wallet is linked, you can deposit, borrow, swap, stake, and participate in Aave governance…basically, you’re unstoppable!

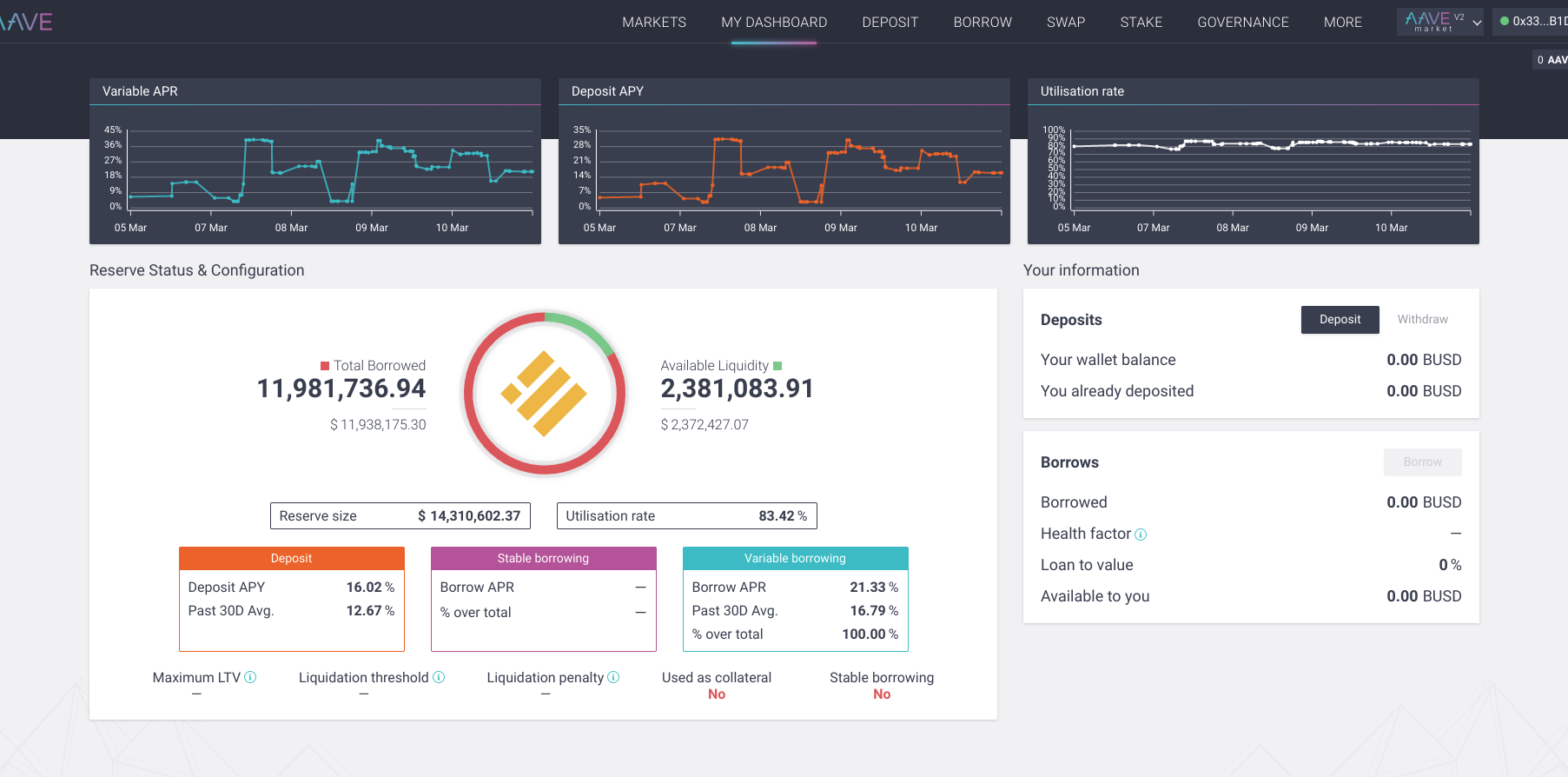

Aave Review 2022

Is Aave safe?

Aave is a secure crypto protocol secured by a decentralized network of Ethereum nodes and staked Aave tokens. Aave, on the other hand, relies mainly on smart contracts. These contracts could be split, offering module interfaces to the platform’s monies. Even though Aave was not technologically subverted in the attack, Aave Flash Loans were utilized in 2022 to dry up more than $80 million in Ether (ETH) into a hacker’s wallet.

Is Aave a Good Investment?

Aave is an intriguing platform that is simple to use and intuitive. They have one of the highest annual percentage yields (APYs) in the DeFi industry. Everything they promised is being implemented while adhering to their timeline. Their token allows holders to invest directly in the project while also having a say over what happens in future plans. It is unquestionably a sound investment in the DeFi space.