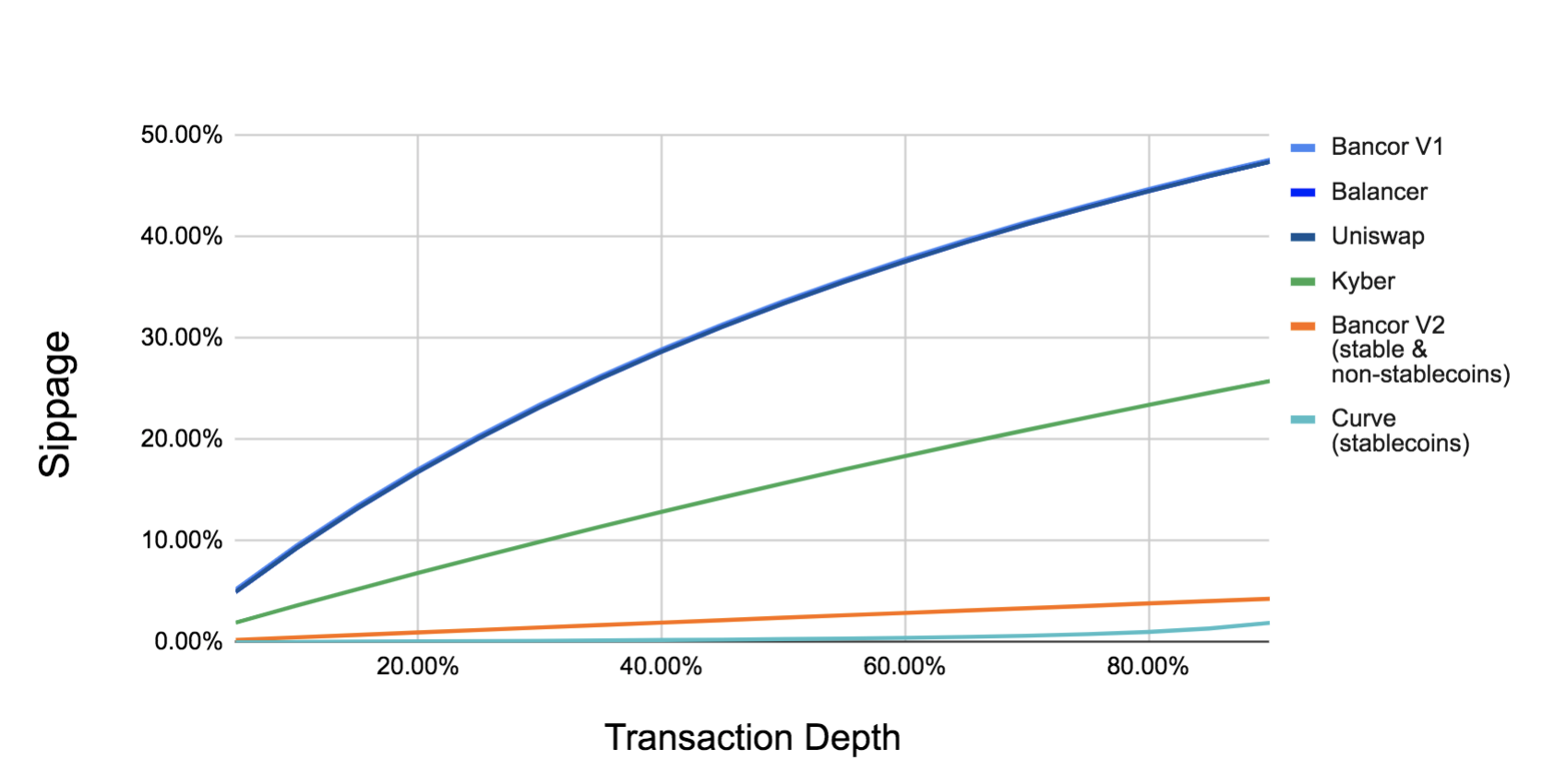

Bancor v2 To Offer The Lowest Slippage Rates Of All Automated Market Makers

Ahead of the major Bancor v2 launch, the team has released a report on the official blog titled “Amplified Liquidity: Designing Capital Efficient Automated Market Makers in Bancor V2” on June 22, showing that the soon-to-be-released Bancor v2 will offer […]

Ahead of the major Bancor v2 launch, the team has released a report on the official blog titled “Amplified Liquidity: Designing Capital Efficient Automated Market Makers in Bancor V2” on June 22, showing that the soon-to-be-released Bancor v2 will offer the lowest slippage rates of all Automated Market Makers (AMMs) by expanding the “liquidity amplification” (previously limited to stablecoins and wrapped-asset pairs) to include “volatile assets” too and introducing high capital efficiency, by utilizing Chainlink decentralized data oracles for continuous provision of accurate and reliable price data.