Plus500 – Everything You Need on One Platform

Plus500 is an all-round solution for traders. The platform allows trading CFDs on over 2,000 different assets. About the company Plus500 is an established name and one of the largest brokers in the market. The company was founded in 2008 […]

Plus500 is an all-round solution for traders. The platform allows trading CFDs on over 2,000 different assets.

About the company

Plus500 is an established name and one of the largest brokers in the market. The company was founded in 2008 and is seated in London. Plus500 is regulated and authorized by the UK Financial Conduct Authority (FCA). Additionally, Plus500 has a seat in Cyprus and is regulated there by the CySEC (Cyprus Security and Exchange Commission). By operating in these legal spaces, Plus500 is subject to high requirements that guarantee the protection of users. Plus500 also has branches in countries outside of Europe.

Registration and trading

Plus500 has a very simple user interface and managing the platform can be learned quickly and intuitively. To trade with real money, verification is required with a photo ID. As soon as this is done, you can start.

There are several ways to make deposits on Plus500. Specifically, it is possible to make deposits with a credit card, bank transfer, SOFORT-Überweiseung, Ideal, PayPal, Skrill, Trustly, Multibanco, MyBank, Bpay, and Przelewy24. The minimum deposit required is € 100 like most other brokers.

A big advantage of Plus500 is the multiple languages supported on the platform. It is available in more than 50 countries and over 30 languages.

>>Click here for the Plus500 website<<

76,4 % of small investors lose their money

How to use the platform?

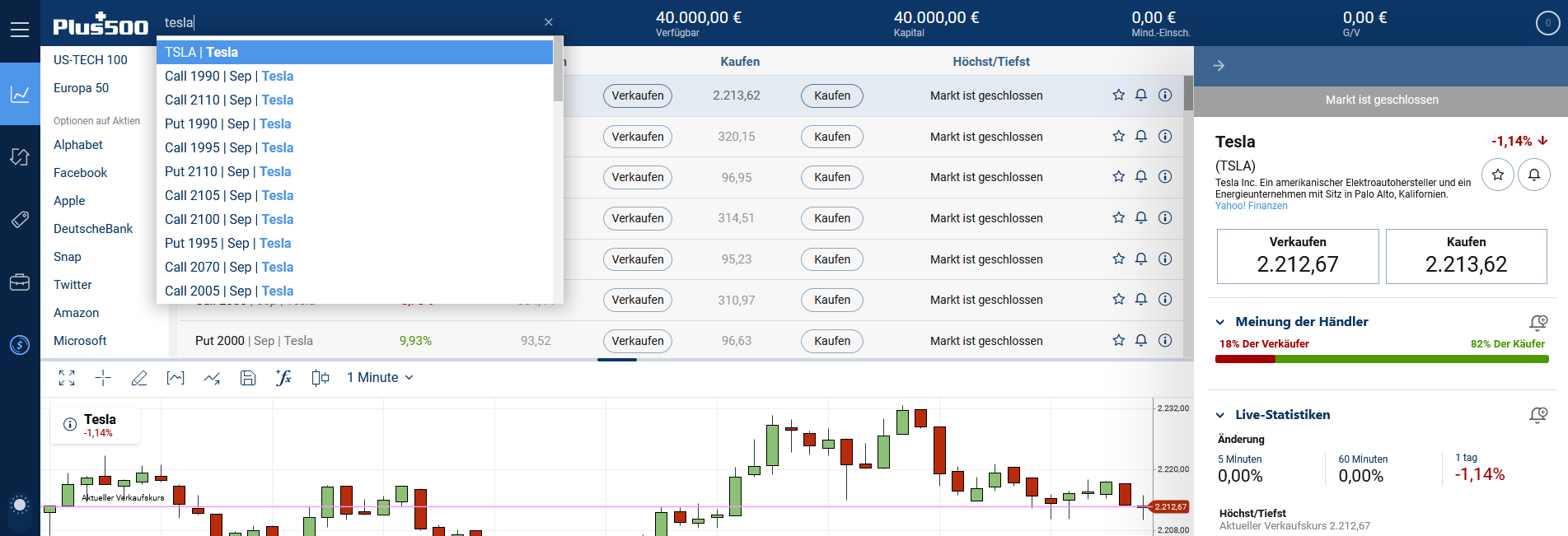

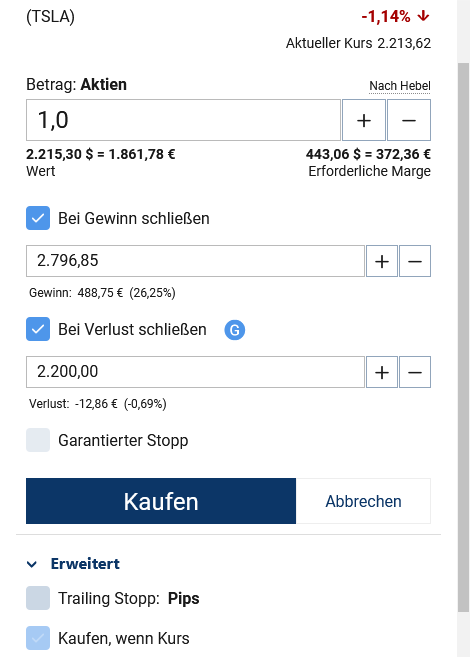

In this example, we want to take a look at the currently hot Tesla share. To do this, simply enter the name in the search field. After clicking it, a window with the data opens on the right. We can buy the stock or we can also short sell it. The important thing to remember here is: You are never the owner of the underlying asset, in this case the Tesla share. The CFDs only show the price development of the underlying asset and you participate in profits and losses. The rights normally given shareholders (Tesla in this case) are not applicable here.

Plus500 offers the most common options when setting up a trade. The two options “Close at Profit Order” (Stop limit order) and “Close at Loss Order” (Stop Loss Order). “Guaranteed Stop Order” represents the lowest risk of loss. “Trailing Stop Order” is a trailing stop loss. You enter the difference in pips (1 pip = $0.1 so $15 = 150 pips), then the mark indicating the stop loss will be trailing the current price by as much when the price develops in your facor. Let’s consider for example a Trailing Stop Order of 150 pips when buying Tesla shares at a price of $2,000. The share moves up to $2,017. $2,017-$15=$2,002. If the price now drops to $2,002 the position will be closed. If the price further rises to $2,040, the stop loss will follow it to $2,025.

Plus500 offers charting for each trading pair via the web interface for analyzing past and current price developments. There is also a large selection of indicators for professional traders. In addition to the web interface, there is a trading software for Windows (Windows 10 Trader) and for mobile phones. With the Android or iPhone app, you can keep an eye on your trades around the clock.

The leverage at Plus500 is different for each trading pair and goes up to a maximum of 1:30.

The offer

Plus500 has CFDs on over 2,000 assets in its range, covering the asset classes stocks, commodities, precious metals, cryptocurrencies, and indices. Trading pairs for cryptocurrencies are: BTC/USD, BTC/ETH, ETH/USD, Krypto 10-Index/USD (maps the 10 largest cryptocurrencies by market capitalization), LTC/USD, NEO/USD, XRP/USD, IOTA/USD, XLM/USD, EOS/USD, BCH/USD, ADA/USD, TRX/USD and XMR/USD.

How does Plus500 make its money?

Of course, every company lives off of a well functioning business model. Plus500 takes no fees, but instead makes profit from the spread, i.e. the difference between the bid and ask prices, and through margin. With margin, Plus500 lends the trader capital to leverage his position.

Until he returns this capital, he pays interest. The user can see these individual so-called “swap fees” in the information on the respective trading pair (overnight funding). Plus500 does not charge any account management fees or other commissions. Inactivity fees are also low at $10 after 3 months of inactivity. In other words, Plus500 is on the cheaper side with its fees.

Demo account

The Plus500 demo account is especially interesting for new traders. It offers the possibility to learn about trading and the platform with no risk. No identification is required for demo accounts.

>> Here you can set up a demo account on Plus500 <<

76,4 % of small investors lose their money

Risks

When speculating making profits isn’t guaranteed. Unfortunately, most people lose money when trading CFDs. At Plus500, 76.4% of retail investor accounts lose money when trading CFDs. Therefore, one should always consider whether one can afford to take a high risk and lose money.

Conclusion

Plus500 is an all-rounder for traders who only want to bet on price developments. The platform is easy to learn and with just a few mouse clicks you can access a wide range of assets. Plus500 is subject to high regulatory requirements and is considered safe.

The fees are relatively low and there is always a risk when speculating. With the demo account, it is possible to visualize risks and test strategies without risking money. All in all, Plus500 is a front runner also when compared to other platforms of its type.

>> Click here to go to Plus500’s website <<

76,4 % of small investors lose their money

Prasanna Peshkar

Prasanna Peshkar is a seasoned writer and analyst specializing in cryptocurrency and blockchain technology. With a focus on delivering insightful commentary and analysis, Prasanna serves as a writer and analyst at CryptoTicker, assisting readers in navigating the complexities of the cryptocurrency market.

Regular updates on Web3, NFTs, Bitcoin & Price forecasts.

Stay up to date with CryptoTicker.