BlackRock Crypto Adoption – Will the Crypto Market move HIGHER soon?

The Blackrock crypto adoption was seen positively. Blackrock confirmed this later this week. Let's see how the crypto market reacts.

The largest wealth manager in the world, Blackrock, enters the crypto market. Blackrock confirmed this later this week. In order to be able to open up the crypto market, Blackrock is entering into a strategic partnership with the crypto exchange Coinbase. Their shares rose more than 50% within a week in the wake of the news.

For the crypto market, the strategic partnership could mean a lot of money in addition to prestige. You can find out what else is behind the project below.

Who is BlackRock?

Blackrock is one of the world’s largest wealth management firms. The US company, with its CEO Larry Fink, became known above all for the investment tool “Aladdin”. Aladdin is a kind of “super software” for data analysis of investments and is an invention of the CEO Larry Fink. It enabled Blackrock to become the world’s largest wealth manager. Blackrock now manages over $10 trillion in assets. These assets are often represented via ETFs. For example, the most well-known ETF brand “ishares” belongs to Blackrock. In addition to private investors, the company’s customers also include companies and states.

What does that mean for the Crypto Market?

With Blackrock comes a lot of trust and prestige in the crypto market. Blackrock can already influence prices through its market power and reputation. Above all, the partnership with Coinbase should return confidence to the market. In addition to the factors of trust and prestige, there is one production factor in particular: capital. If Blackrock opens up the opportunity to invest in Bitcoin, Ethereum & Co, this will enable millions of customers to discover the “cryptocurrencies” investment opportunity for themselves. With the customers, billions of capital come into the market.

Blackrock could now increasingly find its way into the market for crypto ETFs.

Effects of market entry

The trust that has been created brings old and new crypto investors into the market. Whether via ishares ETFs or other products, the crypto market could be in for a money spree. The logical consequence of this would be rising prices – first of all for the large and well-known currencies, then also for lesser-known Altcoins.

In addition, Blackrock works with a wide variety of corporate clients, governments and even central banks. Even sovereign wealth funds and pension schemes are among the wealth manager’s large customer base. According to Blackrock, these customers want to get involved in the market and thus move the market forward. For the crypto industry, this could mean more than just capital.

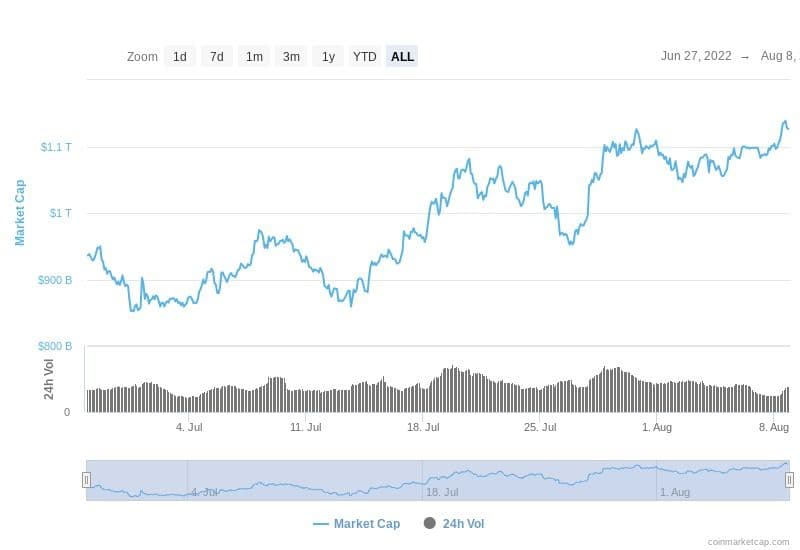

The crypto market is already on an uptrend. This important fundamental news will definitely add more positivity to the crypto market.

Conclusion

Blackrock’s entry into the market is a boon for the crypto industry. Thanks to Blackrock’s numerous partnerships, the crypto industry can build a basic framework for the next bull market. Especially since, in addition to relevant partnerships, capital should also flow into the market. However, the time factor should not be underestimated. It will be some time before Blackrock launches the corresponding products and the group’s customers actually access them.

As of now, the partnership with Coinbase brings prestige and trust to the industry, but long-term capital and strategic partnerships will follow.