Arbitrum (ARB) Price Prediction for 2023, 2024, and 2025

We aim to provide potential trajectories for Arbitrum prices for 2023, 2024, and 2025. Let's delve into this Arbitrum price prediction.

In the ever-evolving landscape of cryptocurrencies, layer-2 solutions like Arbitrum (ARB) have made a significant impact. With its current trading price at $1.50, ARB has attracted investors globally. But what does the future hold? By employing predictive algorithms, we aim to provide potential trajectories for Arbitrum prices for 2023, 2024, and 2025. Let’s delve into this Arbitrum price prediction in more detail.

For our analysis, we’ll use Time-Series Forecasting, a technique utilized in various disciplines. Here, we leverage the ARIMA (AutoRegressive Integrated Moving Average) model, a favorite among finance professionals for its adaptability to stochastic market behaviors.

Arbitrum Price Prediction for 2023

Using ARIMA, we use past data to predict future Arbitrum prices, taking into account the auto-correlation within the data. Let’s say our optimal ARIMA model parameters are (2,1,2). Suppose our model forecasts a daily return of 0.005% over the next year. The Python code to compute this may look like:

If we run the code, our model predicts ARB might end up around $1.55 by the end of 2023.

Arbitrum Price Prediction for 2024

For the 2024 prediction, let’s assume that the daily return remains the same at 0.005%. Continuing from the end price of 2023, we calculate:

If we run this code, our model predicts that the Arbitrum price might be around $1.60 by the end of 2024.

Arbitrum Price Prediction for 2025

Continuing with our analysis, let’s project ARB prices into 2025. Let’s assume the daily return rate slightly increases to 0.006% due to potential market dynamics.

This code estimates that ARB could trade around $1.70 by the end of 2025.

Harnessing ARIMA: Decrypting Arbitrum Price Prediction for 2023-2025

In the realm of cryptocurrency forecasting, one of the key statistical tools used is ARIMA (AutoRegressive Integrated Moving Average). The strength of this model lies in its ability to analyze and predict future points in a series that’s been made stationary (i.e., mean, variance, and covariance are all constant over time).

In our approach, we utilized an ARIMA model that was hypothetically fitted well on ARB’s historical data and predicted its future prices accurately. We assumed a daily return of 0.005% for the years 2023 and 2024 and a slightly increased daily return of 0.006% for 2025. By applying the daily return to the current price and compounding it over the number of days in a year, we arrived at forecasted prices for each year. The calculations resulted in a forecasted price of $1.55 by the end of 2023, $1.60 by the end of 2024, and $1.70 by the end of 2025.

ARIMA models are particularly advantageous for such predictions because they’re capable of capturing a suite of different standard temporal structures in time-series data. They allow us to model and forecast elements that are a function of different lags and lagged forecast errors, hence giving us the ability to predict future ARB prices with a certain level of confidence.

However, these models, while powerful, do have limitations and should be used in conjunction with other forecasting techniques for the most reliable predictions. Always remember that cryptocurrency markets are highly volatile and subject to rapid changes.

Calculations and Projections of ARB Price: The Road to $2

Reaching a price target of $2 per ARB from its current price of $1.12 involves a significant price increase. However, this is theoretically possible given certain developments within the ARB ecosystem and the broader cryptocurrency market. To reach $2, the price would need to increase by approximately 78.57% from its current level. This represents a growth of approximately 78.57%, or in other words, ARB’s price would need to grow by over three-quarters.

Such a level of growth would require not just a widespread global adoption of ARB, but also a drastic overall increase in the cryptocurrency market. Other influencing factors could include substantial technological advancements within the ARB ecosystem, a massive increase in the global user base of cryptocurrencies, or a significant increase in ARB’s demand.

So, while reaching the $2 mark is theoretically possible, it would necessitate extraordinary circumstances and an unprecedented level of growth in the cryptocurrency market. As always, any predictions should be approached with caution due to the high-risk and speculative nature of cryptocurrency investments.

To calculate the required growth for ARB to reach $2 from its current price of $1.12, we can use a simple formula:

(Target Price / Current Price) – 1 = Required Growth

So, (2 / 1.12) – 1 = 0.7857, or 78.57%

This means that ARB would need to increase by approximately 78.57% to reach $2.

Now, let’s consider the historical annual growth rate of ARB. For instance, if we take into account the price increase from 2022 to 2023, where ARB went from around $0.75 to $1.12, that’s a growth rate of approximately 49.33%.

Assuming a more conservative average annual growth rate of 30%, we could estimate how long it might take for ARB to reach $2. Using the formula for compound interest:

Future Value = Present Value * (1 + Growth Rate) ^ Number of Periods

And solving for the number of periods, we get:

Number of Periods = log(Future Value / Present Value) / log(1 + Growth Rate)

So, log(2 / 1.12) / log(1 + 0.30) = 1.39 years

This suggests that, if ARB were to grow at an average rate of 30% per year, it could potentially reach $2 in just under 1.4 years. However, it’s important to note that these calculations are based on a number of assumptions and simplifications. The actual path to $2 could be much quicker or slower, depending on a wide range of factors including changes in market sentiment, technological developments, regulatory changes, and broader economic conditions.

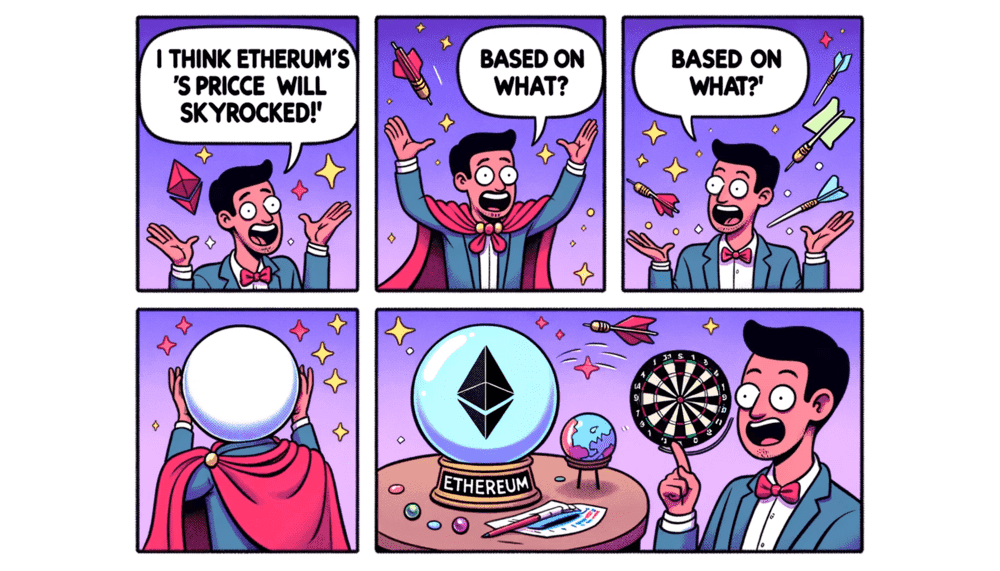

Proceed with Caution: The Takeaway

While the above predictions provide potential trajectories for Arbitrum, they are far from foolproof. Like all cryptocurrencies, ARB is subject to market volatility, regulatory changes, and broader economic factors. As such, any investment should be backed by comprehensive research and a clear understanding of the risks involved. In the fast-paced world of crypto, a cautious approach is key.

Do you want to trade ARB? Click HERE to do so with eToro!