Standard Chartered Investor Guide Places Ethereum At $26K-$35K Valuation

Standard Chartered released an investor guide about Ethereum on Sep 07 placing the valuation at $26,000-$35,000 per Ether. Why?

Standard Chartered analysts are the latest Ethereum bulls as the recently released investor guide places Ethereum valuation at around $26K-$35K per Ether (ETH). The first sentence of the investor’s guide reads “Structurally, we ‘value’ Ethereum at USD $26,000-35,000”. It’s understandable that the word “structure” in Standard Chartered analyst’s vocabulary refers to the more widely used term “fundamentals” in the crypto circles. But, what are these fundamentals that Standard Chartered is referring to?

The report attempts to value Ethereum using the “financial market” analogy. It plots the value of global banks against the value of global credit card companies to arrive at the conclusion of $35,000 per Ether potential value, at which point its market cap would exceed that of Bitcoin – an event known as the flippening. ETHBTC ratio would also cross 0.161 and Bitcoin itself would be trading at around $175,000 bettering investors’ perception of all crypto-assets, according to the Standard Chartered report.

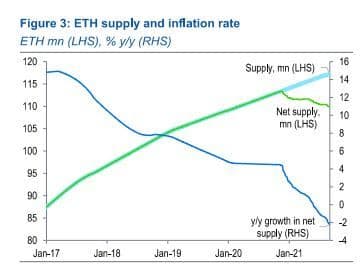

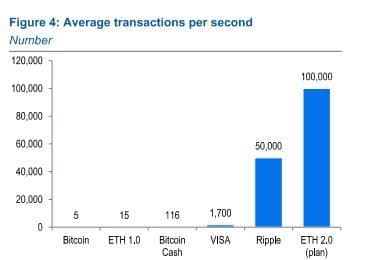

It reiterates that Ethereum is a better medium-term buy than Bitcoin, though it’s complex and riskier. Ethereum needs to deploy Ethereum 2.0 successfully, which will bring improvements in security, scalability, and power consumption. Despite the fact that Ethereum 2.0 timelines aren’t definite and can certainly change, it’s expected that the decreasing ETH circulating supply by virtue of supply getting locked in the Beacon Chain Eth2 staking contract would provide a “price cushion”. It’s further helped by the EIP1559 induced burning and the massive decrease in issuance coming after the full transition to Proof of Stake (POS).

Standard Chartered analysts appear to be mindful of the environmental concerns regarding the Proof of Work (POW) networks and believe that the Ethereum going green at the merge is going to massively enhance its appeal in the eyes of the environmentally-conscious public. The report also proves that crypto-assets are fast gaining legitimacy in the traditional financial system and it’s no longer possible to ignore them or dismiss them as passing fancies.