Bitcoin Spot ETF LIVE TICKER: Countdown to Bitcoin ETF Approval

Bitcoin ETF News LIVE Update: Bitcoin ETFs LIVETICKER: Countdown to Bitcoin ETF Approval

CryptoTicker sums up the events of the last hours in the live ticker of Bitcoin ETF. This article will be updated continuously. Stay tuned for ongoing coverage and analysis.

The highly anticipated Bitcoin Spot ETF is on the verge of realization! Despite a false report circulating yesterday, suggesting official approval by the US Securities and Exchange Commission (SEC), it was clarified that the SEC’s Twitter account was hacked, and the approval is still pending. Today, it is expected to be officially announced. Stay tuned for the latest updates on the imminent ETF launch.

January 09, 2024 : 1:05 pm Eastern Time Wednesday

In the context of the imminent approval of BITCOIN ETFs, Michael Saylor emphasized, “The reason bitcoiners are passionate about $BTC is that no government can take it away from you.” This statement speaks volumes about the dedication of #bitcoin HODLERS and the forthcoming BTC ETF.

BREAKING NEWS: CBOE Officially Lists Certificate for Galaxy/Invesco Bitcoin ETF

January 10, 2024 : 11:15 am Eastern Time, Wednesday

In a groundbreaking move for the cryptocurrency market, the Chicago Board Options Exchange (CBOE) has officially confirmed the listing certificate for the highly anticipated Galaxy/Invesco #Bitcoin Exchange-Traded Fund (ETF). This development marks a significant step towards mainstream acceptance of digital assets and further establishes Bitcoin as a legitimate investment option.

The Galaxy/Invesco #Bitcoin ETF has garnered immense attention from both institutional and retail investors, with its listing on the CBOE set to open new avenues for individuals and organizations seeking exposure to the world’s leading cryptocurrency. The ETF is a collaborative effort between Galaxy Digital Holdings and Invesco, two prominent players in the financial industry.

The CBOE’s decision to list the certificate comes after rigorous scrutiny and compliance assessments, highlighting the growing acknowledgment of the legitimacy and maturity of the cryptocurrency market. With this move, the CBOE joins other major financial institutions in recognizing the increasing demand for regulated cryptocurrency investment products.

The ETF is designed to track the price of Bitcoin and provide investors with a regulated and secure avenue for gaining exposure to the cryptocurrency without having to directly hold or manage the digital asset. This approach is expected to attract a broader range of investors who may have been hesitant to participate in the cryptocurrency space due to regulatory concerns or security issues associated with digital wallets.

Experts predict that the listing of the Galaxy/Invesco #Bitcoin ETF on the CBOE could potentially pave the way for additional cryptocurrency-related financial products in traditional markets. The move is seen as a milestone in the integration of cryptocurrencies into mainstream investment portfolios, bridging the gap between traditional finance and the rapidly evolving digital asset ecosystem.

Market reactions to the news have been largely positive, with Bitcoin experiencing a surge in price following the announcement. The ETF’s listing is expected to bring increased liquidity and stability to the cryptocurrency market, attracting a more diverse range of investors and potentially contributing to the continued maturation of the industry.

As the Galaxy/Invesco #Bitcoin ETF becomes available for trading on the CBOE, all eyes will be on how it performs in the market and its impact on the broader cryptocurrency landscape. This development signals a significant shift in the perception of cryptocurrencies as a legitimate and regulated asset class, further solidifying their place in the global financial markets.

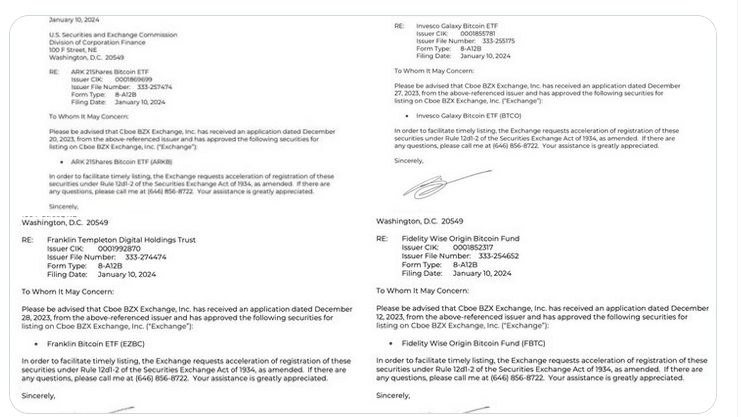

BREAKING‼️ CBOE Accelerates Approval Process for 4 #Bitcoin ETFs

January 10, 2024 : 11:30 am Eastern Time, Wednesday

In a surprising turn of events, the Chicago Board Options Exchange (CBOE) has taken a bold step by submitting a “request for acceleration” to list four #Bitcoin Exchange-Traded Funds (ETFs) by tomorrow. This unexpected move suggests a heightened urgency and enthusiasm within the financial market to expedite the approval process for these cryptocurrency investment vehicles. If successful, this accelerated timeline could potentially open up new avenues for investors seeking diversified exposure to the world’s leading cryptocurrency. As the cryptocurrency landscape continues to evolve rapidly, this development underscores the growing interest and recognition of digital assets within traditional financial institutions. Stay tuned for further updates as the market awaits the outcome of this accelerated approval request. #CryptoNews #ETFListing #FinanceInnovation 🚀.

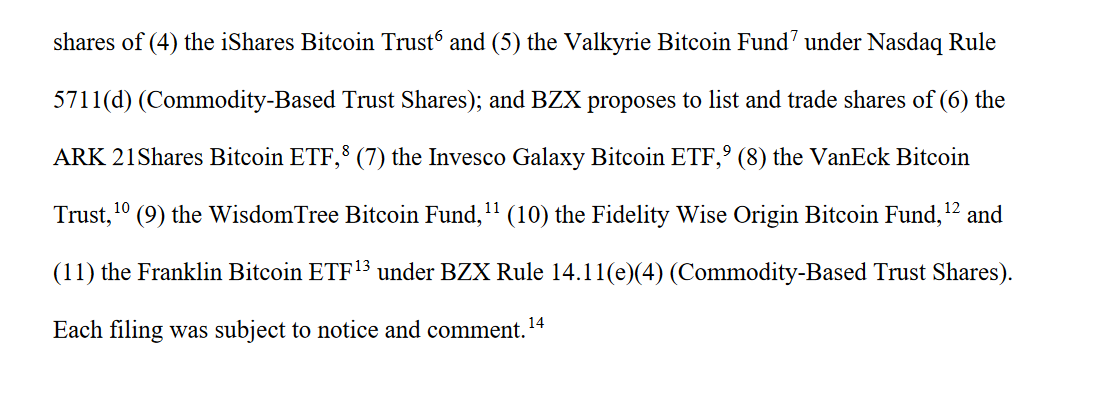

Cboe has granted approval for the listing of Spot #Bitcoin ETFs on its exchange, subject to SEC approval. The approved entities include:

• VanEck

• Fidelity

• Franklin

• ArkInvest

• Invesco Galaxy

Smart Whales Stock Up on BTC Before ETF Buzz!

With the anticipated approval of BlackRock’s Spot Bitcoin ETFs on Wednesday (Jan 10), there are strategic moves of two astute BTC whales who have accumulated a substantial 1,755 BTC ($77.1M) from Binance over the past three days.

Firstly, the savvy whale with the address bc1pj secured 1,750 BTC ($76.9M) at an average price of $43,953. This calculated move resulted in a remarkable profit of $26.4M from BTC transactions. As of now, this smart whale holds a significant 4,750 BTC ($207M).

Secondly, the whale with the address 3MVqp made a distinctive move by withdrawing 5 BTC ($217K) at a rate of $43,426 approximately two days ago, possibly as a trial transaction. Impressively, in 2023, this strategic whale executed three BTC trades, all of which were profitable, boasting a flawless win rate of 100%. These trades accumulated a substantial cumulative profit of $61M. The intricate maneuvers of these whales indicate a calculated and profitable approach in the dynamic crypto market.

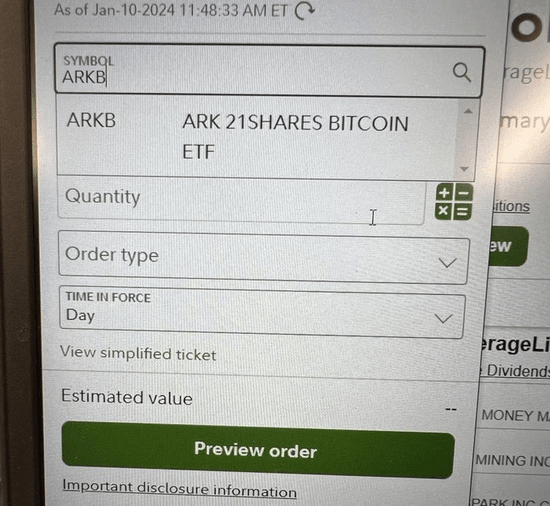

Fidelity offers Bitcoin ETFs of ARK and VanEck

January 10, 2024 : 12:04 pm Eastern Time, Wednesday

$ARKB and $HODL Now Listed on @Fidelity! Limit Orders Are Open. Fidelity’s trading platform now features #Bitcoin ETFs from both ARK and VanEck.

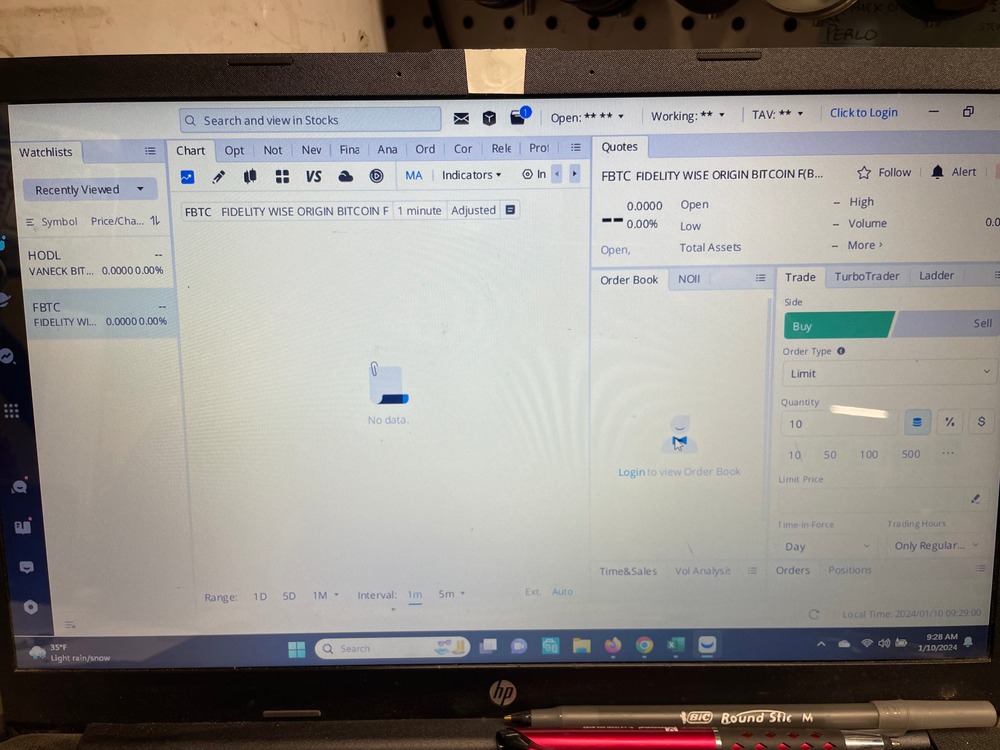

ETF listings on eTrade

January 10, 2024 : 12:20 pm Eastern Time, Wednesday

https://x.com/martypartymusic/status/1745136083187163395?s=20

Update: @vaneck_us is now on @etrade! @MorganStanley gets listed before @BlackRoc:$FBTC is now listed on @WebullGlobal.

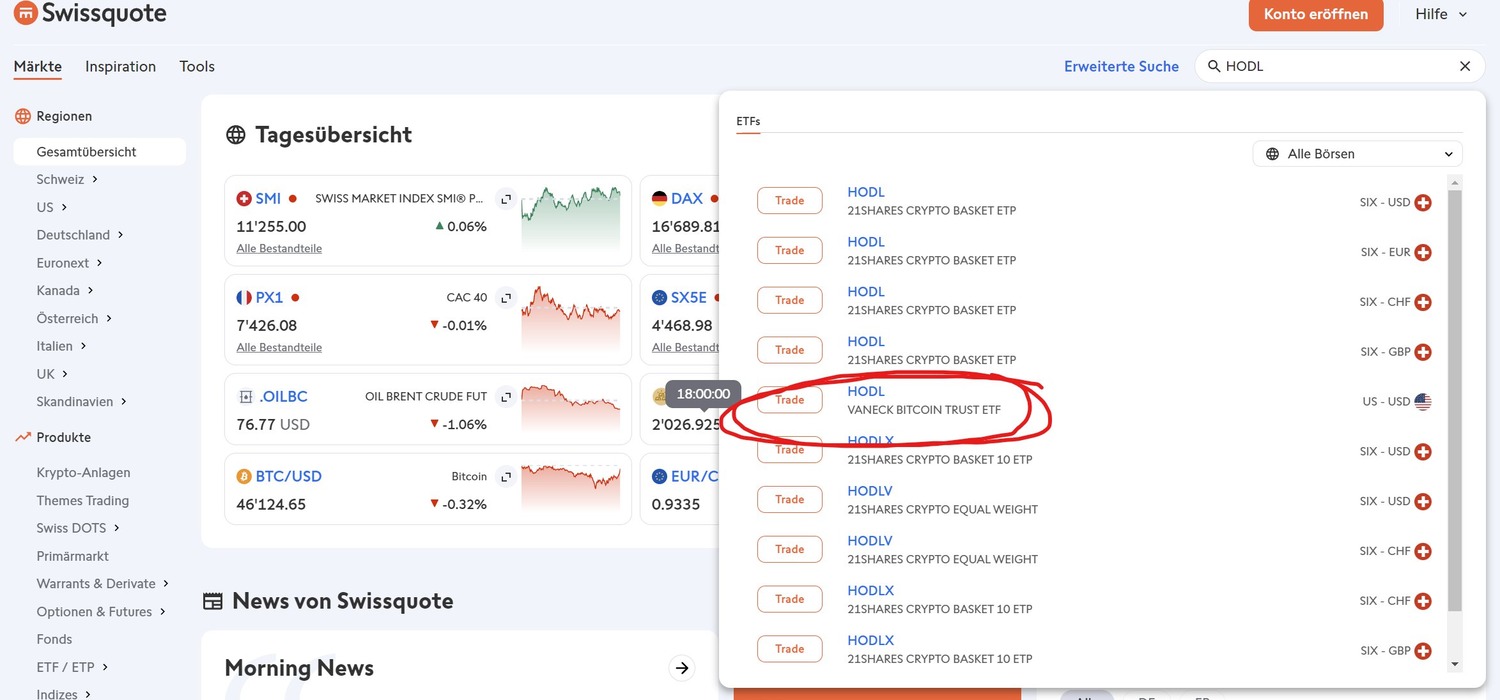

Bitcoin ETF Now Listed on Swissquote

January 10, 2024 : 12:43 pm Eastern Time, Wednesday

Bitcoin ETF Now Listed on Swissquote!

All 11 spot Bitcoin ETF tickers added to the Bloomberg Terminal

January 10, 2024 : 1 pm Eastern Time, Wednesday

All 11 spot Bitcoin ETF tickers are currently being added to the Bloomberg Terminal with the status ‘Pending Listing.’ The approval for the Bitcoin spot ETF has been granted, and the official announcement is anticipated by the end of the business day.

SEC Approved Bitcoin ETF?

January 10, 2024 : 1: 05 pm Eastern Time, Wednesday

It appears that the SEC has given its approval for the #BitcoinETF! 👀🔥 An announcement may be on the horizon. Stay tuned!

Bitcoin Price Reached $46,000 mark again. Can you trade ETFs on Bitget?

January 10, 2024 : 1: 20 pm Eastern Time, Wednesday

Just In: #Bitcoin Surges Back Over $46,000 Again! 🚀The renewed momentum is further fueled by growing anticipation of the potential impact of the Bitcoin ETF. As the approval of ETFs looms and Bitcoin experiences a recent surge, surpassing $46,000, it’s an opportune moment to explore BTC trading. Bitget has introduced an exclusive trading event, providing you with the opportunity to participate in a substantial prize pool of $20,000 USDT! You can join here.

ETF Decision will not be delayed: Cathie Wood

January 10, 2024 : 1: 30 pm Eastern Time, Wednesday

Gracy Chen, Bitget CEO: No FUD Amid BitcoinETF Anticipation

January 10, 2024 : 1: 45 pm Eastern Time, Wednesday

Gracy Chen, CEO of Bitget, addressed the anticipation surrounding the #BitcoinETF, expressing humor at the arrival of FUD. Assuring the community, she emphasized the seamless operations at Bitget with secure funds. Chen highlighted the team’s dedication to preparing for the upcoming bull run and celebrated the platform’s recent growth, which has resulted in over 100 job openings, including senior and management roles. Inviting like-minded individuals to join the team, she concluded with a rallying cry: “FUD less, BUIDL more.

Is it possible To Short the Bitcoin with ETFs?

Yes, the ability to short Bitcoin through ETFs is a reality. One such example is the ProShares Short Bitcoin Strategy ETF (BITI), designed for investors seeking potential profits on days when Bitcoin undergoes a decline. A limit order, categorized as a specific type of exchange order, empowers traders to buy or sell a cryptocurrency at a predetermined price or a more favorable one.

CBOE: ETF trading starts tomorrow

January 10, 2024 : 2:20 PM Eastern Time, Wednesday

BREAKING: Spot #Bitcoin ETFs to start trading tomorrow – CBOE.

SEC confirmation only post USA trading halt

January 10, 2024 : 2:35 PM Eastern Time, Wednesday

A board member of an ETF applicant informed Fox Business that the SEC confirmation will occur after the trading halt in the USA, which won’t be at 22:00 German time. We’ll need to wait an additional 1.5 hours for the official confirmation.

Upcoming Bitcoin ETF Debuts: Cboe BZX Announces Listing Circulars for Six Funds

January 10, 2024 : 2:49 PM Eastern Time, Wednesday

Cboe BZX has released listing circulars for six new #Bitcoin ETFs scheduled to debut on January 11, 2024.

– Invesco Galaxy Bitcoin ETF $BTCO

– Franklin Bitcoin ETF $EZBC

– ARK 21Shares Bitcoin ETF $ARKB

– VanEck Bitcoin Trust $HODL

– Fidelity Wise Origin Bitcoin Fund $FBTC

– WisdomTree Bitcoin Fund $BTCW

We are anticipating approvals from Nasdaq and NYSE.

Note: As of now, 19b-4 approval notices crucial for the listing haven’t appeared on the SEC website. Listing is contingent on this approval.

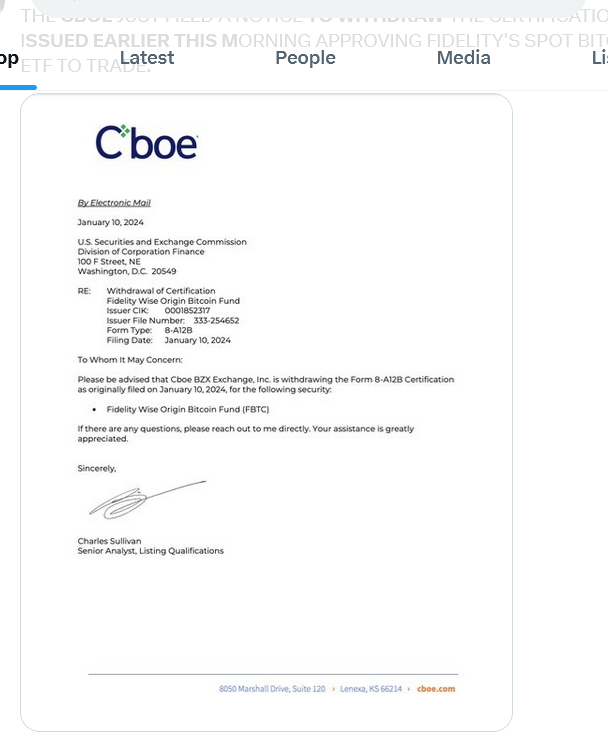

Fake News drop Bitcoin Price under 46,000 Dollars

January 10, 2024 : 3:29 PM Eastern Time, Wednesday

False reports on Twitter claim that CBOE withdrew ETF quotations, causing a Bitcoin price drop below $46,000. Presently, the market is showing signs of recovery from this downturn.

Beware of fake news:

Beware of False Information:Exercise caution regarding social media rumors, such as the fake news circulating on Twitter about CBOE withdrawing ETF quotations. Always verify information from reliable sources before making trading decisions.Trading with leverage can amplify both gains and losses. Be mindful of the risks associated with leveraging your positions and ensure you have a thorough understanding of the potential impact on your investments. Keep abreast of market developments and rely on credible news sources. Making well-informed decisions is crucial in volatile markets. Remember, misinformation can lead to unnecessary panic and erratic trading.

BREAKING: The SEC approves first spot Bitcoin ETF

January 10, 2024 : 4:04 PM Eastern Time, Wednesday

The SEC officially approves the first-ever spot Bitcoin ETF, marking a significant milestone for the cryptocurrency market. You can check here.

SEC officially approves all Spot Bitcoin ETFs

January 10, 2024 : 4:04 PM Eastern Time, Wednesday

- VanEck

- Bitwise

- Fidelity

- Franklin

- Valkyrie ]

- Hashdex

- Ark Invest

- Grayscale

- BlackRock

- WisdomTree

- Invesco Galaxy

With the SEC’s endorsement, the spot Bitcoin ETF is expected to have a notable impact on the broader crypto market, attracting more mainstream investment.

The SEC website is currently inaccessible! Confirmation is exclusively available for download

January 10, 2024 : 4:11 PM Eastern Time, Wednesday

The confirmation is no longer accessible on the SEC website; currently, the document can only be downloaded.

Bitcoin Price To the Moon?

January 10, 2024 : 4:19 PM Eastern Time, Wednesday

With the approval of the Bitcoin ETF, the cryptocurrency has surged to $46,105.90, prompting speculation about its potential upward trajectory. This milestone reflects a growing embrace of Bitcoin within institutional circles and positive market sentiment. However, the inherent volatility of the crypto market necessitates a cautious outlook, urging investors to weigh potential gains against associated risks. The approval of the Bitcoin ETF signals a new chapter in the cryptocurrency narrative, amplifying both opportunities and challenges for market participants.

Reuters confirms approval

January 10, 2024 : 4:25 PM Eastern Time, Wednesday

Reuters, a reputable news portal, has substantiated the approval, further strengthening the credibility of reports affirming its official status. While various sources align in asserting the confirmation’s legitimacy, we eagerly await an official press release from the SEC for formal confirmation.

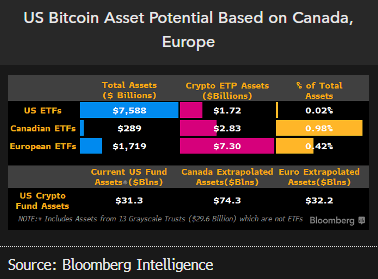

BlackRock’s Bitcoin ETF Launch: A Potential $2 Billion Game-Changer on Day One?

January 10, 2024 : 4:30 PM Eastern Time, Wednesday

@BlackRock might set a groundbreaking first-day flow record, with a potential infusion of $2 billion in assets on the debut of its US spot Bitcoin ETF, as projected by BI’s senior ETF analyst @EricBalchunas. The initial funding, coupled with organic interest, could propel it ahead in a competitive field featuring up to 11 ETFs, collectively aiming for a first-day total of around $4 billion and an ambitious target of $50 billion within the next two years. #BitcoinETF