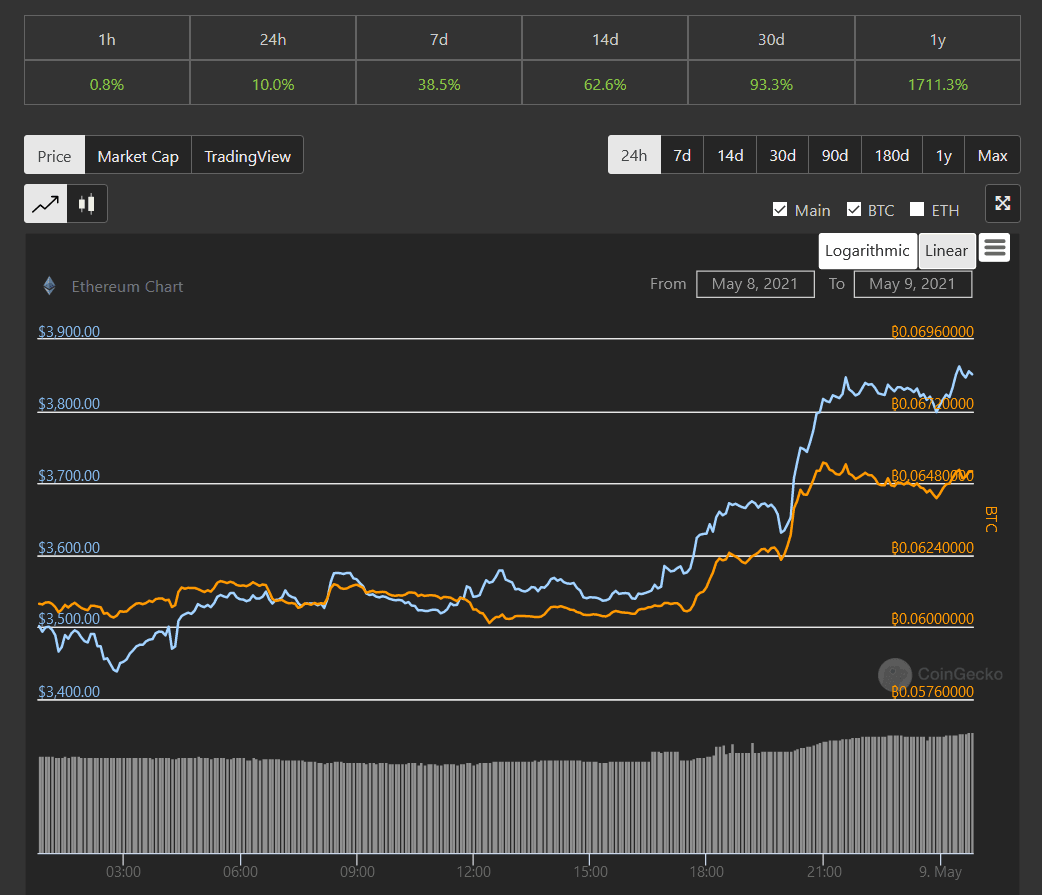

Ethereum’s insane rally continues and the world’s largest smart contracts platform has finally breached $3800. It’s now up over 93% in the past month and 10% in the last 24 hours alone. This massive price rise shows a couple of narratives converging together around the top blockchain, including but not limited to DeFi, NFT, EIP11559, the grand merger between Eth1 and Eth2, etc. One analyst predicts an astronomical $150K per ETH price, because of all these developments in the long run, however, all the other metrics also signal that this run is far from over and likely to continue for quite some time.

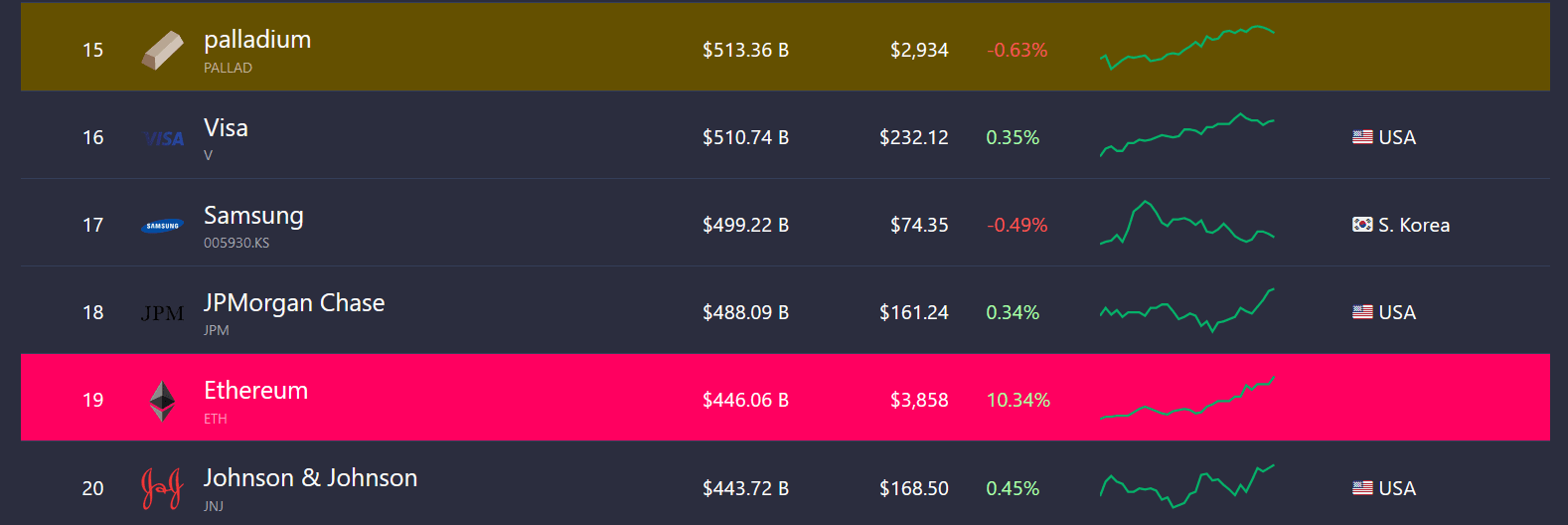

Ethereum Is Now The 19th Most Valuable Entity

According to Companies Marketcap, Ethereum is now the 19th most valuable entity in the world with a $446B market cap. It’s right behind JP Morgan Chase at number 18th with a $488B, though that fort is likely to fall soon. The other important targets in the vicinity are Samsung, Visa, and the precious metal Palladium. Bitcoin – the premier crypto asset is at rank 8 with a market cap of $1.10T.

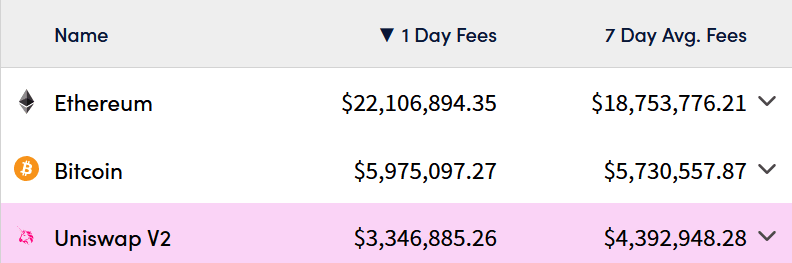

Ethereum Is Unmatched In Fees Generated And Value Settled Metrics

Though, this is largely customary at this point. Ethereum is still unmatched in the fees generated – an excellent representative of the user interest, demand, and willingness to pay to use the blockchain. The world’s most valuable blockchain generated a total of $18M in fees, convincingly edging out Bitcoin which accumulated $5.7M in the same time frame. With EIP1559, these fees will burn ETH tokens, directly impacting the price.

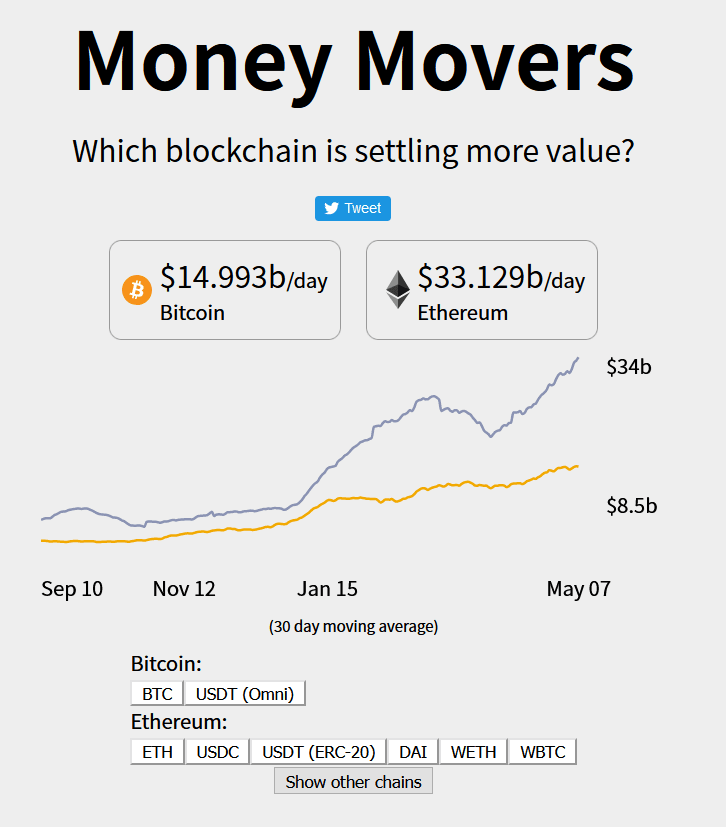

On a related note, Ethereum still occupies the top spot in the money moved and value settled metrics. It’s representative of how much settlement occurs on each chain. Ethereum leads this metrics by a wide margin too, settling $33.12B in value over the past 24 hours against Bitcoin’s $14.99B. Now, this metric includes all stablecoins and wrapped assets on the blockchain. However, even excluding all of them and counting only the ETH token itself, Ethereum still settled over $20B in value.

Ether Tokens Locked In DeFi And ETH2 Are Growing

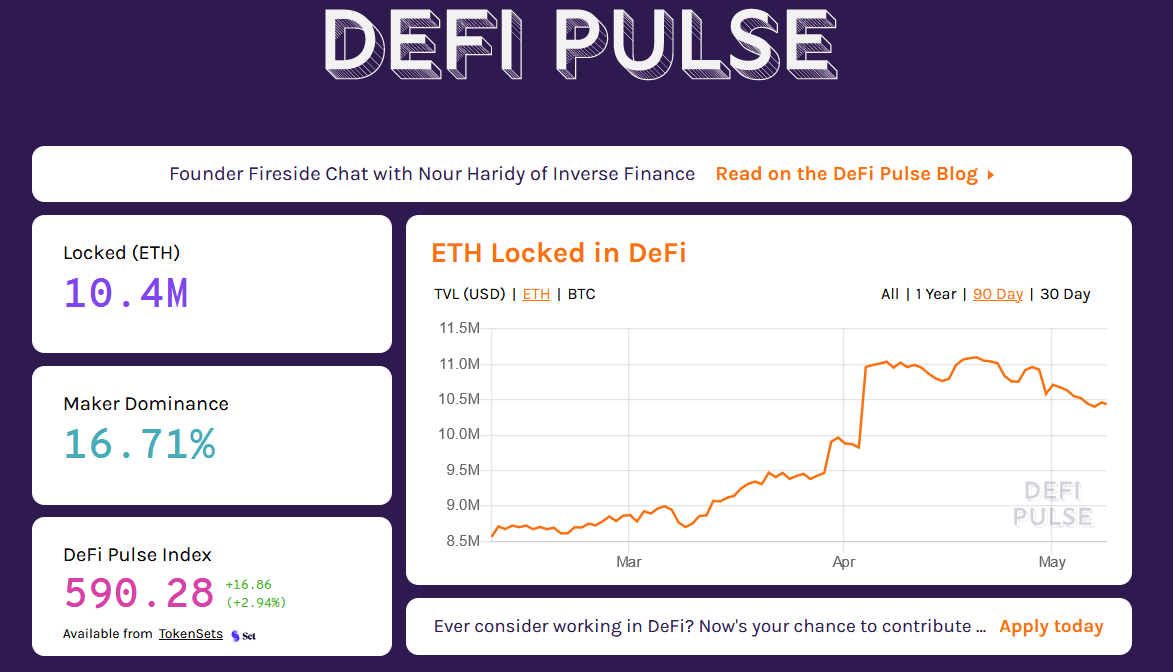

According to DeFi Pulse, there are currently 10.8M Ether (worth over $41B) tokens, currently locked in DeFi based smart contracts. The number has been steadily rising and the total DeFi market cap has reached a massive $81B! These locked ETH tokens don’t count in the supply and will likely have a possible impact on price.

The Eth2 deposit contract or the Beacon Chain shows a similar story. Currently, it holds around 4.2M ETH (worth over $16.2) earning yield and securing the new Ethereum 2.0 blockchain. These deposits can’t be removed and are effectively locked from the circulating supply, until Eth1 and Eth2 merger. The numbers here also show a positive trend as more validators are encouraged to lock in their ETH tokens for a lucrative yield, which is appreciating over time.

Ethereum Unique Accounts Are Rising

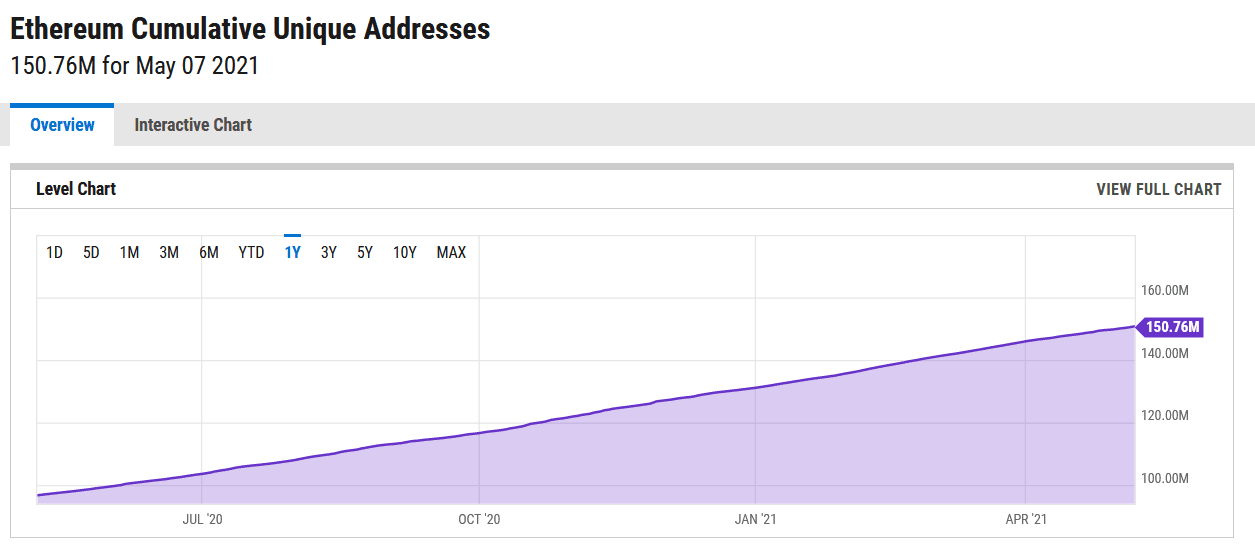

Ethereum unique accounts have been rising too. These are new accounts created, which previously didn’t hold any balance. It’s a measure of new users that the blockchain is starting to onboard. The unique addresses currently stand at 150.76M, up from 150.57M yesterday and 96.60M a year ago. This points to the growing popularity of Ethereum and the massive influx of new users.

DeFi, NFTs, Layer2s, DAOs ETC.

Unfortunately, the data doesn’t show the whole story. Besides having the largest developer base and the most users, Ethereum has been showing leading progress in Decentralized Finance (DeFi), Non-Fungible Tokens (NFTs), the Layer 2s deployment and adoption, Stablecoins, Decentralized Autonomous Organization (DAOs), etc. It’s something that can be seen in the usage number of projects on Ethereum and their activity levels over time.

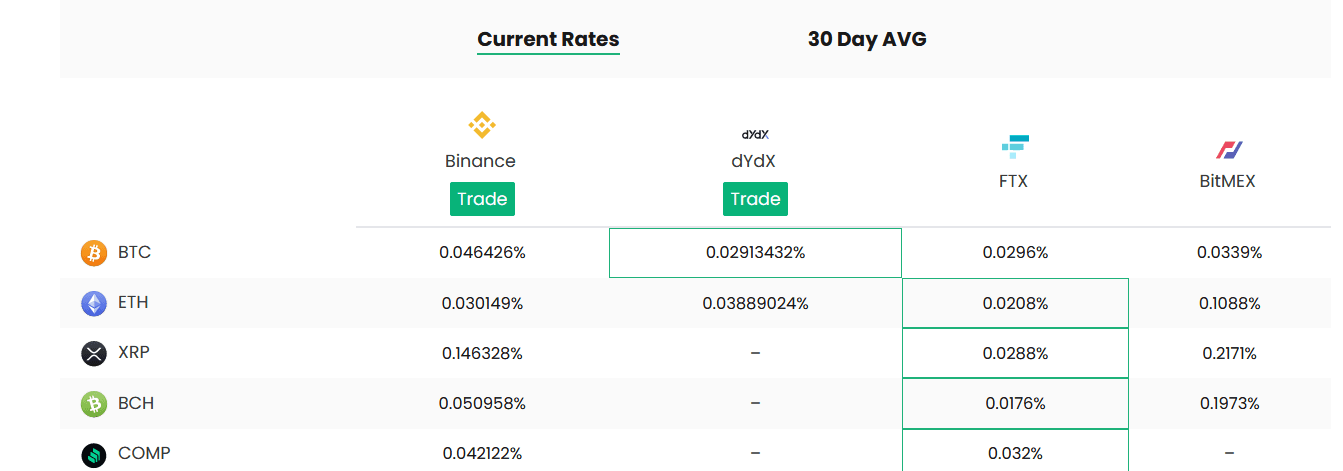

Ethereum Funding Rates Show Healthy Pattern

The funding rates data obtained from DeFi Rate shows that Ethereum funding rates are extremely healthy and normal, these signal that the market isn’t currently over-leveraged and we aren’t all heading towards a domino effect causing major liquidations across the board. It can be understood that this rally is likely to have been caused by institutional buyers and not leveraged traders riding the wave.

Where’s Ether Headed? $10K Or Somewhere Far Beyond?

An analyst @SquishChaos might have the answer. In his recent 79 page report, detailing the three Bitcoin halvenings equivalent to Ethereum halvening, the analyst noted a price target of $30,000-$50,000 in the not-so-distant future and an astronomical $150,000 per ETH prediction in a speculative frenzied severe mania by 2023! By this logic, Ethereum would long become the most valuable entity in the world, surpassing the current crown holder Gold at $11.6T. Would that happen? Sure, let’s see!