Cryptocurrencies or Crypto-Assets?

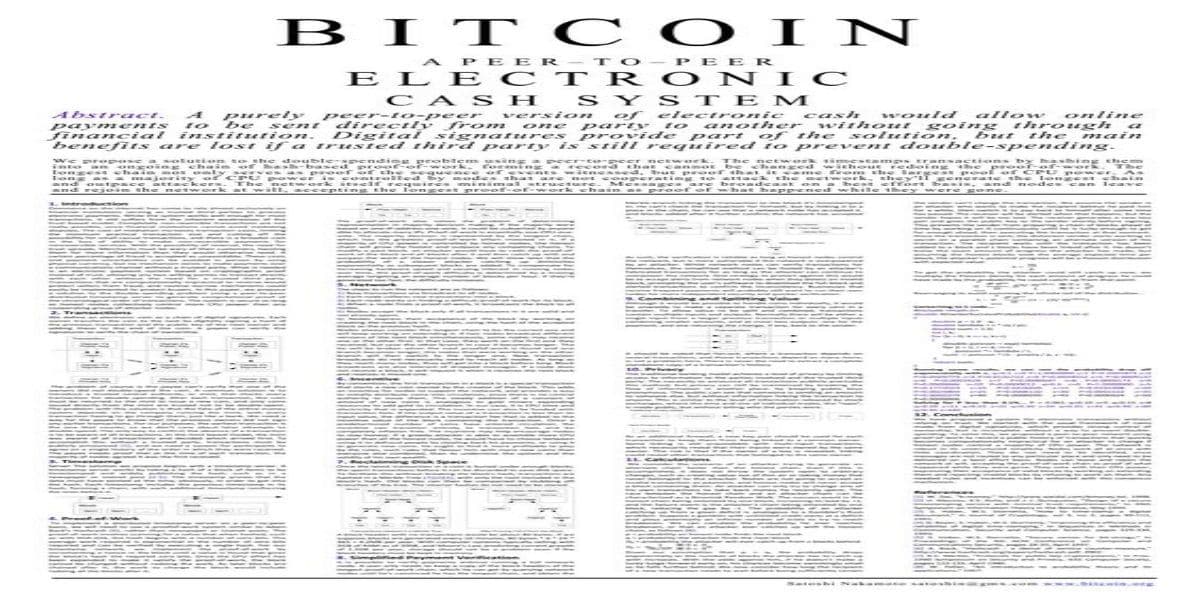

When Bitcoin was first released, it was accompanied by a paper authored by the enigmatic Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System. From the phrase ‘electronic cash system’, one might imagine Bitcoin to be a groundbreaking technology that […]

When Bitcoin was first released, it was accompanied by a paper authored by the enigmatic Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System. From the phrase ‘electronic cash system’, one might imagine Bitcoin to be a groundbreaking technology that will eventually replace fiat currencies in our day-to-day transactions.

However, as 2017 comes to an end, it is evident that Bitcoin and other altcoins have become more of a store of value rather than a substitute for cash. In fact, instead of spending them – which is what we usually do with fiat money – most people are actually quite reluctant to spend their digital currencies.

Why do users ‘HODL’?

#alrightalrightalright #HODL pic.twitter.com/nVwgqDwnWL

— CryptoTicker (@CryptotickerIo) December 18, 2017

Turns out, one of the biggest reasons users are unwilling to cash out their cryptocurrency holdings is the bullish belief that the value of their digital currencies will increase over time. Judging by the current trend, as well as the rise of different altcoins that helps diversify the risk a full-scale market crash, this belief is not entirely unsubstantiated.

In an interview at the Fortune Global Forum in China earlier this month, Yahoo co-founder Jerry Yang said that cryptocurrencies like Bitcoin, Ethereum, Dash, and Litecoin are the future of the current financial system. However, he agrees that they are not quite there yet.

“Bitcoin as a digital currency is not quite there yet. People are not using it to transact. People are using it as an investable asset. I personally am a believer in where digital currency can play a role in our society. Especially in, not only the front end of doing transactions but also in the back end of creating a much more efficient system and a much more verifiable system”.

The second reason why people don’t spend their cryptocurrencies is the issue of convenience: There is still no simple and effective way for people to spend Bitcoin, let alone other altcoins. As of today, cryptocurrencies are not ready for widespread adoption yet as there are still many parts of the world that do not recognize the transaction of these intangible coins – coins that can’t be touched or felt. As long as there is no solution that facilitates fluid transactions of cryptocurrencies for in-person spending parts of the ecosystem, people will keep “hodl-ing” their digital investments.

The third and final reason is pretty straightforward – the sky-high transaction fees. Take Bitcoin for example: According to data provided by BitInfoCharts, users are paying $28 on average to make transactions using the digital currency. This might not seem very significant if you are just looking to cash out your holdings, but if you expect to use Bitcoin for micro-transactions, you might end up incurring losses because of the colossal fees. Of course, there are other cryptocurrencies that allow users to perform transactions at a fraction of that $28, but we are still facing the issue of a widespread adoption in the world of cryptocurrency.

In short, without an overarching solution to tackle the three aforementioned issues, cryptocurrencies will remain solely as ‘investments’ as opposed to a replacement for traditional fiat currencies. This prompts the question: Are we buying cryptocurrencies, or are we purchasing crypto-assets?