Bitcoin News: Whales on the Move- $59 Million Worth of Bitcoin Withdrawn from Binance!

Bitcoin, the pioneering cryptocurrency, has seen its share of ups and downs. Let's take a look at this Bitcoin news in more detail.

Bitcoin, the pioneering cryptocurrency, has seen its share of ups and downs because of Bitcoin Whales. In the ever-evolving world of digital assets, certain events act as significant markers, and one such marker was observed in the past 24 hours. Two brand-new addresses withdrew a staggering 2,273 BTC, amounting to approximately $59 million, from Binance, one of the largest cryptocurrency exchanges in the world. Let’s take a look at this Bitcoin news in more detail.

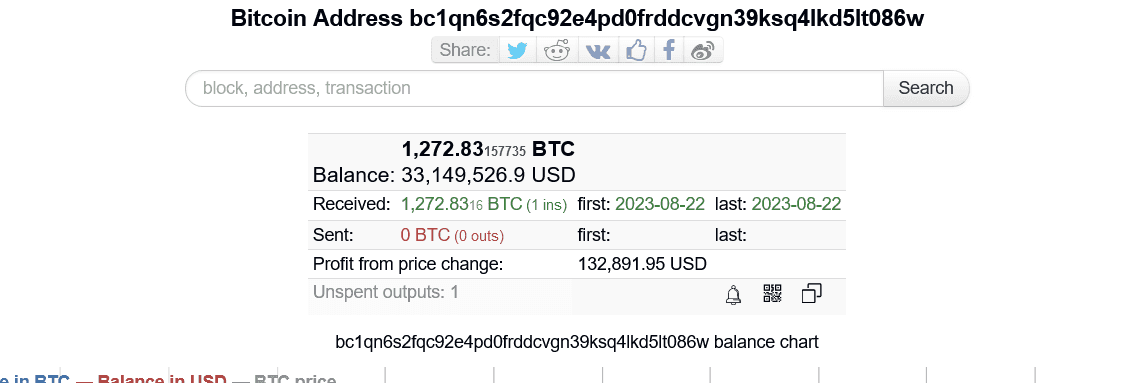

In recent blockchain activity, two nascent Bitcoin addresses have executed substantial withdrawals, collectively amassing a total of 2,273 BTC, valued at an approximate $59 million. The first address, currently boasts a balance of $33,149,526.9, having received an infusion of 1,272.8316 BTC in a singular transaction.

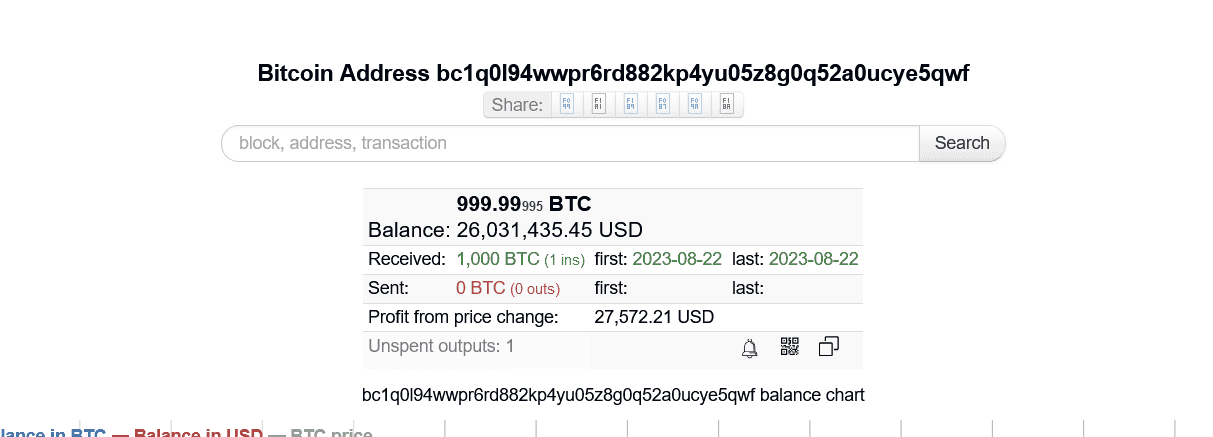

Conversely, the second address, has a balance slightly lower at $26,011,075.43, with a credited amount of 1,000 BTC from a single transaction. This substantial movement of assets to these newly established addresses underscores the dynamic nature of Bitcoin’s ecosystem and the significant capital operations therein.

In simple terms, imagine two brand-new vaults were just created, and in a short time, they were filled with a vast amount of Bitcoin, a type of digital money. These two vaults, which in the Bitcoin world we call ‘addresses’, received a total of 2,273 BTC. Now, to give you an idea of its value, that’s similar to someone depositing roughly $59 million into these vaults.

The first vault, has about $33 million inside it and has received 1,272.8 Bitcoins. Meanwhile, the second vault, holds a bit less, around $26 million, and was filled with 1,000 Bitcoins. Both of these actions happened pretty quickly, indicating that someone or some group has decided to store a significant amount of their digital wealth in these new vaults.

Bitcoin News: What does this Bitcoin withdrawal mean?

Before diving deep, let’s understand the scenario using a simple analogy. Imagine a bustling fish market. Every day, thousands of fish are bought and sold, with most transactions involving small fishes. But every once in a while, someone comes along and buys a massive tuna or a whale – a purchase that doesn’t go unnoticed.

In the world of cryptocurrencies, this large fish is analogous to a substantial amount of Bitcoin, often owned by a single individual or entity. These entities, often referred to as ‘whales‘, can influence the market with their massive trades.

Accumulation or Mitigation? Analyzing Whale Motivations in Cryptocurrency Movements

In the intricate dance of the cryptocurrency market, discerning the motivations behind significant transactions is often more art than science. It’s challenging to determine if the recent activity is indicative of accumulation—where entities are amassing more Bitcoin in anticipation of future price increases—or if the whales are attempting to reduce counter-party risk.

Counter-party risk refers to the potential for one party in a financial transaction, like a cryptocurrency exchange, to default on its contractual obligations. By moving vast sums of Bitcoin out of exchanges, whales could be signaling a lack of trust in these platforms, aiming to safeguard their assets from any unforeseen institutional failures. Both scenarios carry profound implications for the market’s direction, highlighting the nuanced and multifaceted nature of cryptocurrency trading dynamics.

Bitcoin News: Why is this significant?

1. Possible Indication of Large Players Entering the Market

The recent withdrawal suggests that a new player (or players) has entered the Bitcoin game, acquiring a significant amount of BTC. When new addresses are created and high sums of Bitcoin are withdrawn, it often indicates that the individual or entity behind the address is planning to hold onto the cryptocurrency for a more extended period, rather than trading it immediately.

2. Market Impact and Speculation

A substantial purchase, like the one we’re discussing, can result in market speculation. Traders and analysts often see such massive withdrawals as bullish indicators, hinting that there might be an upward trend in Bitcoin’s price soon. After all, if someone is willing to invest $59 million in Bitcoin, they probably have a reason to be optimistic about its future.

Bitcoin News: What could be the reason behind such a move?

1. Buying the Dip

Often, savvy investors and institutions buy assets when their prices are lower, expecting them to rise in the future. If Bitcoin’s price is currently undervalued, this could be a strategic move by the whales to ‘buy the dip’, aiming for lucrative returns when the value goes up.

2. Long-term Investment

The parties involved might be viewing Bitcoin as a long-term investment, a hedge against traditional financial systems, or a store of value. By withdrawing their holdings from Binance, they’re likely storing it in a more secure, private wallet, indicating a long-term holding strategy.

Bitcoin News: Waves in the Digital Sea

In the grand ocean of cryptocurrencies, the movements of whales can cause significant waves. While no one can predict the future with absolute certainty, the recent withdrawal of $59 million worth of Bitcoin is certainly a notable event, warranting attention from traders and enthusiasts alike. As the digital landscape continues to evolve, keeping an eye on such monumental shifts can offer valuable insights into the potential trajectories of the market.

Bitcoin News: How Whale Movements Impact Bitcoin Prices?

Whenever there’s a substantial movement by whales in the cryptocurrency ecosystem, there’s a corresponding reaction in the market. Let’s delve into the potential consequences such a significant withdrawal might have on Bitcoin prices.

1. Immediate Market Reaction

When large amounts of Bitcoin are withdrawn from exchanges, it often gets the immediate attention of traders and analysts. The perception is usually positive: if someone (especially a whale) is removing such a vast sum from an exchange, they’re likely bullish about the future price and maybe moving the funds to a more secure, personal wallet for longer-term holding.

2. Decreased Liquidity

Removing a considerable amount of Bitcoin from an exchange reduces the available supply for trading, leading to decreased liquidity. In simple terms, with fewer Bitcoins available for buying and selling, even small trades can have a more pronounced impact on the price.

3. Potential Price Surge

Given the positive sentiment and reduced liquidity, there’s a chance the Bitcoin price might surge. When traders see a whale making a significant move, it can lead to FOMO (Fear of Missing Out). The thought process is, “If the whale is buying or holding, they must know something we don’t.” This can lead to more traders buying Bitcoin, driving its price up.

4. Speculative Waves

Whale activity also invites a lot of speculation. Crypto news outlets, social media influencers, and forums like Reddit may start buzzing with discussions about the recent move. Such speculations, depending on their nature and reach, can either amplify the bullish sentiment or introduce skepticism, which in turn can influence the price further.

5. Potential Short-term Volatility

While the initial reaction might be a surge in price, the crypto market is notorious for its volatility. The price might see short-term fluctuations as traders react to the whale movement, try to gauge its implications and strategize their trades accordingly.

Conclusion

Whale movements in the cryptocurrency world are akin to dropping a sizable stone in a pond. The initial splash is evident, but the subsequent ripples, their reach, and duration can vary. For traders and investors, understanding these dynamics can provide an edge in navigating the tumultuous waters of the crypto market.