Crypto Market Loses $90 Billion Amidst Waves of FUD

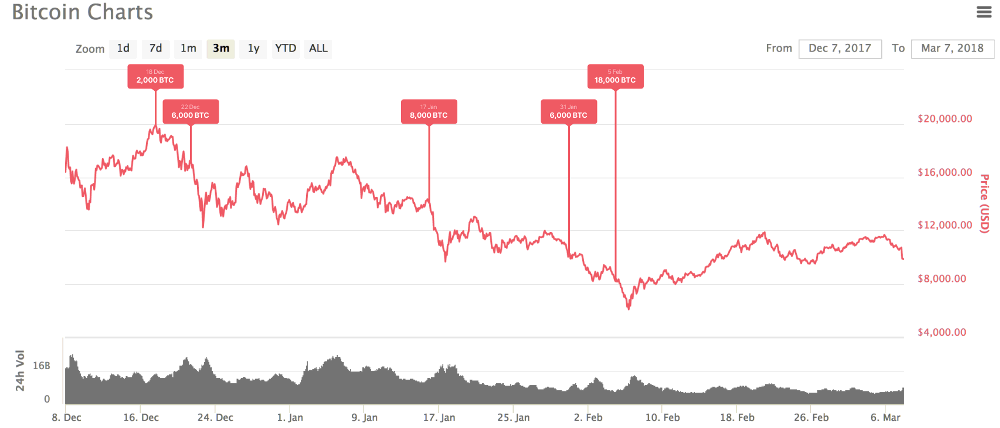

The cryptocurrency market has dropped by over $90 billion this week as multiple consecutive waves of unfavorable news pummelled the already unstable market. Source: CoinMarketCap The price of Bitcoin dropped by over 15% this week, hitting a low of $8,397 […]

The cryptocurrency market has dropped by over $90 billion this week as multiple consecutive waves of unfavorable news pummelled the already unstable market.

Source: CoinMarketCap

The price of Bitcoin dropped by over 15% this week, hitting a low of $8,397 today morning. Just a few days ago, its price was just about to cross the $10,000 mark. Ethereum, on the other hand, had a pretty rough week as well as it fell from $837 to $671 – almost a 20% deficit.

Like all market ‘dips’ and ‘crashes’, this price drop is mainly due to two major factors.

Trigger #1: South Korean Raid

Earlier yesterday, Upbit, the largest cryptocurrency in South Korea, was raided by local police and investigators after reports of alleged fraud was picked up by the authorities. To provide some further context, Upbit is the cryptocurrency exchange operated by Korean tech mammoth Kakao Group, and is currently ranked the world’s fourth largest cryptocurrency exchange by 24-hour trade volume.

According to a local news network Chosun, Upbit is suspected to have “faked its balance sheets” and “deceived its investors”. In light of those suspicions, South Korea’s Financial Supervisory Commission (FSC) have also sent 10 investigators to Upbit’s headquarters and will be accessing the company’s databases to audit their cryptocurrency holdings to make sure everything tallies.

“We have secured hard disks and accounting books through confiscation. Analysis is expected to take days,” said local authorities.

This is not the first time unfavorable news from South Korea has affected the global cryptocurrency market. In fact, one of the critical points that led to the cryptocurrency bear market this year was news that South Korea might be banning all cryptocurrency trading in the near future.

Trigger #2: Mt Gox Trustee BTC Sale

When Mt Gox went bankrupt after an alleged $350 million hack that devastated thousands of investors, its bankruptcy trustee, Nobuaki Kobayashi, was tasked with selling off 200,000 BTC. In the last few months, it has been observed that the cryptocurrency market would take a dive every time Kobayashi sells off a certain chunk of the BTC that he holds.

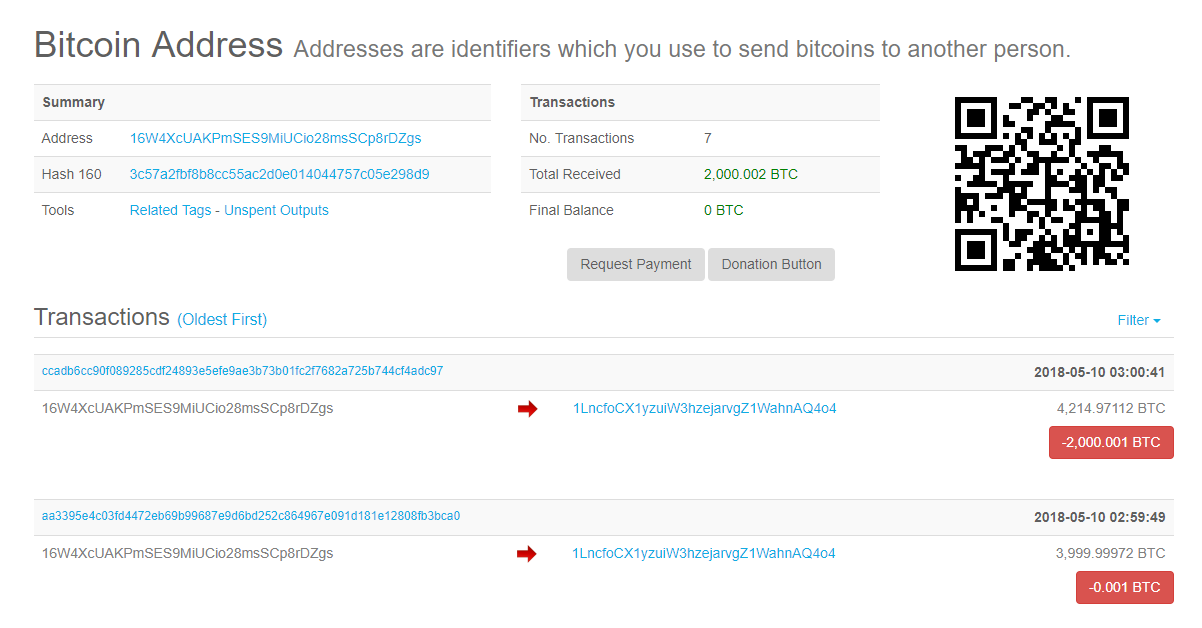

Source: David Gerard

This time, it was no different. On May 11, when four of the Mt Gox trustee’s wallets moved 2,000 Bitcoin’s each, transfering a total of 8,000 Bitcoin to exchanges, a crash was impending.

Source: CCN

Steven Steel

Steven Steel is an award-winning novelist, blogger, and entrepreneur. He is currently the Content Manager at the cryptocurrency blog, CryptoTicker. He is also in charge of community management for Paranoid Internet, the leading marketing and consulting agency in Germany.

Regular updates on Web3, NFTs, Bitcoin & Price forecasts.

Stay up to date with CryptoTicker.