2022 is for DeFi 2.0! Everything You Should Know About Convex Finance

In this article, we will be looking into various things that makes Convex Finance unique in the decentralized finance sector

Many technologies in the digital asset space focus on enabling users to access financial services. One of the top-tier industries focused on is decentralized finance (DeFi). This relatively new industry is one of the most used and practical aspects of the virtual asset sector. People enjoy financial services, such as saving, borrowing, and even investing.

Experts built Convex Finance on Curve Finance, which is an exchange. The official website suggests that liquidity providers can stake assets, earning platform fees. Like other DeFi platforms, Convex prioritizes liquidity providers for smooth running. In this article, we will be looking into everything related to Convex Finance.

What Is DeFI?

Before understanding what Convex is about, it’s crucial to comprehend DeFi. This industry enables financial liberality because it gives access to direct financial services. Unlike traditional systems, there are third parties or intermediaries for transaction settlement. Also, users enjoy popular services, such as loans, savings, and investments.

Today, many protocols provide DeFi services while rewarding liquidity providers for their contributions. Without it, the system would have difficulties with liquidity. Additionally, DeFi utilizes a public decentralized blockchain, making it easy for anyone to use.

Decentralization is crucial in decentralized finance. It gives power to users rather than a central body. Since this technology focuses on decentralization, it requires smart contracts to actualize contracts between two parties. Because there is no central body to fulfill administrative work, the smart contracts take over, helping them automate their transactions.

Thanks to the interest in this industry, many people are now interested in becoming liquidity providers. This makes it easier for the blockchain to access liquidity to achieve its goals. Experts created this system to remedy the traditional financial structure, which they see as time-wasting and full of procedures. Because it leverages the public blockchain, anybody can access services without discrimination.

What Is Convex Finance?

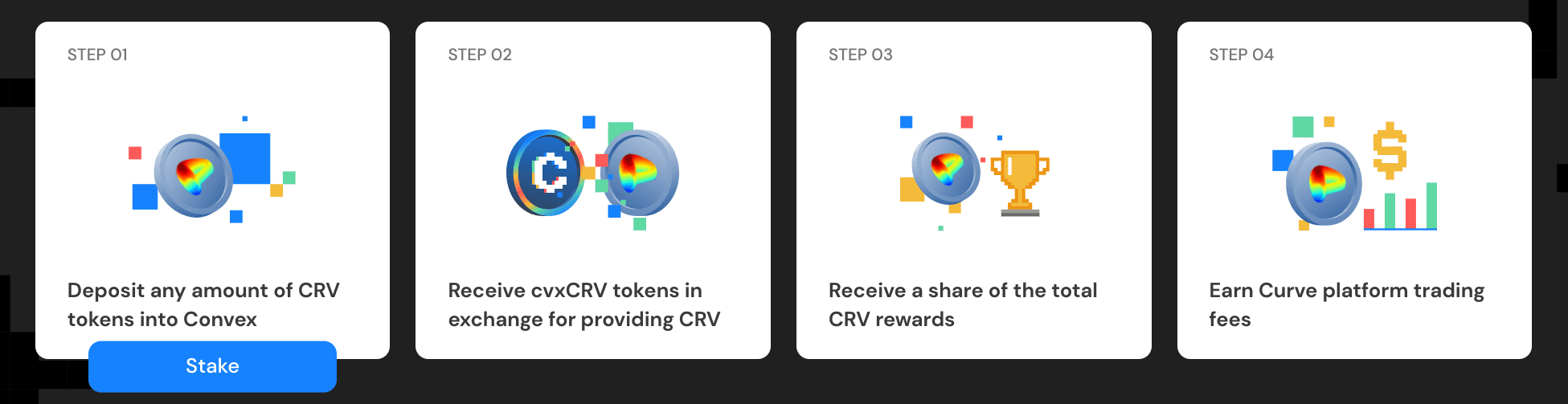

Convex is a platform that allows CRV holders and liquidity providers to earn more rewards and trading fees on the staked assets. It essentially enables a more rewarding way to stake tokens. While the platform is quite simple and easy to use, you may enjoy additional benefits from it.

Presently, there are two categories of people that need the platform:

What Is Curve Finance?

Curve Finance is a decentralized exchange that focuses on stablecoins. Stablecoins are particular kinds of cryptocurrencies pegged to real currencies or assets, making them stable compared to others in the space. Unlike other cryptos, stablecoins are not volatile, making them excellent as a medium of payment. However, you may not enjoy significant price growth with these assets.

Today, there has been a lot of focus on decentralized exchanges, removing the bureaucracy needed in centralized platforms like Coinbase. This platform seeks to provide fast and seamless stablecoin-related services. It enables users to trade those coins on the Ethereum blockchain while supporting several stablecoins, such as USDT, BUSD, and USDC.

How Does Curve Finance Work?

Curve works like other decentralized platforms. However, its focus is mainly stablecoins, making it a unique venue. It’s important to note that this platform is an AMM protocol, so we need to understand it to grasp the technology fully. For Curve to work efficiently, there are four main aspects of the protocol.

- Liquidity pools: liquidity pools are vital when utilizing a decentralized exchange. Liquidity pools enable users to create liquidity by incentivizing them with rewards. This is usually gotten from trading fees. This pool keeps tokens, solving the problem of illiquidity.

- Liquidity providers: They give their tokens to increase liquidity for platforms.

- Traders: Traders help create the forces of demand and supply, determining the token price. When sell-offs are high, the token price will fall. The protocol’s algorithm also analyzes selling and buying pressure to put an appropriate token price.

How Convex Finance Helps Increase Rewards For Curve Liquidity Providers

Convex finance is primarily related to Curve as it hopes to boost rewards for liquidity providers. People interested in earning rewards can choose to provide liquidity, helping the platform’s growth. However, to persuade people into doing this, it promises attractive rewards. If you want to enjoy a boost for your curve reward, Convex may help with that.

People utilizing Convex essentially bring their assets together because more CRV assures higher veCRV conversion. This helps Curve holders enjoy a boost. You may maximize your earnings by adding your token to the pool, even with low stakes. However, you should know that boosts differ, mainly determined by veCRV in the collection.

What Is Convex (CVX)?

CVX is the native token of Convex Finance. You receive your trading fee rewards in this asset because it is fundamental to the smooth running of the platform. You can also earn rewards by staking more CVX earn more rewards. The community might utilize this token as the platform’s governing token.

—-> Click here to Buy CVX <—-

What Is DeFi 1.0?

Since the buzz surrounding DeFi in 2019, many providers and protocols have embraced decentralization to remove time-wasting procedures. The main focus of this technology is to remove intermediaries from a financial system. However, this has changed with more interest in this growing industry.

DeFi 1.0 laid the foundation for the decentralized financial system we have now. Experts built on these basics to create a more advanced blockchain-based space. This first-generation DeFi is primarily based on Ethereum, meaning that all protocols leveraged it for services during the era. Because of the blockchain programmability, they could add essential parts of a decentralized system for easy access.

What Is DeFi 2.0, And How Is It Different?

DeFi 2.0 is a new generation DeFi, which hopes to provide more services. Additionally, it hopes to improve problems associated with DeFi 1.0, making it a crucial upgrade for the industry. Like in every aspect of the digital asset Industry, an upgrade is vital for smooth running.

Without it, users may find it challenging to enjoy DeFi services. It hopes to improve scalability, which is the ability of a system to handle more workload. For many years, the blockchain industry has continued battling scalability issues, leading to expensive gas fees and slow settlement. With faster transaction settlement, DeFi 2.0 can compete with traditional financial services.

Essentially, the second-generation DeFi brings decentralized applications (DApps) into the limelight. While DApps exist only briefly, it has changed how people access certain services. DApps are applications that run on decentralized networks rather than a computer. They are like ordinary applications programmed on the chain.

Another problem 2.0 hopes to solve is decentralization. While many protocols claim to be decentralized, they are not decentralized autonomous organizations, making it challenging to centralize power. A community controls a DAO and not a central body. This includes crucial matters, such as governance and making decisions. It is transparent and consists of smart contracts, helping the system automate some areas.

Liquidity is a major problem facing DeFi protocols. There is liquidity split around blockchains and also getting more from providers. Oftentimes, tokens staked have no utilities, making them inefficient. Some DeFi platforms have found numerous ways to solve this issue.

How Convex Might Lead As DeFi 2.0

Convex finance is a new generation protocol that prioritizes incentivizing liquidity providers. Because it does this, it persuades liquidity providers, helping them stake their assets in the hope of rewards. In a way, this significantly affects the liquidity and also ensures holders and stakers boost their returns to a special rate. This solves a significant problem DeFi 1.0 failed to address, helping it gain a stance.

As seen in Convex Finance, stability is becoming more critical in DeFi 2.0. There is a possibility this protocol will become a leading DeFi 2.0 platform because it is focused on providing liquidity while helping people earn rewards. When liquidity is no longer an issue, transaction settlement becomes faster and more efficient. Since 2.0 improves on issues associated with the first generation, it’s possible that it would create a more efficient medium to access liquidity and faster services.

Conclusion

Convex finance is a platform built on Curve Finance. It helps users earn money for holding assets and also provides liquidity. This makes it one of the leading DeFi platforms because it helps solve liquidity issues and may also promote decentralization due to its fundamentals. While the DeFi Industry is still small, there are indications that many individuals may continue to demand DeFi-based services.