Decentralized finance (better known as DeFi) is a set of peer-to-peer financial services running on decentralized blockchains, most commonly Ethereum. Uniswap has been one of Ethereum’s hottest projects ever since its launch in late 2018. But can the rise of SushiSwap endanger its very presence? This article is delves into the infamous Uniswap Vs Sushiswap competition, comparing their pros and cons for users, liquidity providers, and token holders.

What are decentralized exchanges (DEX)?

The most prevalent decentralized exchanges or protocols are UniSwap, Curve, SushiSwap, and Balancer. All of these DEXs are based on the Ethereum blockchain. A decentralized exchange allows the trade of one coin for another, while maintaining custody of the coins in the hands of the users, contrary to CEXs (centralized exchanges) that keep their users’ coins under the custody of the exchange.

How do Uniswap and Sushiswap work?

Uniswap and Sushiswap are DEXs working on the AMM principle (Automatic Market Maker). Unlike regular exchanges, AMMs don’t require order books to set the price of a pair. AMMs also don’t require a buyer and a seller on opposite ends to execute a trade.

Instead, AMMs use liquidity pools. Any user can access these pools to buy or sell their tokens, while the price is determined by the ratio of the two assets within a trading pair’s pool. For example, if the ETH/USDT pool has 100 ETH and 60,000 USDT, the price of 1 ETH would be equal to 600 USDT (60,000/100=600). As users buy or sell their ETH or USDT, the ratio within the pool changes, which is reflected in the change of the price.

The liquidity itself is also provided by users. In fact, anyone can supply liquidity to a pool, earning them fees.

A-User experience: Uniswap vs Sushiswap

1-Uniswap Vs Sushiswap: Liquidity

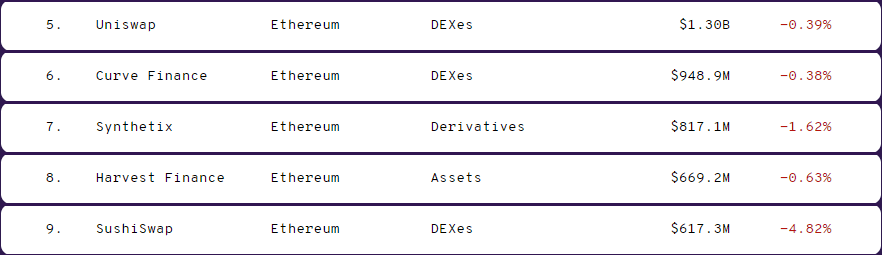

According to DeFi Pulse, Uniswap currently boasts $1.30B in locked liquidity. In comparison, Sushiswap only makes it to $617.3M, slightly less than half of Uniswap’s liquidity.

Although both exchanges have seen betters days, with Uniswap reaching a maximum liquidity of $3.07B on Nov 14 2020, and Sushiswap reaching a high of $1.43B on Sep 12 2020.

Uniswap liquidity: $1.30B

Sushiswap liquidity: $617.3M

Winner: Uniswap

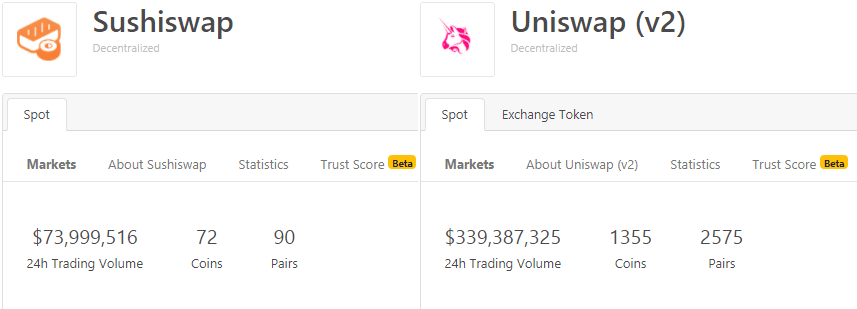

2-Uniswap vs Sushiswap: Pair selections

Sushiswap offers its users 72 coins in 90 different pairs. In comparison Uniswap offers its users 1355 coins in a total 2575 pairs. This is because Uniswap is more established, with almost every new Ethereum based project using it to raise liquidity, making a CEX listing no longer crucial to a project’s success.

Uniswap: 2575 pairs

Sushiswap: 90 pairs

Winner: Uniswap

3-Uniswap vs Sushiswap: Fees

Both DEXs charge their users 0.3% in fees when selling or buying a coin. Uniswap and Suschiswap pay out these fees differently to the liquiity providers, but this results in no difference for the users no difference for the end users.

Uniswap fees: 0.3%

Sushiswap fees: 0.3%

Winner: Neither

4-Uniswap vs Sushiswap: Slippage

Slippage is the difference between the price of a pair at the beginning of a trade and at the end of a trade. Low slippage is preferred for the user as they are guaranteed a more exact price for the pair. Slippage is the lowest when liquidity is the highest, hence favoring Uniswap in this case. However some exceptions exist. For example, trading the SUSHI/ETH pair on Sushiswap has lower slippage than trading it on Uniswap. But these exceptions are well, the exceptions.

Winner: Uniswap

B-Liquidity providers: Uniswap vs Sushiswap

Both Uniswap and Sushiswap rely on the community to provide their liquidity. In return for locking up their funds, liquidity providers can earn fees on transactions.

But which of the two DEXs is more profitable for liquidity providers?

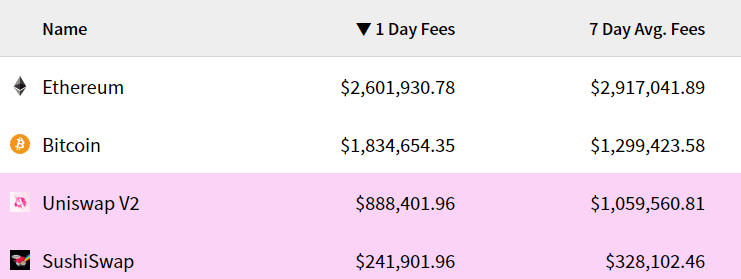

1-Uniswap vs Sushiswap: Fees earned

As already said above, both Uniswap and Sushiswap charge 0.3% in fees on transactions. Uniswap completely pays out these fees to the liquidity providers, whereas Sushiswap only pays out 0.25% to the liquidity providers while reserving the other 0.05% to the SUSHI token holders.

In addition to that, Uniswap’s daily traded volume is much higher than Sushiswap’s. This results in more fees collected on Uniswap as well.

Uniswap: 0.3% to liquidity providers

Sushiswap: 0.25% to liquidity providers

Winner: Uniswap

2-Uniswap vs Sushiswap: Farming tokens

Another way for liquidity providers to earn passive income is by farming UNI or SUSHI tokens. While Uniswap ended farming on Nov 1 2020, Sushiswap still enables this very lucrative practice.

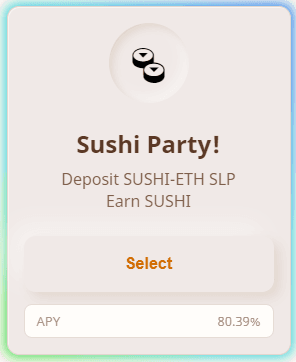

In order to farm SUSHI, liquidity providers will need to stake their SLP (Sushi Liquidity Pool) tokens. These pools can have very attractive yields, as in the case shown above. In fact, farming can be much more lucrative than the fees previously discussed. Currently, 17 such farming pools exist.

Uniswap: No farming

Sushiswap: Lucrative farming

Winner: Sushiswap

C-Token holders: Uniswap vs Sushiswap

1-UNI vs SUSHI

The UNI token is a governance token. It intends to transform Uniswap into a decentralized, community-owned protocol. Its only function is voting on proposals regarding the protocol.

SUSHI is similar to UNI in function, with the added benefit that it enables the coin holders to share 0.05% of the exchange fees.

UNI: Governance token

SUSHI: Governance token + earns 0.05% fees

Winner: SUSHI

Conclusion

Uniswap remains by far the most popular and most widely used DEX. It is also the best from a user’s point of view. For liquidity providers however, Sushiswap might be the more profitable option when considering the pairs that enable SUSHI farming. As for the tokens themselves, barring any price fluctuations, SUSHI comes with the added benefit of earning fees passively for the token holders.