What’s the New Liquidity Metric on Coinmarketcap?

Cryptocurrency exchanges have been known to inflate trading volume data, engage in wash trading and consequently report false or inaccurate data, which paint the wrong picture. The top price aggregating and analytics site, Coinmarketcap is attempting to combat this problem, […]

Cryptocurrency exchanges have been known to inflate trading volume data, engage in wash trading and consequently report false or inaccurate data, which paint the wrong picture. The top price aggregating and analytics site, Coinmarketcap is attempting to combat this problem, by introducing a new metric for the determination of something which is actually beneficial for traders and investors alike, the liquidity metric.

What is Liquidity?

Liquidity is defined as “how readily or easily an asset can be bought or sold” or “the level of trading activity in the market”. As a general principle, the more liquid a market is, the easier it is to sell or buy an asset there. Vice versa, if the market is less liquid, it is more difficult to engage in trading there.

The Cryptocurrency Volume Inflation Problem

Crypto-assets are usually measured by “volume” metric, however many centralized exchanges manipulate that data, by wash trading resulting in volume inflation, which can mislead users about how much real trading is actually taking place.

Some exchanges routinely trade between bots to give the appearance of trading activity. For instance, Bot A of exchange will place an order for selling 50 shares or units of a particular asset. Bot B will buy it immediately. The cycle is then repeated, continuously, or on defined time periods, throughout the day. This adds to the trading volume of the asset, usually ranking it higher than it really is. Further, upon listing of new assets, some exchanges give the team option for “market making” – a fancy term for automated bots buying and selling tokens amongst themselves, to paint a false picture and give illusion of activity. Some exchanges are also known to even allow team members from a project, to operate multiple accounts to do the same “market making” by themselves.

How Does Coinmarketcap Liquidity Metric Work?

The new liquidity metric by Coinmarketcap is a proper amalgamation of distance of order from the mid price (best bid+best ask/2), order size (bigger orders are indicative of higher liquidity) and relative asset liquidity (the system adapts equally) and not just a measurement of only order-book depth (the buy and sell orders with their size). The calculation is made by retrieving data from the market pair at random intervals over a 24-hour period and then taking its average, which ensures that the system isn’t manipulated.

How to Use the Coinmarketcap Liquidity Metric?

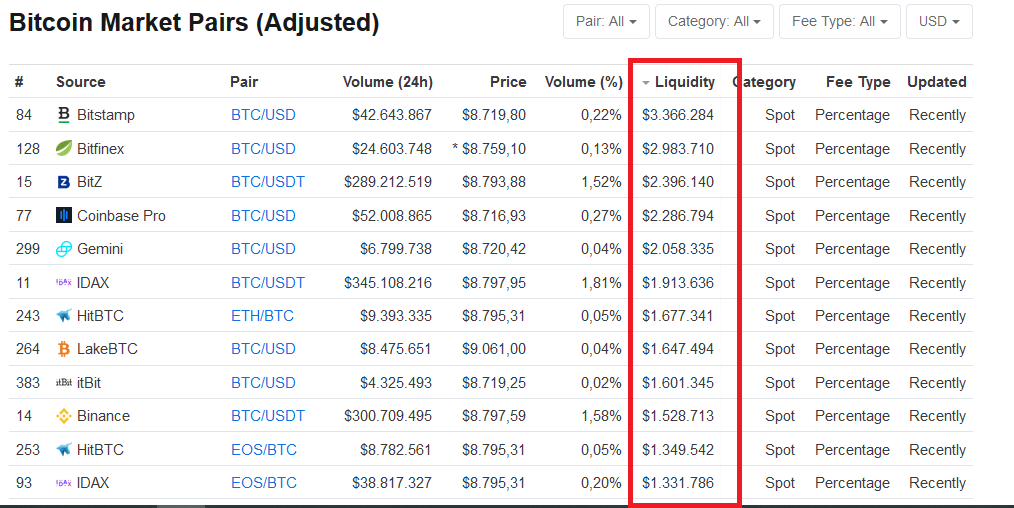

Its easy to view and understand the liquidity metric on Coinmarketcap. Just choose any asset in the list, on the site. Next, click the Market pairs link, select either “By adjusted volume” or “By reported volume”. Alongside the exchange information, specific trading pair, volume, price etc, you will see the “liquidity metric”. It reports the value in USD.

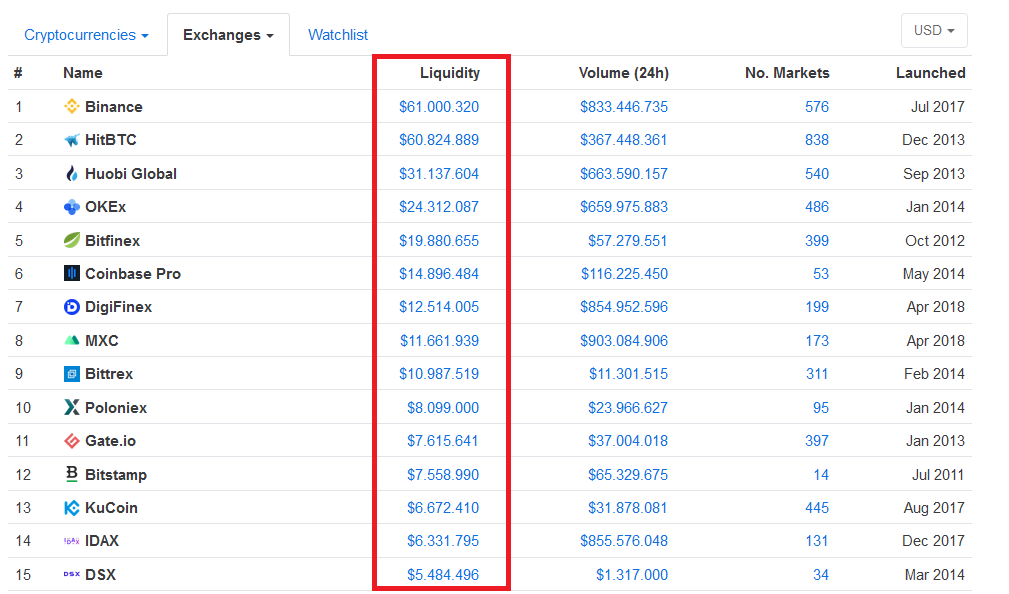

You can also view the total liquidity value of exchanges, by clicking on Exchange drop down box, on the main page and selecting “by Liquidity”.

This liquidity value (average over 24 hour period) can be used to compare different exchanges and trading pairs.

What Comes Next?

Coinmarketcap new metric makes it difficult for exchanges to give false data to manipulate the traders and investors. As most exchanges realize that this wash trading or volume inflation tactics aren’t working, they will be forced to report real data. Especially if they see that they can’t get away with reporting false volumes anymore and actually risk hurting their reputation in the process.