In the world of cryptocurrencies, there are many terms and strategies that can seem elusive to the uninitiated. One of these is the concept of a “token burn,” a phrase frequently heard in conversations around various tokens, including Shiba Inu (SHIB). So what is a token burn, and why does it matter? Let’s delve into the concept and its potential impact on the price of Shiba Inu.

What is a Token Burn?

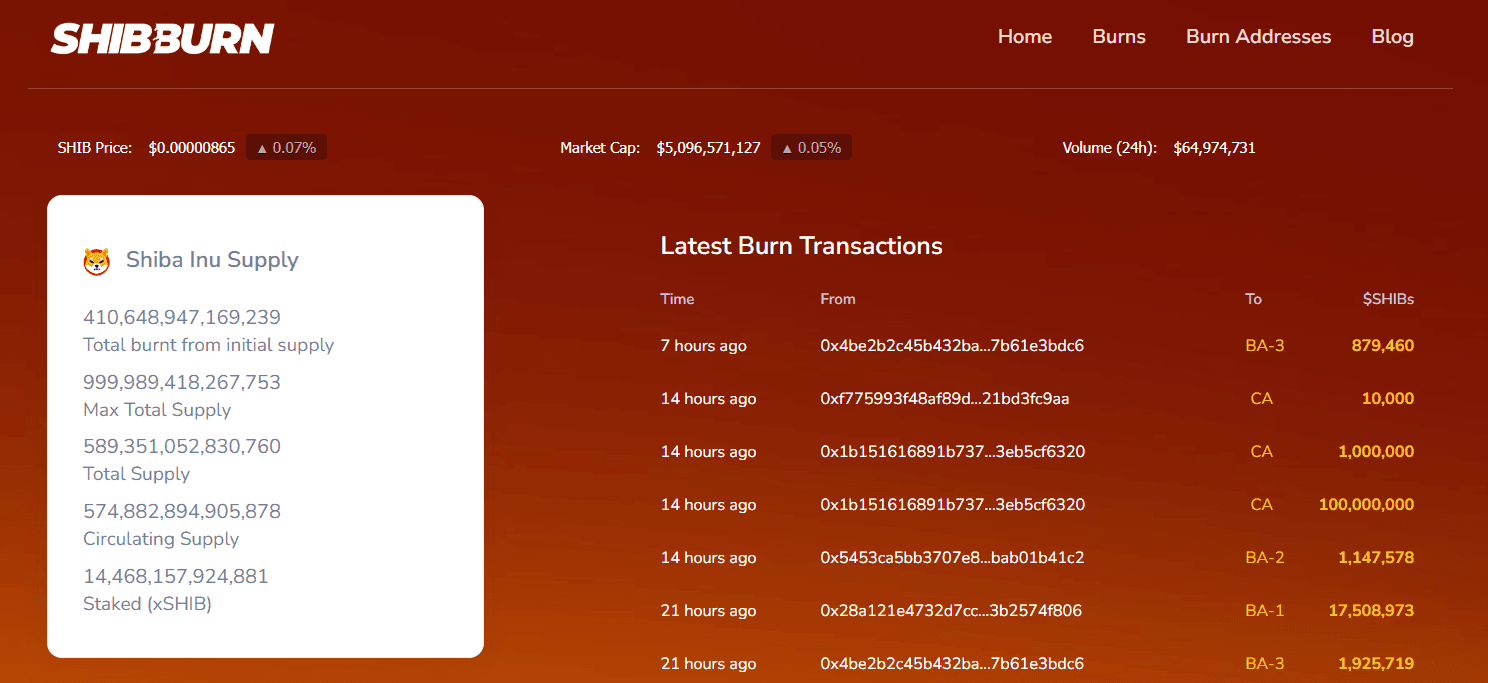

At its core, a token burn is a process of permanently removing coins from circulation, reducing the total supply of the coin. The process essentially involves sending a certain quantity of the token to a public address that is unspendable, often known as an “eater address.” Once the coins are sent to this address, they are effectively “burned” – taken out of circulation forever.

Why do Token Burns Exist?

But why do token burns exist in the first place? What purpose do they serve? There are several key reasons:

- Supply Control: Token burns are a way of managing the cryptocurrency’s supply. By reducing the number of tokens in circulation, the value of each remaining token may potentially increase due to the principles of supply and demand.

- Value Distribution: Token burns can redistribute value to remaining token holders. As the total supply decreases, the proportionate ownership of each token holder increases, essentially spreading the value of the burned tokens among remaining holders.

- Project Funding: Some projects burn tokens to fund ongoing operations without inflating the token supply, offering a viable alternative to selling tokens, which could depress prices.

Token Burn and Shiba Inu Prices

So, how does this relate to Shiba Inu? Shiba Inu is a popular meme-based cryptocurrency that’s gained significant traction over the last few years. As with any cryptocurrency, the price of Shiba Inu is determined by supply and demand dynamics. If demand for Shiba Inu tokens outpaces supply, the price goes up, and vice versa.

In the context of a token burn, if Shiba Inu’s total supply decreases through the process, this may lead to a decrease in selling pressure, making each remaining SHIB token potentially more valuable. Consequently, this could lead to a price increase, assuming demand remains steady or increases.

It’s worth noting, however, that while token burns can theoretically contribute to a price increase, they’re not the only factor at play. Market sentiment, overall cryptocurrency market trends, investor behavior, and the project’s development and partnerships all play crucial roles in the price dynamics of a cryptocurrency. Moreover, while token burns reduce the circulating supply, they don’t directly increase demand, which is equally critical for price appreciation.