What is Bitcoin SV? Should you add BSV to your portfolio?

Bitcoin SV or Bitcoin Satoshi‘s Vision is a hard fork of Bitcoin Cash. The coin was tossed in the fall of 2019 fetching a hash war.

Bitcoin SV or Bitcoin Satoshi‘s Vision is a hard fork of Bitcoin Cash. The coin was tossed in the fall of 2019 fetching on a so-called “hash war“. Bitcoin SV has hardly any discrepancy compared to Bitcoin Cash, yet both coins have been able to establish themselves on the -market. This post is all about Bitcoin SV and should you add it to your portfolio.

What is Bitcoin SV?

Blockchain technology firm nChain created the BSV and has been providing protocol updates that fix the operations of the actual Bitcoin protocol. nChain now has a team that strives to run the node software and other foundation mechanisms for the BSV network.

nChain Chief Scientist Craig Wright, who has self- asserted to be Satoshi Nakamoto, has been a promoter of BSV after the separation between BCH and BSV in 2018, after the recommendation of contentious protocol modifications by various BCH developers.

During Bitcoin’s earlier phases of growth, the blockchain was more than competent in handling the transaction burden of a miniature community, mostly comprised of programmers and cryptography fanatics. But as Bitcoin’s rage increased, the blockchain began to get mired with a rising volume of transactions, ultimately causing a severe consequence on processing duration.

Many became worried that someday, Bitcoin transactions might need days or weeks to unclog if nothing was performed to handle the problem. If these multi-day uncertainties were to actually happen, transaction prices could rise enormously. These pause and fee problems constituted the core of what evolved as Bitcoin’s scalability issue.

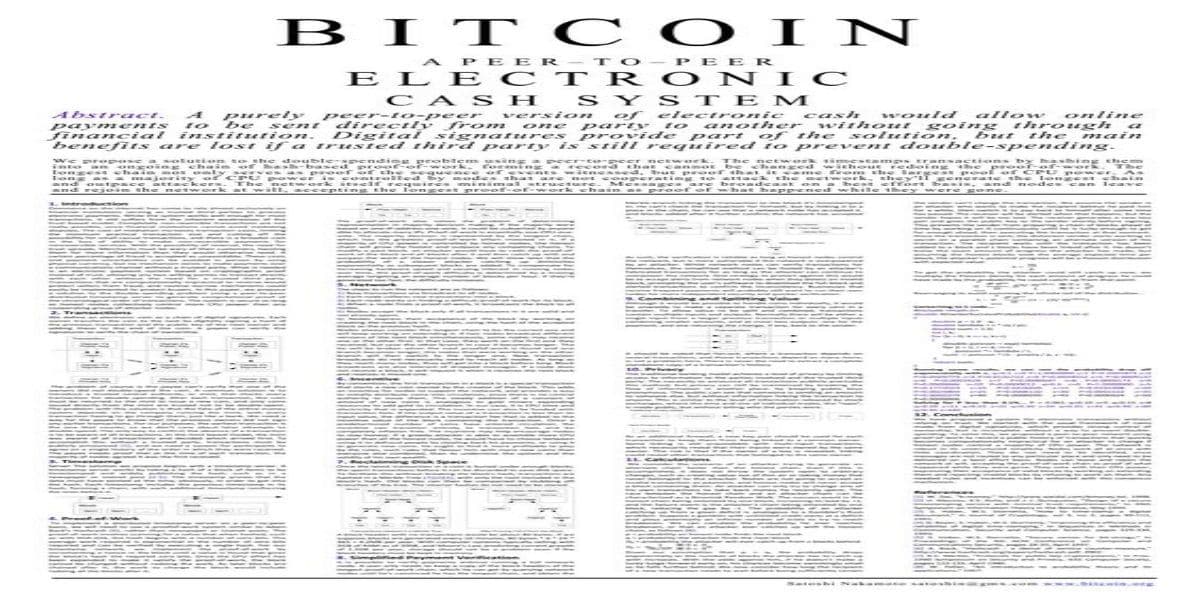

The purpose of Bitcoin SV is to achieve the foremost idea of the Bitcoin protocol and plan as defined in Satoshi Nakamoto’s white paper. BSV strives to deliver scalability and resilience in line with the actual definition of Bitcoin as a peer-to-peer electronic cash method, as well as provide a circulated data grid that can back enterprise-level cutting-edge blockchain applications. But in fact, Bitcoin SV (BSV) arose after a hard fork of the Bitcoin Cash in 2018. The Bitcoin Cash is the hard fork of the Bitcoin blockchain.

The primary distinctions between Bitcoin Cash and Bitcoin SV are the block size. Bitcoin SV has quadrupled it likewise to a max of 128 megabytes. In expansion, Bitcoin SV reactivated OP codes that were switched off in Bitcoin at the start and thus reintroduced an entire programming language at the protocol grade.

Now, this Bitcoin SV has terminated manufactured block size limits and re-configured Script commands and other specialized capacities which had been off or limited by the protocol architects of the Bitcoin blockchain. This permits the blockchain to process numerous transactions per second while keeping very lower transaction prices for micropayments, in addition to delivering cutting-edge stuff such as tokens, smart contracts, analysis, and much more.

Bitcoin SV: How does BSV Work?

BSV uses the proof-of-work instrument as illustrated in the Bitcoin white paper. This suggests that for a block having the latest transactions to be mounted on the blockchain, miners must crack an intricate mathematical puzzle by utilizing their machine’s processing capacity. The miner who cracks this puzzle first gains the block prize and transaction expenses, and their block is mounted on the blockchain.

BSV varies from other renditions of Bitcoin in its compliance to the actual Bitcoin protocol and concentrates on acknowledging the idea for the Bitcoin network drafted in the Bitcoin white paper. Unlike Bitcoin, which now predominantly works as an asset or store of value asset, BSV strives to deliver a scalable and functional blockchain platform for robust incomes and circulated data applications for clients and businesses.

How many Bitcoin SV (BSV) coins are in circulation?

As described by the actual Bitcoin protocol, there will be an utmost of 21 million BSV coins. New coins from this circulation are allocated to BSV miners via block dividends, which they gain in extra transaction expenses for verifying blocks.

The prizes for miners are slashed by 50% at pre-established times to gradually move the dependence of miners on these contributions to transaction costs and to decrease the outpour of fresh tokens as they hover their utmost quantity.

Conclusion

Now, the question is should you add BSV to your portfolio? So, before making any investment, users should perform their own analysis, study, and research. It is always more profitable to study several cryptocurrencies and the current market emotions and various parameters before investing.

Bitcoin SV has consistently managed to grab attention again and again through the suspicious goings-on from Craig Wright. But not ever in a positive way. Since Wright messed with some big names from the crypto world, he pulled the wrath of Binance chief Changpeng Zhao (CZ). After the situation worsened, Binance removed BSV from the list. It didn’t take long for Kraken and it also began a survey on Twitter as to whether BSV should be removed. Participants voted in favor and the cryptocurrency suffered another setback.