Ethereum Price – Two Potential Scenarios before 2021

ther jumped well above the USD 400 price and consolidated around USD 450 in an attempt to break a very important area. This challenge is being calculated by traders in order to get a sense of the general consensus of the crypto market as a whole. Which area are we talking about specifically?

Ether jumped well above the USD 400 price and consolidated around USD 450 in an attempt to break a very important area. This challenge is being calculated by traders in order to get a sense of the general consensus of the crypto market as a whole. Which area are we talking about specifically?

Ethereum Technical Analysis

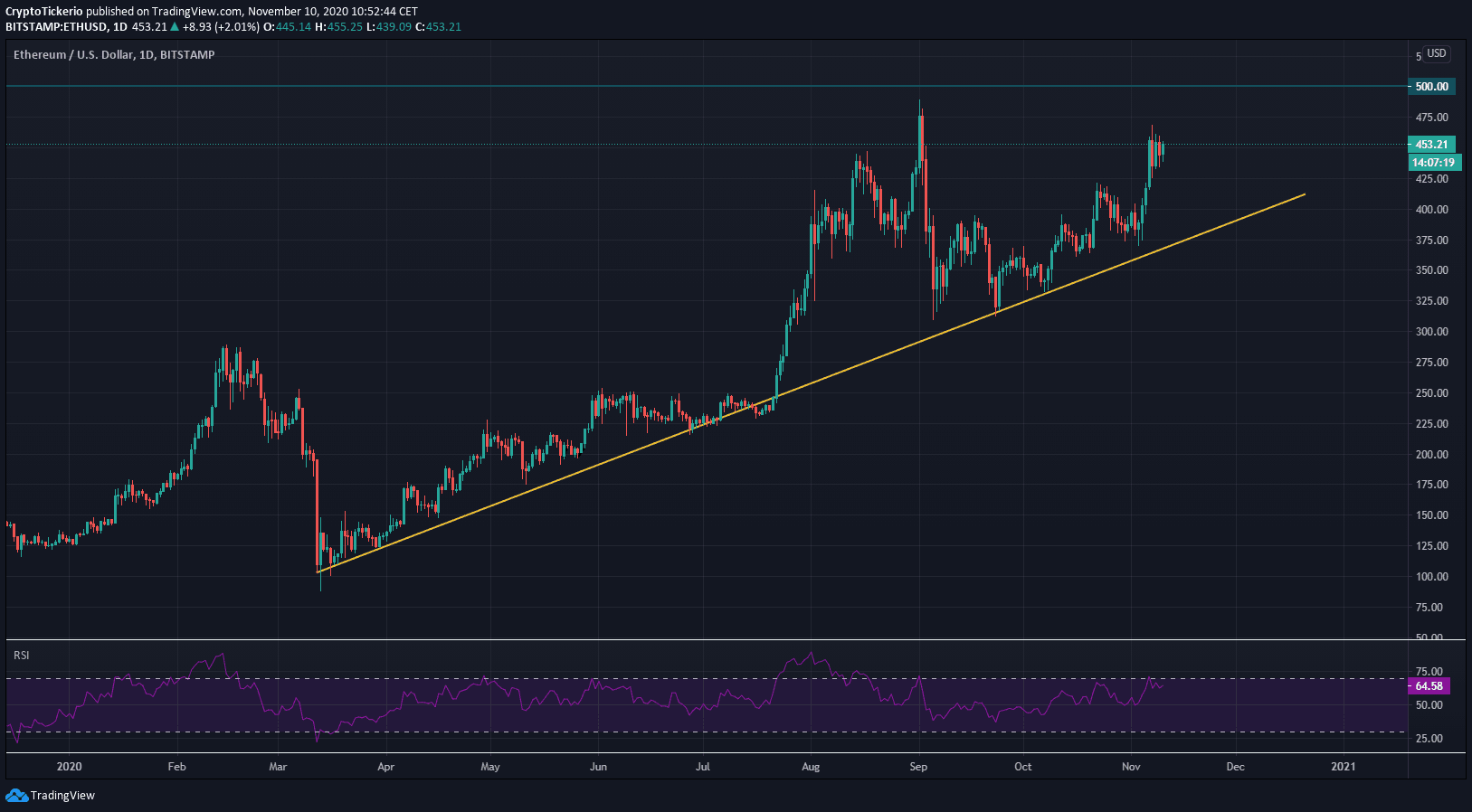

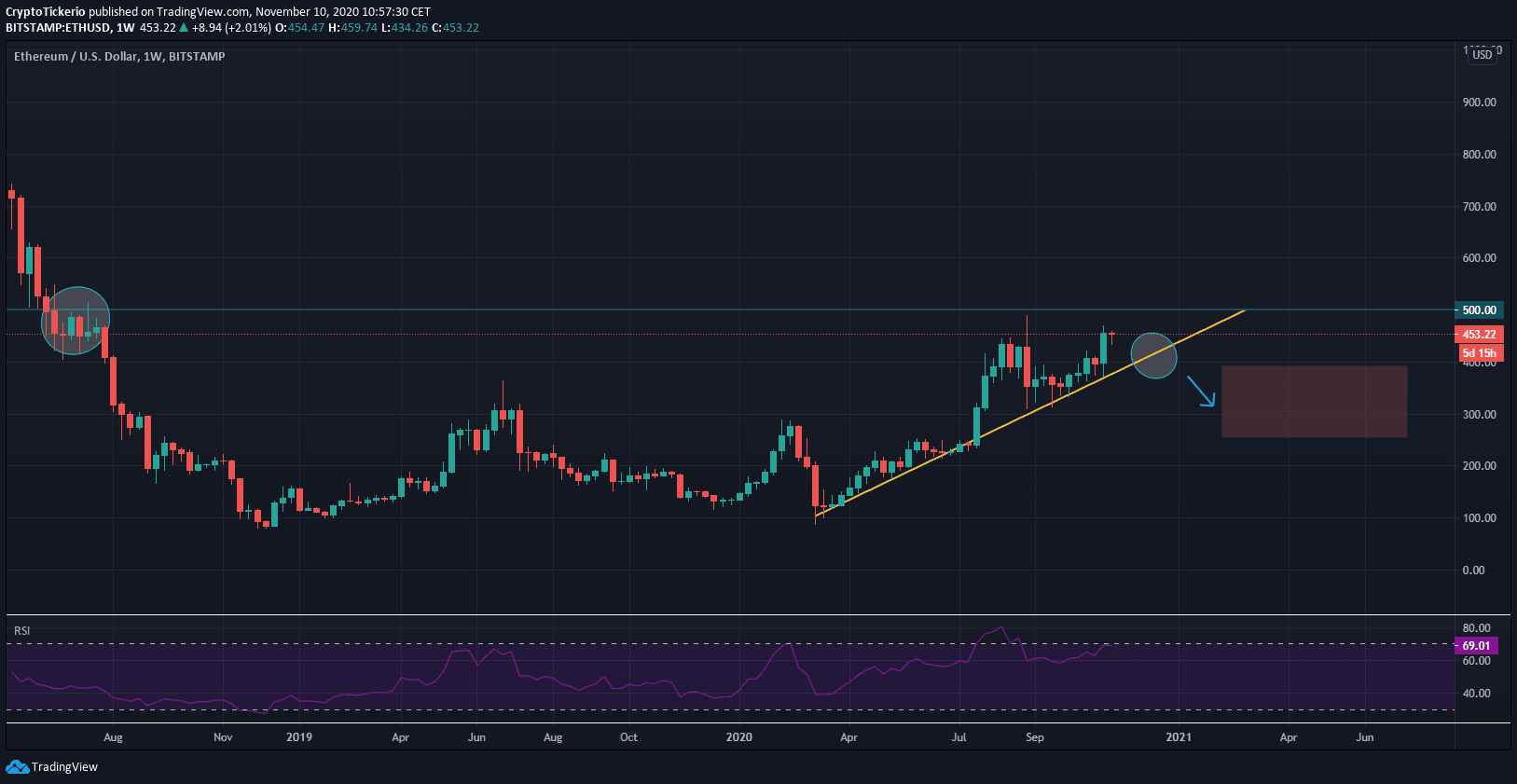

Since the beginning of 2020, the price of Ether has been on a solid uptrend. The events of the market crash worldwide slowed down the pace for a while, but prices recovered well and continued on their uptrend. (fig.1)

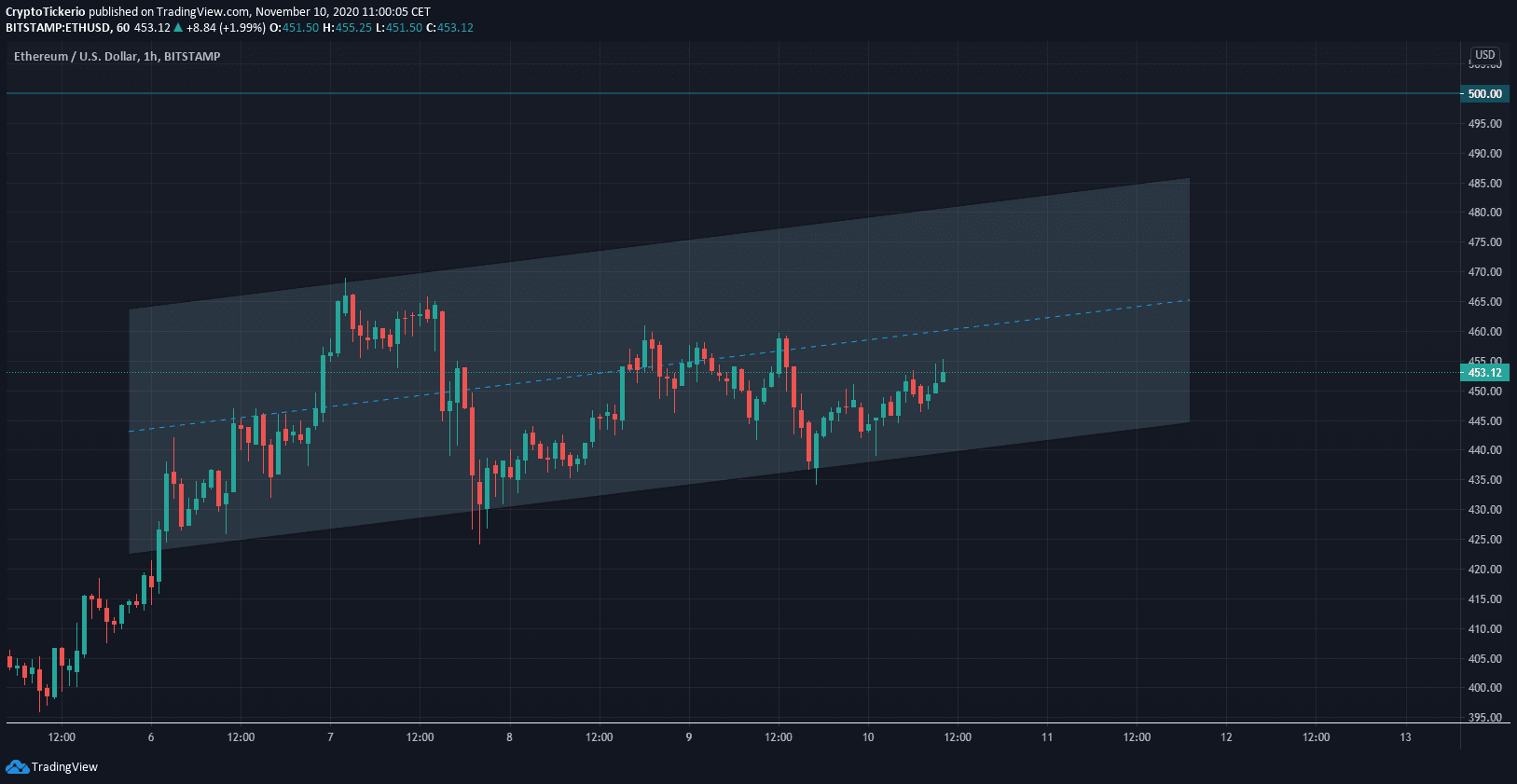

Last week, Ether reached a 2-year all-time high price of USD 468, defying all naysayers who were skeptical about the return of this contract based cryptocurrency. During the weekend though, prices did adjust and fell roughly 9%. Despite this sudden fall (which might have wiped out short term traders who placed tight Stop Loss levels), the price stayed in an uptrend channel (fig.2). A Fibonacci retracement also would’ve signaled a heads up for a potential retracement in the short term.

Charting and using technical analysis is very important to time trade entries, and plan important trade exits. Even long term traders know when to enter or exit the market, as they usually reshuffle their portfolios depending on market dynamics and performances.

Ethereum Price – The important price of USD 500

We usually mention in our analysis quite often the term “psychological price”. Those levels are not only important support or resistance areas, but also key whole numbered prices which affect traders’ emotional trading analyses.

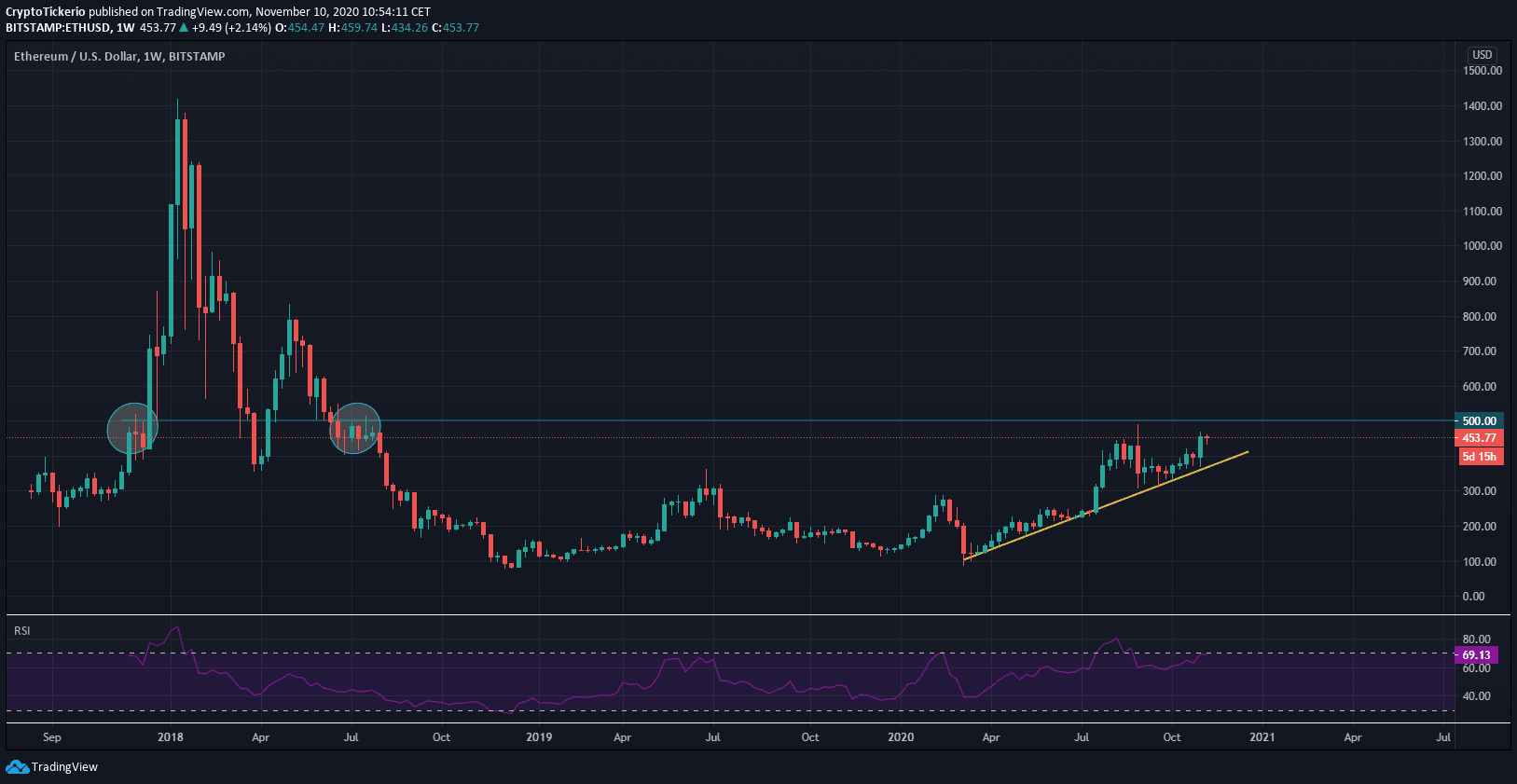

With the price of Ether, the psychological price of USD 500 is of utmost importance. In fact, this level was a determining element in support and resistance during the great bull run of cryptos back in 2017 (fig.3). Prices moved and were highly volatile when reaching this area, having two potential scenarios happening before 2021 theoretically.

Ethereum Price Prediction– Two Potential Scenarios

If we want to account for what might happen from a standard viewpoint, it is true that markets either go up or down. But determining the general consensus of the market has a lot of other aspects as well:

- Knowing the general trend of the whole cryptocurrency

- Placing Trade entries and exits

- Using adequate risk management levels

- Easier charting and a better understanding of the price

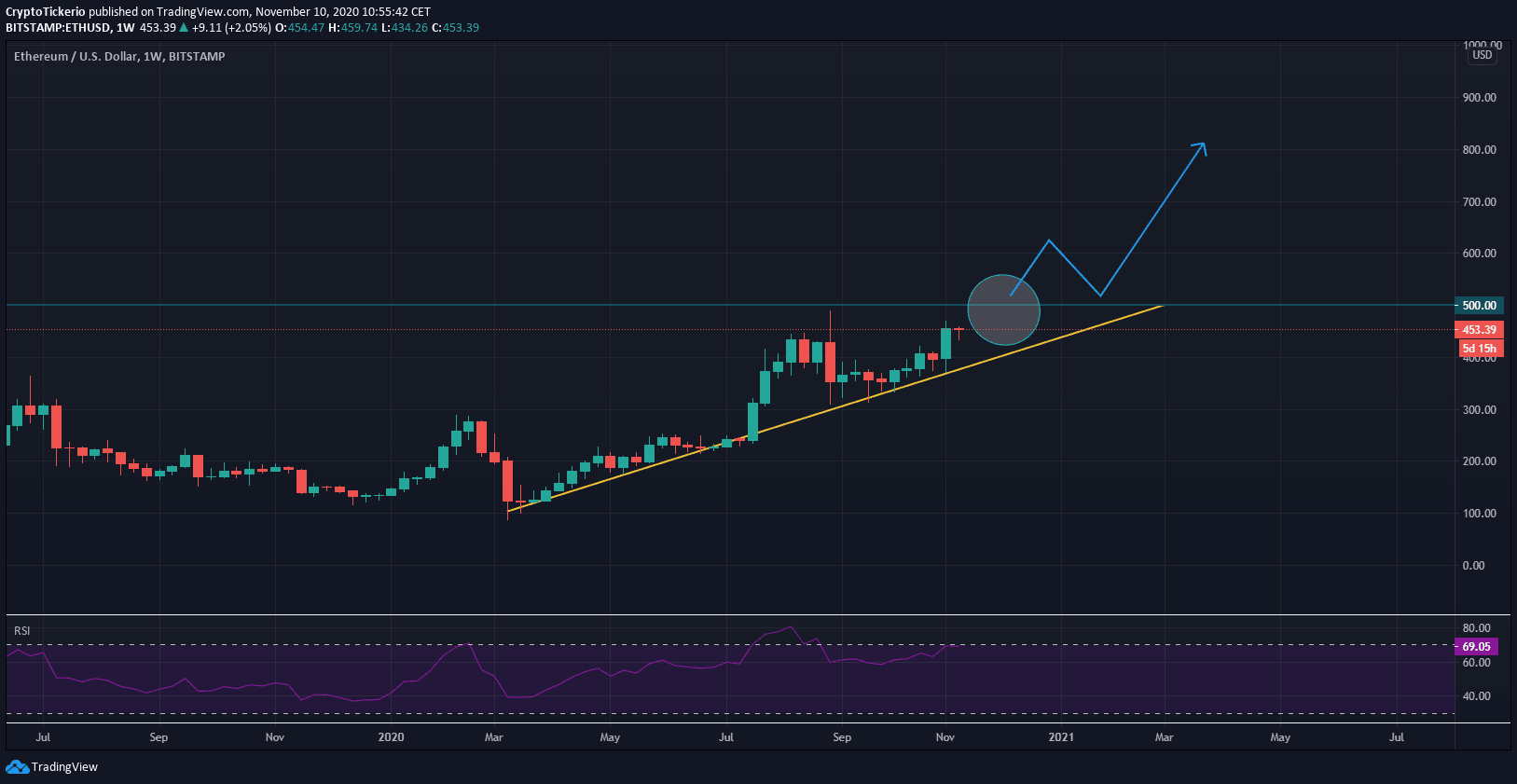

In this scenario, the price of Ether continues on its uptrend and breaks through the psychological level of USD 500 before 2021 in a similar pattern from 2017, where volatility increases, and in turn pushes the price to higher highs (fig.4)

The price of Ether fails to break the USD 500 price, and breaches below the long term uptrend yellow line of 2020 and consolidates between the price of USD 300 and USD 400.

Stay Ahead, Stay Updated

Rudy Fares