Chainlink (LINK) is the largest DeFi project by market capitalization, but that’s not about it. The decentralized data oracles protocol also secures value of billions of dollars in DeFi protocols. It does so by ensuring that those protocols receive timely updates of accurate data, which are key in ensuring their proper and effective functioning.

However, due to the recent Ripple (XRP) trouble with Securities and Exchanges Commission (SEC), which saw the project’s native token XRP being declared as an “ongoing security” and left the price tumbling down with uncertain future of the project, similar concerns and rumors are being raised that SEC is likely to declare the LINK token security too and crack down on it. Here’s why it’s unlikely to happen.

Chainlink ICO Wasn’t Open for American Citizens

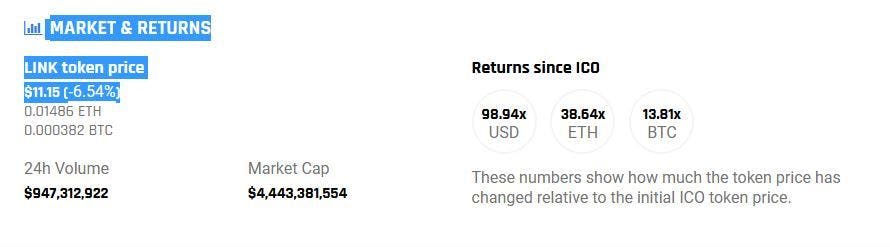

Chainlink was bootstrapped through the notorious Initial Coin Offering (ICO) mechanism, it succeeded in raising $32M at a rate of $0.11 per LINK. Since then, it has returned 100x versus USD, 14x against BTC and 39x against ETH. However, a salient feature of it’s ICO was that it wasn’t open to US citizens, to safeguard against future regulatory hurdles stemming from unclear policy and thus litigation.

LINK Is A Utility Token

The value of a token is determined by it’s utility within the network and it’s capture mechanism from all the activity happening on that particular protocol. LINK derives it’s value and price from the payments to oracle providers, managers from the users or service in particular, who must be paid in it. This ensures that heightened activity on the Chainlink network and total value secured through usage, results in more value for the LINK token.

Buying LINK Doesn’t Give Holders Shares In The Chainlink Company

Perhaps the most significant of all is the fact that LINK tokens don’t represent equity shares in the Chainlink company. It simply means that LINK tokens don’t give holders share in Chainlink company’s profits. They are utility tokens, which can be used on the network, but don’t serve any other purpose. Hence, they aren’t equity security.

Chainlink Company Doesn’t Comment On LINK Price

Chainlink team and officials have never commented on the LINK token’s price, making it unlikely that the SEC can take the position that the investors have been mislead or given wrong impressions about the nature and purpose of the LINK token. Further, Chainlink’s business model doesn’t rely on merely selling the tokens to generate profits.

Chainlink Is Based In Cayman Islands

Last, but not least. Chainlink is headquartered in the Cayman Islands and not directly in the United States. While this doesn’t absolve the company from a securities claim or make it completely immune to any legal action from SEC, it does grant it several advantages when it comes to litigation.